Bitcoin’s (BTC) price rose above $62,000 after Fed Chair Jerome Powell hinted at interest rate cuts on Friday. The chair mentioned this in his Jackson Hole Speech, leading the coin to jump in less than an hour.

But will Bitcoin price continue to climb? This analysis reveals the possibility.

Powell’s Good Hint Drives Quick Bitcoin Bounce and Short Liquidations

Powell, the Federal Reserve Chairman, began his speech around 10 a.m. E.T. on Friday. Before the Jackson Hole Economic Symposium, Bitcoin traded a little above $60,000. But minutes into the keynote address, the coin’s value jumped to $62,324, seemingly due to part of his remarks.

In his speech, Powell mentioned that the agency’s main goals remain tackling inflation and maintaining a strong labor market.

“Our objective has been to restore price stability while maintaining a strong labor market, avoiding the sharp increases in unemployment that characterized earlier disinflationary episodes when inflation expectations were less well-anchored,”he said.

Read more: Who Owns the Most Bitcoin in 2024

Given last week’s positive Consumer Price Index (CPI) result, this development appears to be another good one for the crypto market. Powell’s statement about cutting interest rates soon seemed to be the major highlight that helped Bitcoin’s price increase.

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” the Fed Chair reiterated.

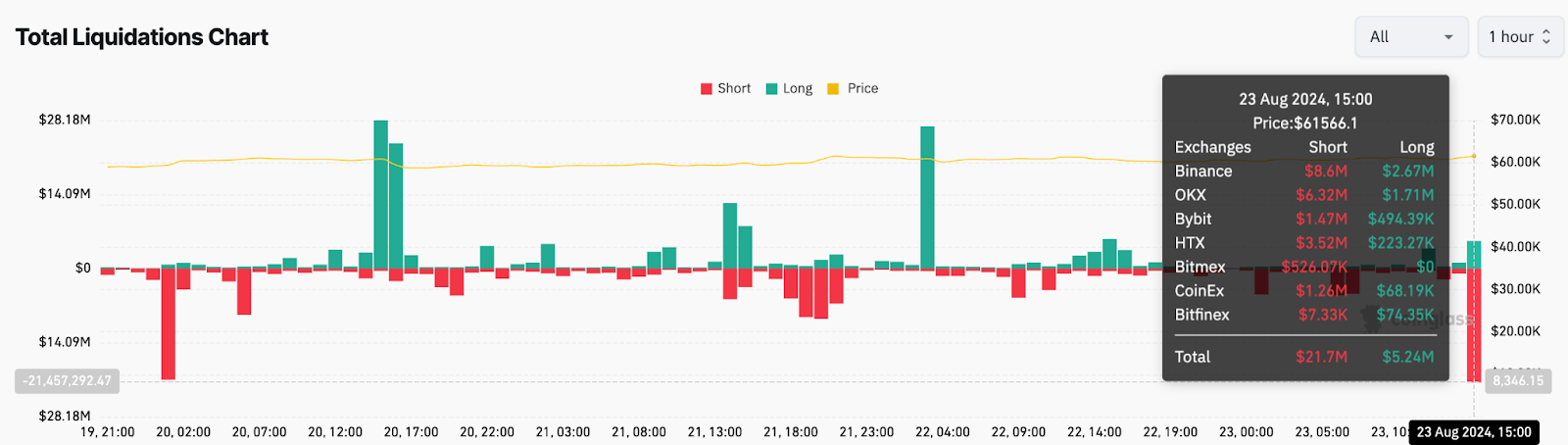

Following the development, Coinglass showed that positions valued at about $27 million were liquidated within one hour. Liquidation occurs when traders are unable to meet a contract’s margin requirements.

When this happens, exchanges are forced to close the position to prevent further losses. As seen below, over $21 million of shorts were liquidated, while long liquidations amounted to a little over $5 million.

For context, shorts are traders betting on a price decrease, while longs are those predicting a price increase. Therefore, Bitcoin’s quick jump above $62,000 caused large-scale short liquidations.

BTC Price Prediction: Consolidation May Last for Sometime

On the daily chart, Bitcoin price reversed below $61,000, indicating that that price pump was short-lived. Also, the Relative Strength Index (RSI) hovers around the neutral 50.00 line. The RSI measures momentum, and an increase in the indicator suggests a bullish momentum.

A decrease, however, indicates a bearish momentum. Therefore, the current reading indicates that most market participants are staying on the sidelines. If this remains the case, BTC might keep swinging sideways.

Additionally, the coin trades near the supply zone at $61,350. Despite this, Bitcoin continues to form lower highs, suggesting that the possibility of another uptrend is not out of place.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Thus, if BTC’s price rebounds, the next target could be $62,290. However, rejection at the supply zone could force a bullish invalidation. If this happens, Bitcoin might drop to $59,939.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

![SUI vs Solana [SOL]: How $7.5B in DEX volume changed the game](https://cryptosheadlines.com/wp-content/uploads/2024/11/News-articles-FI-Samyukhta-5-1000x600.webp-150x150.webp)