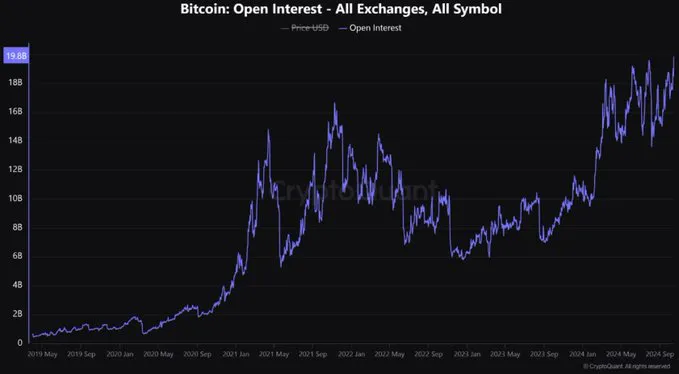

Open interest in Bitcoin reached a new all-time high of $19.8 billion on October 15, according to data from CryptoQuant shared by certified analyst EgyhashX. The milestone highlights the increasing demand for the flagship asset and the flow of funds into the crypto markets over the past few months.

According to EgyhashX, this is a sign of bullish sentiment among investors. Funding rates also reached their highest positive level since August, an indication that most of the open interest was in long positions.

He said:

“This upward trend in the derivatives market indicates a growing influx of liquidity and increased attention in the cryptocurrency space. The rise in funding rates further points to a bullish sentiment among traders.”

Open interest describes the number of active futures contracts on an asset at a particular time, and an increase in open interest usually indicates the inflow of funds into the asset. While many consider the increased open interest a good sign for BTC price action, some observers are concerned that the high leverage poses a volatility risk, as price changes could trigger large-scale liquidation.

Cash-margined futures contract dominates Bitcoin open interest

However, volatility fears might be unfounded, given that institutional investors and cash-margined contracts account for a sizable percentage of the open interest. According to data from Glassnode, most Bitcoin futures contracts are in cash margins rather than crypto margins. A cash-margined contract refers to futures contracts with open interest margined in USD or stablecoins pegged to the US dollars, as opposed to futures contracts with crypto margins.

Open interest in cash-margined futures reached an all-time high of $25.5 billion on Monday, with the CME futures accounting for 40% of all the cash-margined contracts. By comparison, the crypto-margined contracts account for around 18.2% of the total open interest.

With CME leading the cash-margined contracts, institutional investors appear to rely heavily on Bitcoin futures for their strategic plays, just as they have been using the Bitcoin spot exchange-traded funds (ETFs). Since the launch of the spot ETFs, Bitcoin ETFs have received almost $20 billion in net flow.

Meanwhile, data from Coinglass shows that Bitcoin’s future open interest is now at 574,680 BTC ($38.04 billion), with the Chicago Mercantile Exchange (CME) alone accounting for $11.07 billion of the open contracts. This is followed by Binance with $8.01 billion and ByBit with $5.61 billion.

The dominance of CME highlights how institutional interest is one of the major factors driving the demand for BTC, even in the future market. Crypto analyst Arslan Ali also observed this, noting that retail interest played a prominent role in fueling this rally.

Bitcoin hits $67k as demand remains strong

Beyond the recent rise in open interest for BTC, several other metrics also show that investors are increasing their demand for Bitcoin, which is the main factor fuelling its performance. Cryptoquant data shows that BTC demand is growing at the fastest monthly pace since April 2024.

Additionally, Bitcoin recorded a net purchase of $1.1 billion on Monday, a sign that despite some investors taking profits, more people are buying. Unsurprisingly, Bitcoin has continued to soar, highlighting the bullish momentum fuelling its performance.

The flagship asset recently hit $67,000, its highest price since July 29, before retracting to $66,800. This represents a massive gain, given it was trading at $59,000 only five days ago.