- Bitcoin is likely to continue to trend downward in the coming weeks.

- The short-term holders’ average cost basis marked out a potential local top for Bitcoin.

Bitcoin [BTC] experienced heightened volatility over the past couple of days. It reached $61.8k on the 21st of August, but a few hours later fell to $59.7k a few hours later.

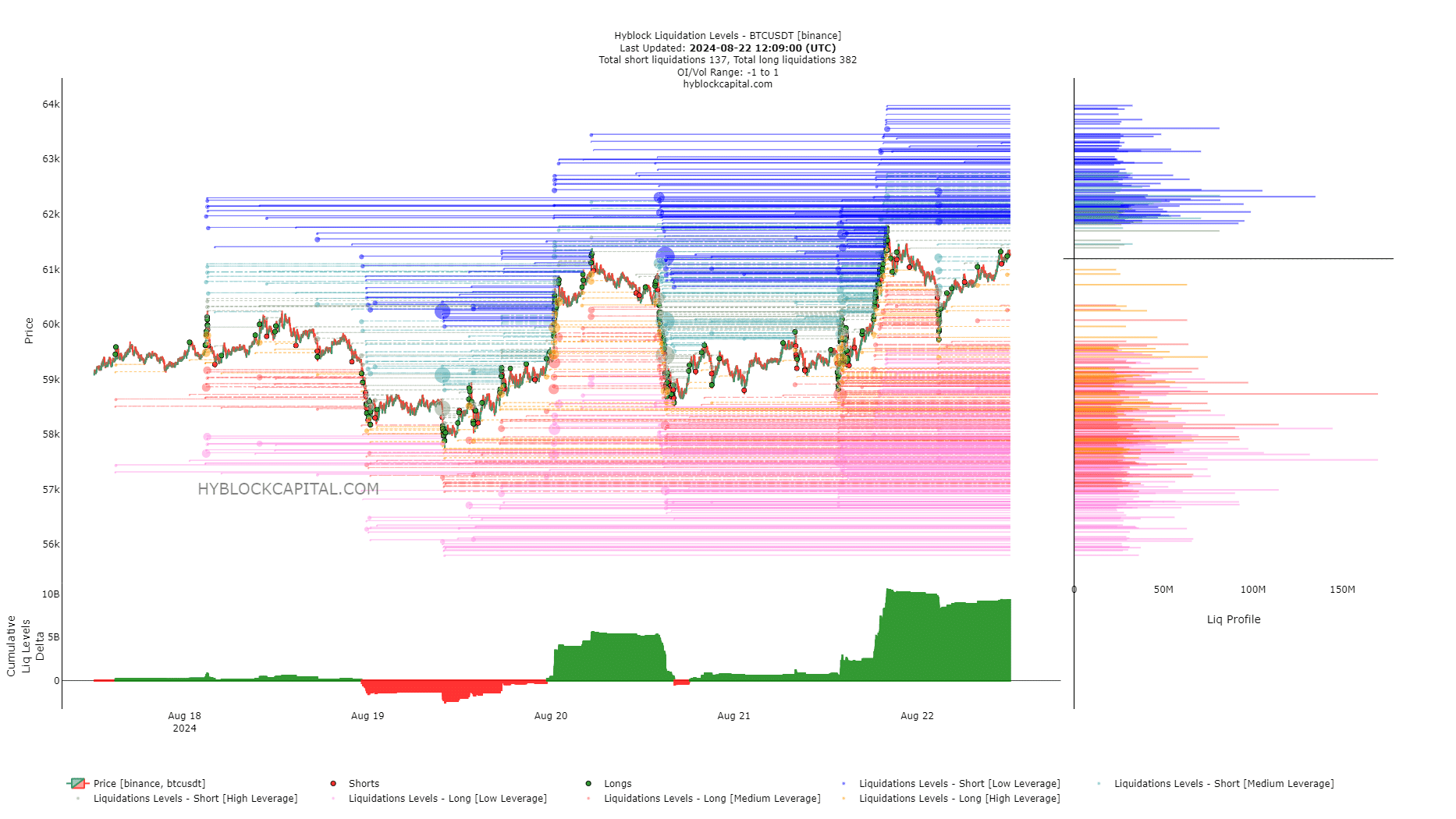

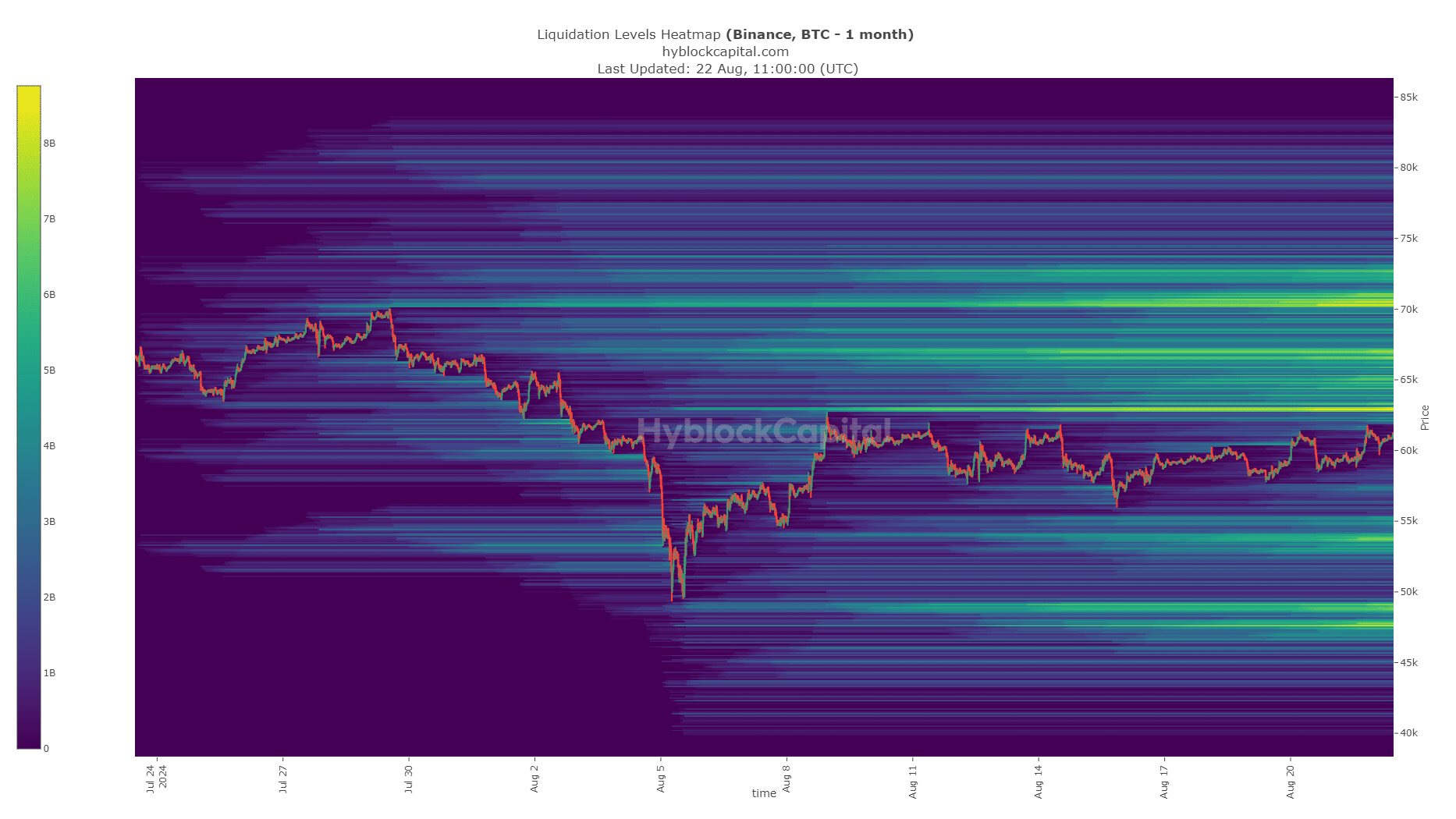

Source: Hyblock Capital

These price moves could be driven by the liquidity pools that have built around BTC over the past week.

