Key Points

- Bitcoin reached a new ATH above $79,600, catalyzed by Trump’s support for digital assets.

- Crypto traders predict a friendlier regulatory framework for the industry in the US.

Bitcoin continued its price rally, which debuted earlier this week during the US elections, reaching one ATH after another.

The digital asset’s rally is fueled by optimism stemming from Donald Trump’s win at the elections, and his support for the crypto industry, which could see a friendlier regulatory framework in the US and globally.

Bitcoin Hits a New ATH Above $79,000

At the moment of writing this article, BTC is trading above $79,000, up by over 3.5% in the past 24 hours.

Earlier today, BTC reached a new ATH above $79,600, racing towards the next important level of $80,000.

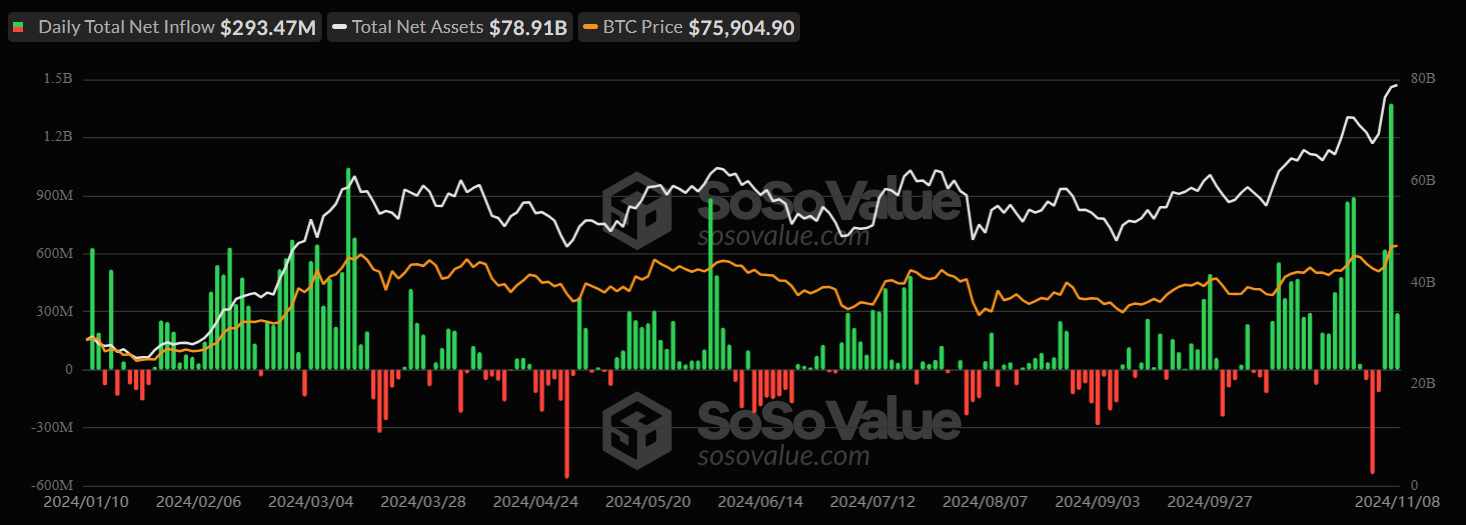

BTC’s price was catalyzed by multiple factors this week, including huge inflows in the US BTC ETFs which sent the cumulative flows in the crypto products at almost $25.8 billion.

The highest inflow day for BTC ETFs was on November 7 when they recorded $1.38 billion in influxes, the biggest day since their January debut, SoSoValue data shows.

Also, the coin’s rally was fueled more by the US Fed’s decision to cut interest rates by 25 bps this week, following the most recent FOMC meeting.

Another rate cut is projected to take place in December, and more adjustments are expected next year as well, according to predictions.

However, the strongest price catalyst for BTC is Trump’s crypto support and the prospect of a Congress featuring pro-crypto lawmakers, according to the latest observations by Bloomberg.

A Crypto-Friendlier Regulatory Framework Expected in the US

During his 2024 Presidential Campaign, Trump made various promises for the crypto industry, vowing to make the US the crypto capital of the planet, creating a strategic Bitcoin reserve, and appointing regulators who support the digital assets industry.

Considering that the Republican Party now has control of the Senate and is on its way to holding the majority in the House, the future for crypto looks promising.

With Trump’s victory in the US, it was only a matter of time before a strong bullish move emerged in the markets, given Trump’s pro-crypto stance, according to Le Shi, Hong Kong managing director at market-making firm Auros, cited by Bloomberg.

Trump promised supportive crypto regulation, and the sweep of the House and Senate in the US is paving the way for a bright future for crypto, Noelle Acheson, author of the Crypto Is Macro Now newsletter also highlighted cited by Bloomberg as well.

Optimism is Rising in the Crypto Industry

Also, Satoshi Act Fund’s CEO and co-founder, Dennis Porter, has been also revealing his massive optimism regarding the future of Bitcoin and the crypto industry, after securing the Bitcoin Rights Act in Pennsylvania not too long ago which protects people’s right to self-custody crypto.

Yesterday, he shared a post via his X account, saying that big things are coming for the industry.

He also shared a video via X, telling his followers that he just landed in the first place in the world to make Bitcoin legal tender – El Salvador.

El Salvador’s President, Nayib Bukele, was one of the first important political names who congratulated Trump following his US win.

David Bailey, the CEO of Bitcoin Magazine and one of Trump’s campaign crypto aides said that at least one country has been actively buying Bitcoin and is now a top five holder across all users.

Predictions claim that Qatar and Saudi Arabia may be the right guess, since the country he’s referring to is not the US, China, UK, Ukraine, El Salvador, or Bhutan.

It remains to be seen which country he was referring to, but what matters most is that the Bitcoin momentum is rising globally, with the industry expecting $100,000 as the next price target for the coin soon.

Recently, Binance’s CEO, Richard Teng, also highlighted the start of a “golden era” for crypto, as a radical shift is expected in Washington in 2025.