Analyst WiseAnalyze has shared insights into Bitcoin’s (BTC) price movements and market status. In a long X post, the analyst highlighted Bitcoin’s bullish momentum, important volume levels, and key resistance and support zones.

With BTC hovering near $91,000, the analyst monitors whether the crypto can sustain its upward trajectory or face a potential correction.

Bitcoin is consolidating near $91,000, a critical level identified by both analysts and technical indicators. The developing weekly and monthly candles show a strong bullish trend, with BTC making higher highs and higher lows.

According to WiseAnalyze, the weekly VWAP VAH3 level at $91,000 serves as an immediate resistance. A breakout above this zone could pave the way for Bitcoin to rally toward $95,000 or higher.

Furthermore, BTC recently rebounded from a liquidity sweep at $79,450, which reignited bullish sentiment. The analyst emphasized the significance of monitoring the VWAP levels, particularly the third band, as acceptance below these levels could lead to a drop toward $81,699.

However, the ongoing momentum has kept traders optimistic, with many maintaining long positions.

BTC’s Bullish Indicators

Technical indicators suggest continued bullish momentum. The RSI stands at 77.51, placing Bitcoin in overbought territory. While this signals the possibility of short-term consolidation or correction, the MACD remains positive.

The MACD line is above the signal line, with the histogram expanding, reflecting strong buying interest and momentum.

Bitcoin faces resistance around $91,500 and $92,000, a zone that has consistently challenged its upward movement. Breaking above this level could confirm a bullish breakout, setting $95,000 as the next target.

On the downside, support at $85,000 and $81,699 provides a safety net for bulls, with strong historical buying interest at these levels.

WiseAnalyze highlighted key Bitcoin liquidity pools that traders are monitoring for potential market activity. The zones above include $92,375, $93,215, $95,050, and $96,108.

Moreover, those below are $90,541, $89,548, $88,555, and $87,714. These levels are expected to play a big role in shaping Bitcoin’s next major price movement.

Read also: Why Is Algorand (ALGO) Price Up? Analyst Predicts a 300% Rally

Extreme Greed and Institutional Interest

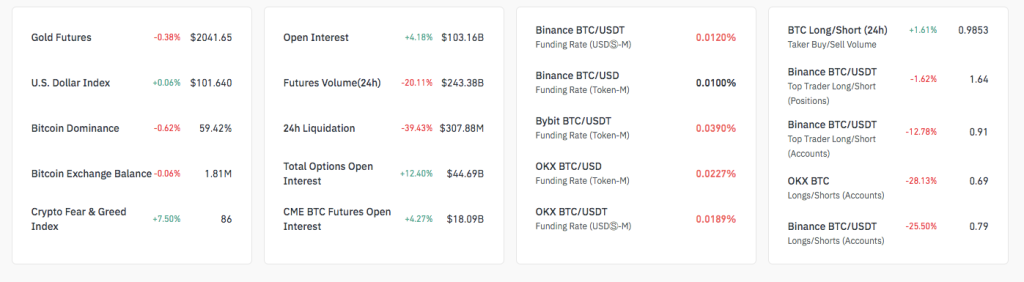

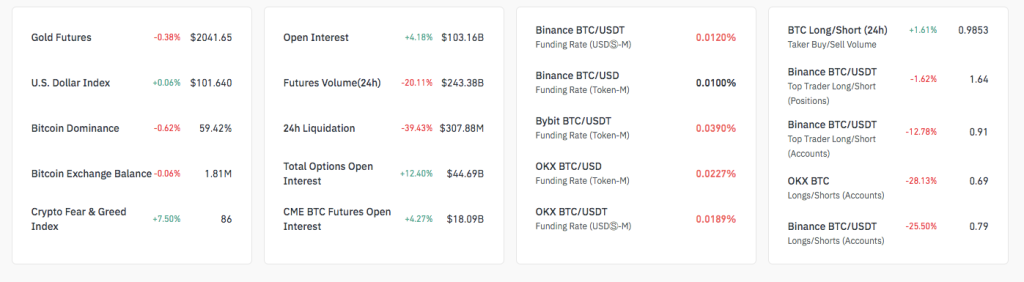

The market is extremely greedy, as seen by the Crypto Fear and Greed Index’s recent spike to 86. Altcoins have gained popularity, which has increased market optimism even if Bitcoin’s dominance has marginally decreased to 59.42%.

Futures open interest rose by 4.18% to $103.16 billion, and options open interest jumped 12.40%, hinting at increased institutional participation.

Even with this optimistic outlook, several warning indications have surfaced. A more cautious stance by traders was reflected in the 20.11% decline in futures volume and the 39.43% decline in liquidations.

Furthermore, there may be short-term volatility as indicated by the negative leaning of the long/short ratios among major traders on Binance and OKX.

Potential Scenarios: Bullish Breakout or Correction

The market suggests two potential scenarios for Bitcoin’s trajectory. A bullish continuation could unfold with a breakout above $92,000, paving the way for targets at $94,000 and $95,000, supported by sustained volume and a widening MACD histogram.

Alternatively, a bearish correction may occur if Bitcoin fails to break $92,000, potentially leading to a pullback toward $85,000 or even $81,699, with this scenario aligning with a cooling RSI and reduced market activity.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link