The cumulative liq levels delta was enormously positive and promised a price pullback in the short term to flush overeager bulls out.

To understand if Bitcoin can resume its uptrend after a price dip, AMBCrypto looked closer at other metrics and whale accumulation trends.

The short-term holder cost basis would be a strong barrier

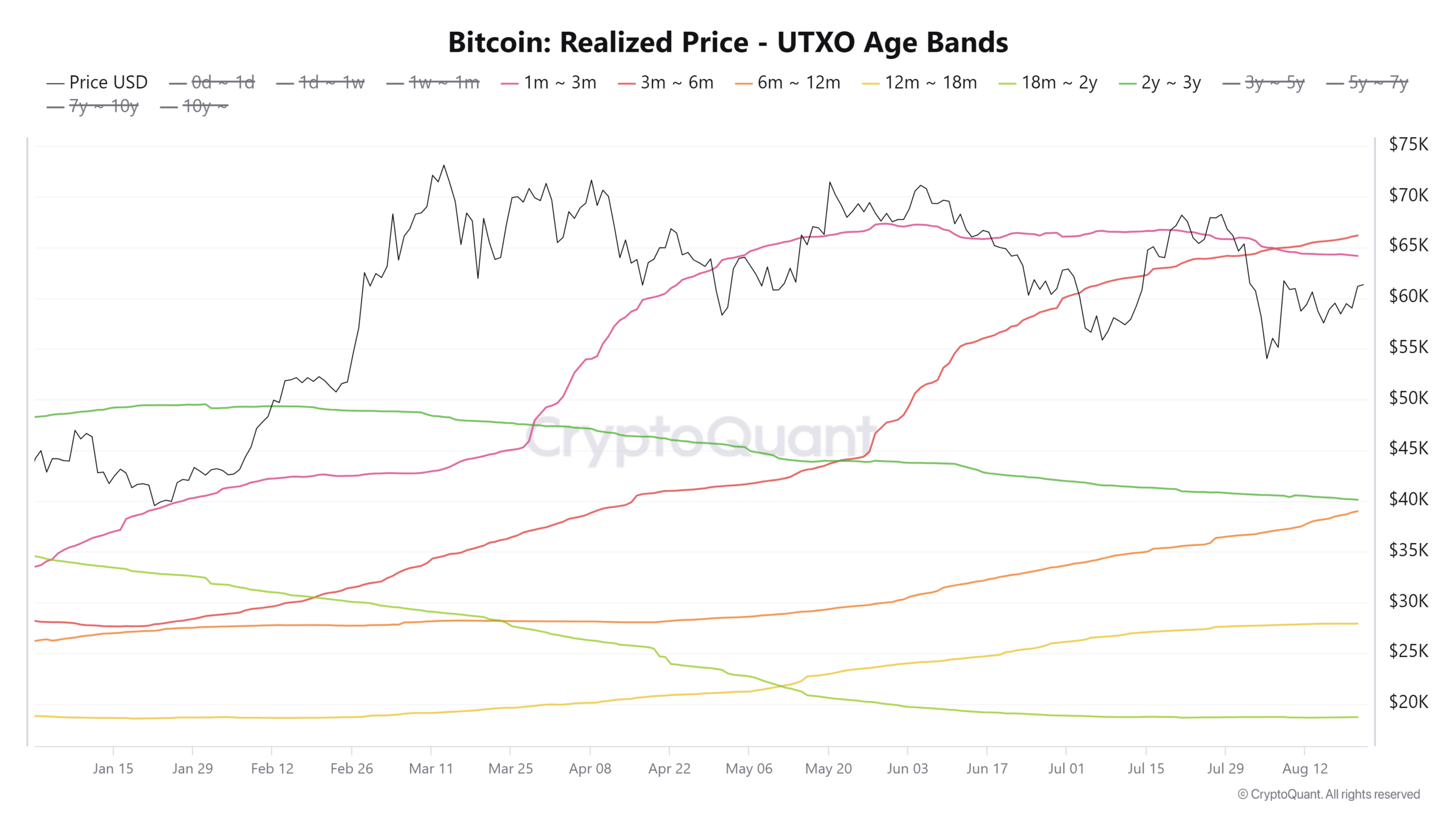

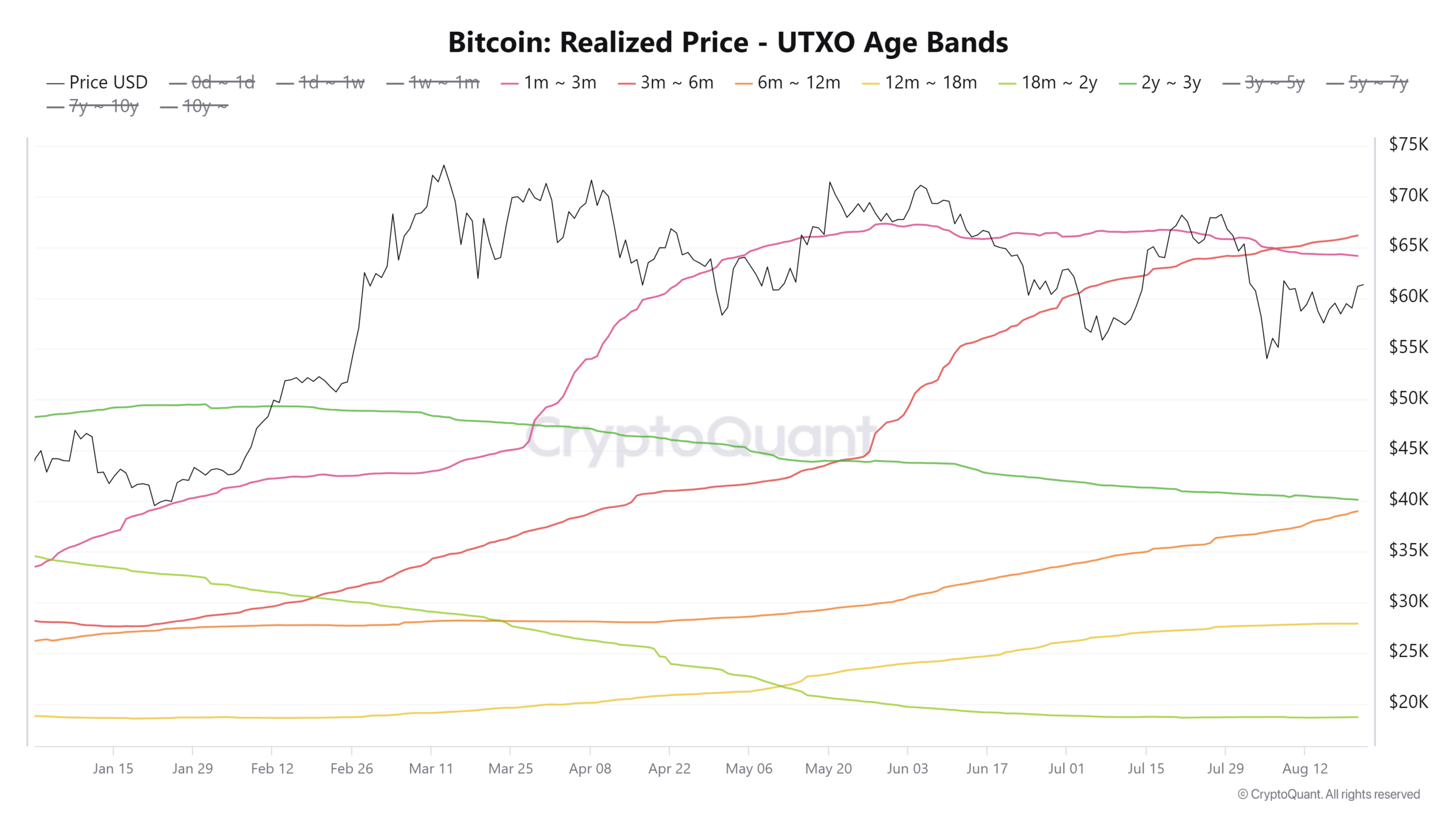

Source: CryptoQuant

CryptoQuant analyst Burak Kesmeci noted that the short-term Bitcoin holders’ realized prices could be used to mark out resistance zones. Short-term holders are those who have held BTC in their wallets for under 155 days.

Using the UTXO age bands, he observed that the 1-3 month BTC holding cohort had an average cost basis of $64k. Similarly, the 3-6 month class had an average cost basis of $66k.

With market prices beneath this zone, most of these holders were likely at a loss.

Therefore, a price bounce into this area would likely see underwater holders exit the market at near break-even, which could fuel selling pressure.

The range-like price action of BTC in recent months means that a move toward $66k would likely also be a good profit-taking opportunity.

