Key Points

- Glassnode data recently analyzed the intensity of Bitcoin LTHs sell-side pressure.

- BTC is currently trading above $92,000.

After reaching a new ATH above $99,000 on November 22, BTC began a descendant trajectory on November 25.

At the moment of writing this article, BTC is trading above $92,000, down by 5% in the last 24 hours.

BTC’s recent price drop was triggered by long-term holders taking profits, and LTHs sell-side pressure beginning to outpace the ETF net inflows among others.

Factors Leading to BTC Price Drops

Yesterday, a New York Times report revealed that the Biden Administration has discussed the idea of handing nuclear weapons over to Ukraine as it gets ready to leave office.

Today’s BTC trajectory is also reminiscent of the 2020 “Thanksgiving Day Massacre” when BTC recorded a 13% price drop in 24 hours to $16,412 on November 26. This year, Thanksgiving will be celebrated in the US on November 28.

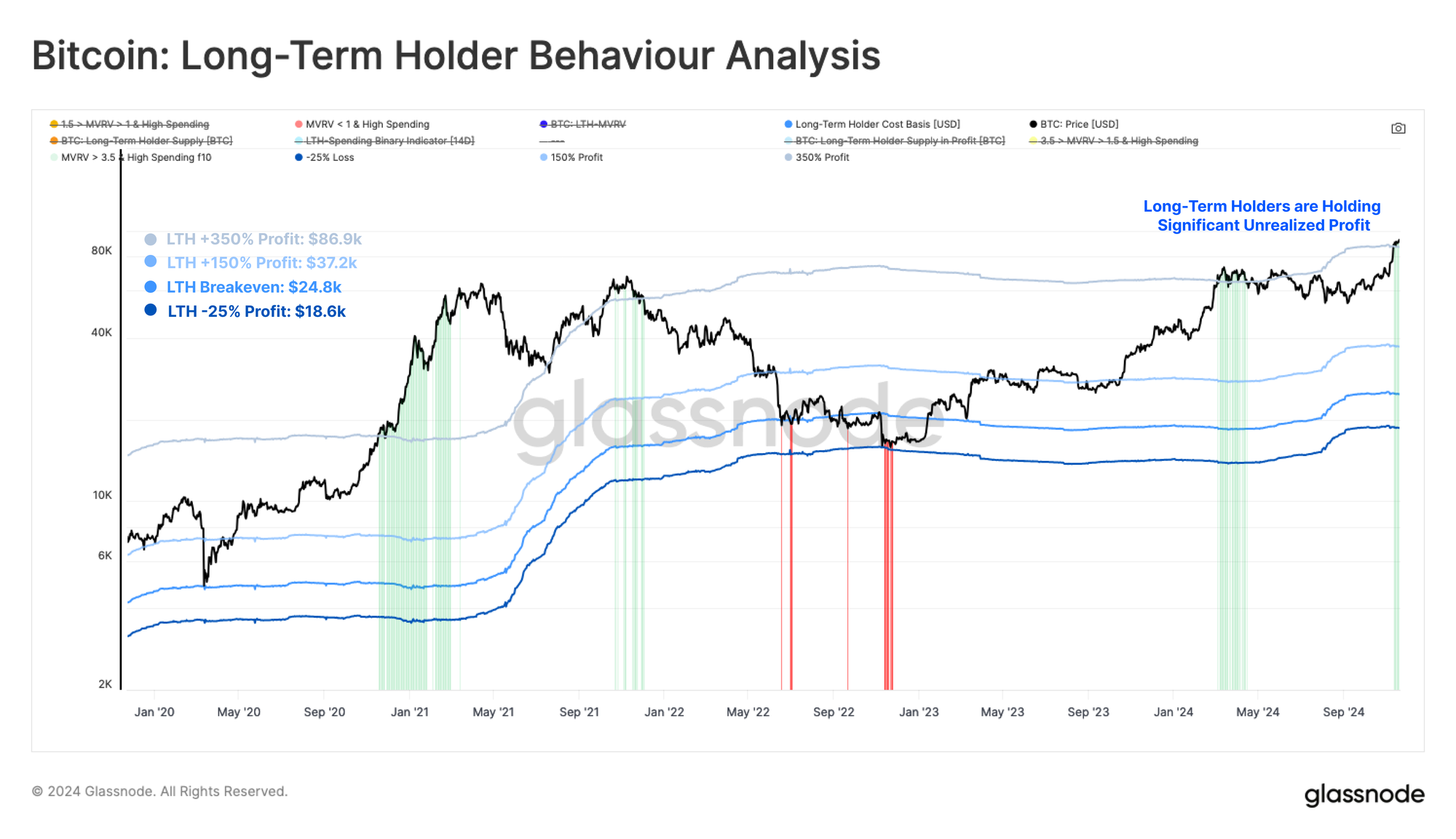

Regarding Bitcoin’s latest price drops, recent reports from Glassnode analyzed LTHs’ sell-off activity following the recent surge above $75,600 that BTC reached on November 7.

Accelerated BTC Sell-Off Activity

Glassnode data from November 20 revealed that as Bitcoin hit a new ATH above $75,000 on November 7, all of the 14 million BTC held by long-term holders (LTHs) entered a profitable state.

This triggered an acceleration of sell-off activity which resulted in a significant decrease of over 200,000 BTC in balance.

This was a classic and repeating pattern, in which LTHs take profits when price action is strong and demand is sufficient to absorb them.

Since the beginning of September, when BTC’s price gained momentum, LTHs’ spending steadily increased. When spending exceeds accumulation, this triggers a net decline in holdings.

However, LTHs were holding significant amounts of unrealized profits in September.

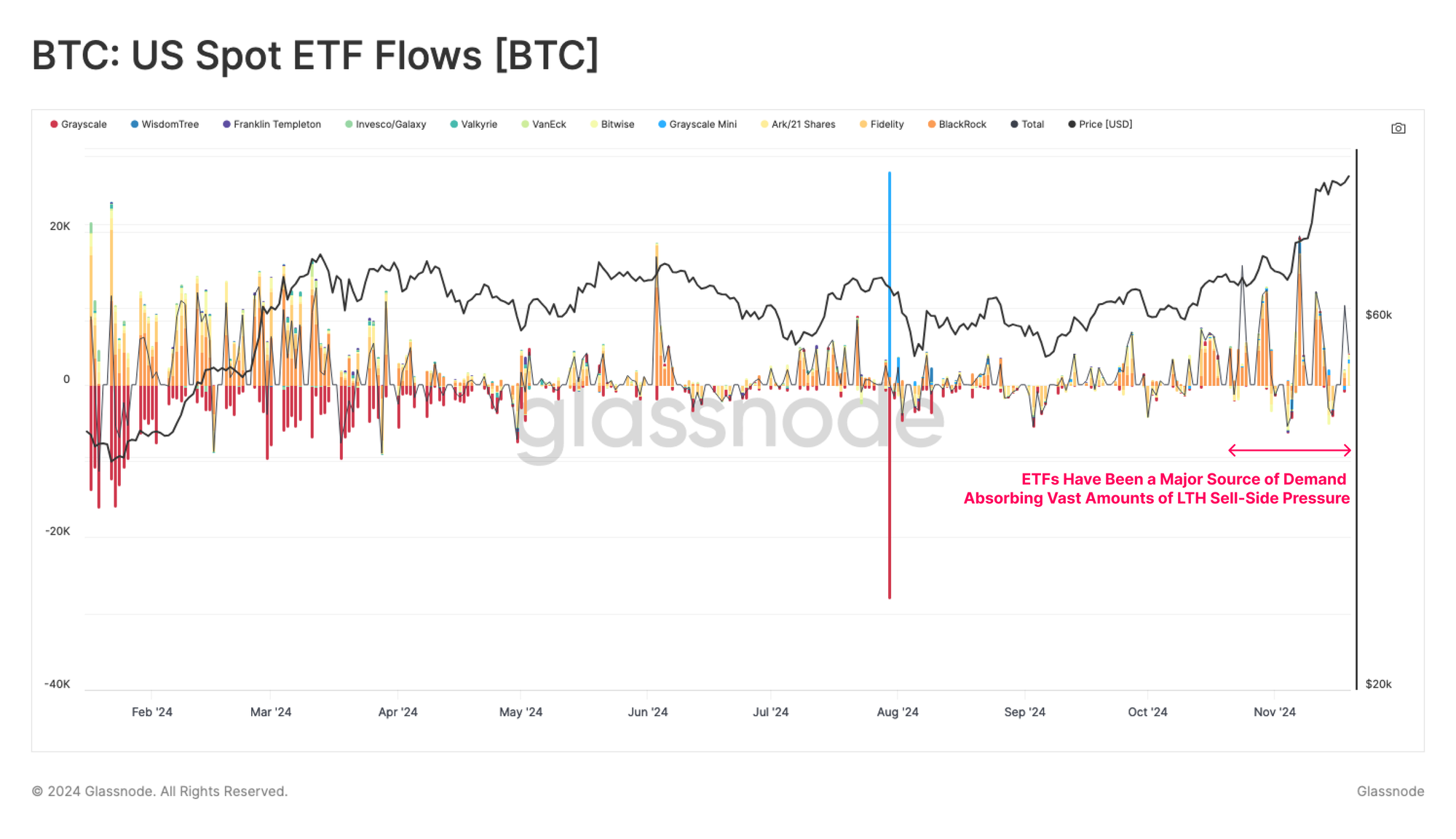

ETFs have reportedly played an important role in the market, absorbing more than 90% of the sell pressure from LTHs, Glassnode reveals.

BTC ETFs, a Major Source of Demand

Bitcoin ETFs have been an important source of demand in recent weeks, absorbing most of the sell-offs by LTHs. Such a dynamic highlights the rising influence that institutional demand has in shaping the modern BTC market structure.

Since mid-October, weekly ETF inflows have surged between $1 billion to over $2 billion per week, highlighting an increased institutional demand.

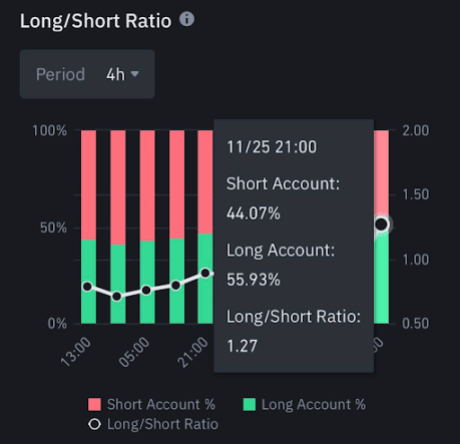

Since November 13, the LTH sell-side pressure began outpacing the ETF net inflows, in a similar manner observed in late February 2024. Back then, the imbalance between supply and demand triggered increased market volatility and consolidation.

As unrealized profits reached higher levels, more LTHs accelerated their sell-off, which already exceeded the inflows of BTC ETFs in the short term.

Optimism Remains Strong in the Crypto Industry

The optimism in the crypto industry continues, as preparations are being made for a Strategic Bitcoin Reserve in the US and beyond, and the upcoming shift in Washington will bring more crypto-friendly policies, following Trump’s Presidential Inauguration set to take place on January 20.

Despite its recent price drops, analysts suggest that BTC’s price will recover following this sell-off, and get back on track to $100,000 in 2024.