Assessing whale accumulation/distribution trends

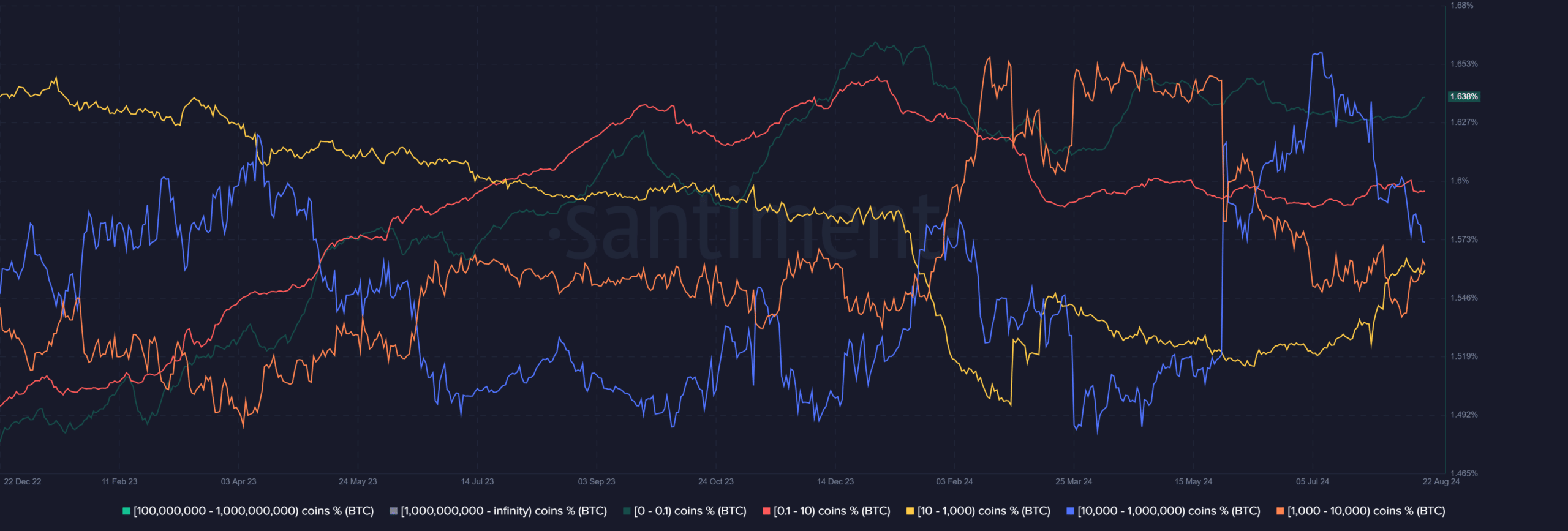

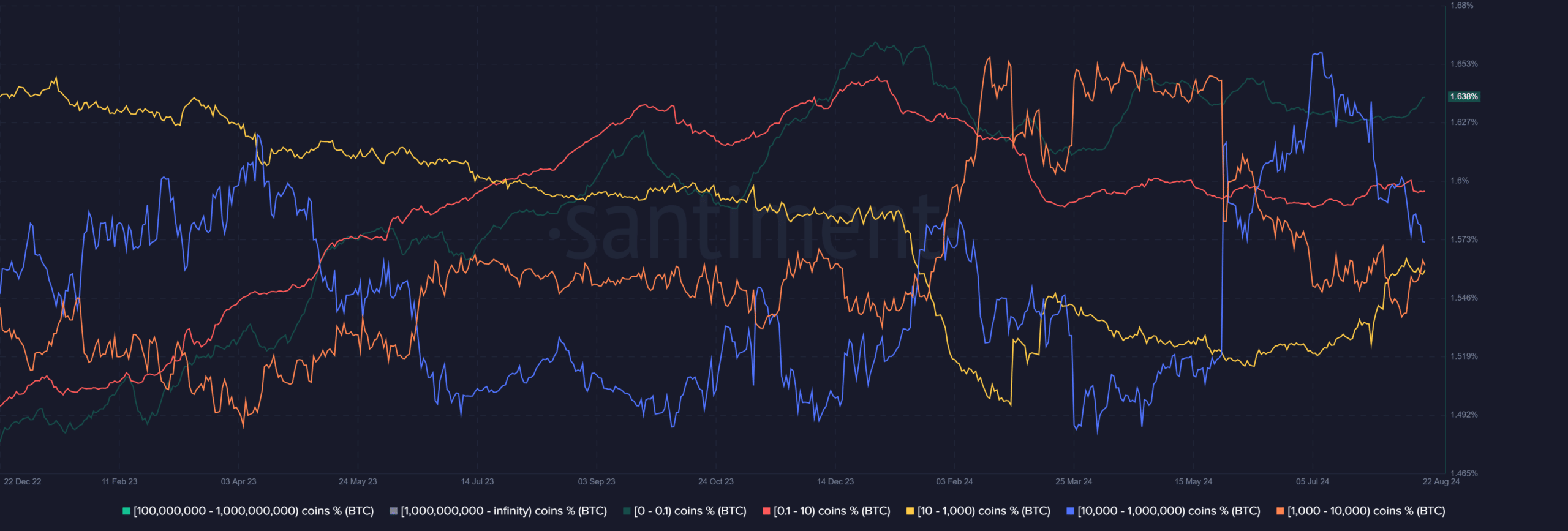

Source: Santiment

The wallets with 10k-1M BTC saw a sustained accumulation phase from early December 2023 to late January 2024. During this period, the price of the king of crypto appreciated by 16%.

Fast-forward to March, and BTC was up another 70%, but this came alongside the BTC whale cohort (above 10k coin holdings) distributing and taking profits during the rally.

Similarly, this whale cohort saw a distribution phase over the past six weeks, even though Bitcoin price performance was not strongly bullish.

The implication was an expectation of a price dip and continued downtrend.

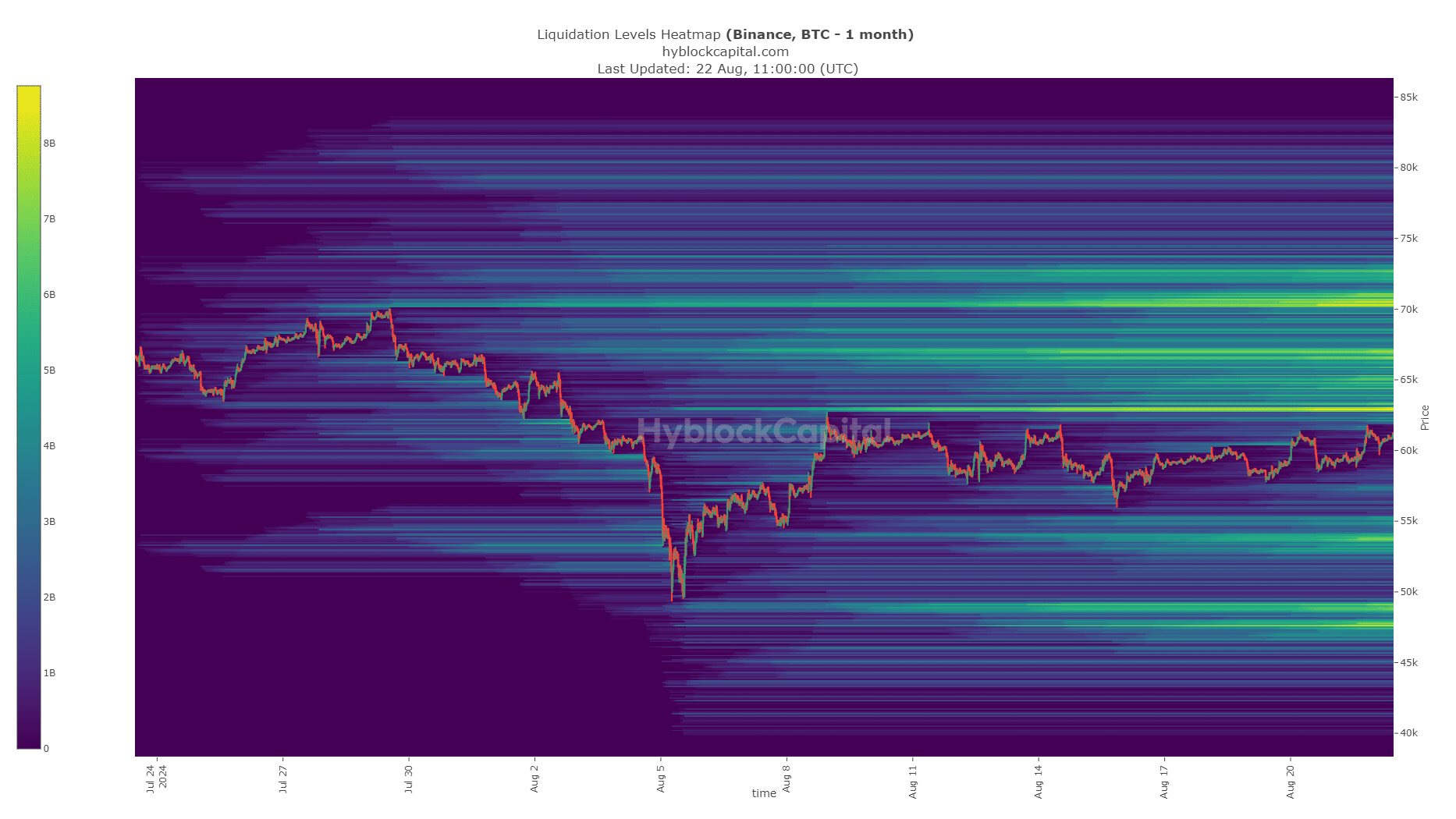

Source: Hyblock Capital

Read Bitcoin’s [BTC] Price Prediction 2024-25

The 1-month liquidation heatmap highlighted the range potential more clearly. The deep pockets of liquidity at $63k, $67k, and $70k are likely to attract prices to them in the coming weeks.

Yet, the liquidity built up to the south at $54k and $49k were also significant magnetic zones. As things stand, the price action and whale accumulation trends do not favor a breakout past $66k.