In the lead-up to the United States election, Bitcoin’s price movements have become increasingly intertwined with the presidential race, according to a pair of crypto executives. On Oct. 30, Bitcoin stormed above $70,000 for the first time since June, nearly tearing past its all-time high of $73,750, before stopping just short.

Speaking to Cryptopolitan, Cory Klippsten, CEO of Swan Bitcoin, said the recent price surge likely reflects investor sentiment regarding future regulatory policies, legal clarity, and possible Bitcoin adoption by the federal government.

“The recent surge in Bitcoin’s price, which has brought it within striking distance of its all-time high, can be attributed to a combination of investor optimism surrounding the election due to positive engagement from both campaigns and a significant influx of capital into Bitcoin ETFs,” he said.

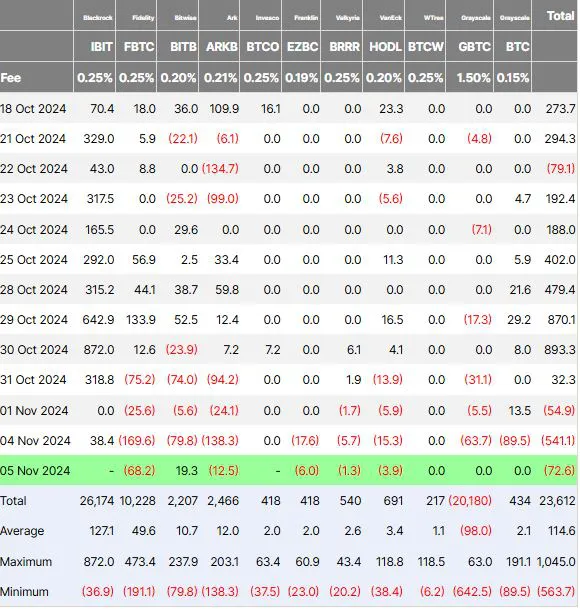

Throughout October, the 11 United States-based spot Bitcoin exchange-traded funds (ETFs) saw consecutive inflows, peaking at almost $900 million on Oct. 30, the second-largest ever, according to Farside Investors.

However, on Nov. 4, the day before polling day, ETFs recorded their second-biggest day of outflows, $541.1 million. This represents the largest outflow since May 1, when $563.7 million was registered.

Crypto-heavy election fueling positive investor sentiment

Presidential candidates’ views on cryptocurrency regulation have become more prominent in the lead-up to the 2024 election. According to a survey released on Oct. 17 by crypto advocacy group, The Digital Chamber, about 26 million voters could be part of a “crypto voting bloc,” flagging a pro-crypto policy as a top requirement when deciding who to vote for.

One in seven of the 1,004 survey respondents said crypto was “extremely” or “very” important in deciding who they would vote for.

Klippsten says both candidates and their campaigns have discussed crypto in some form, which is likely fueling investor optimism that when the dust settles, there might be a more crypto-friendly environment in the U.S.

“Donald Trump has taken a decidedly pro-Bitcoin position, pledging to transform the U.S. into the world’s leading Bitcoin hub and even proposing the establishment of a national Bitcoin reserve,” he said.

“Kamala Harris has adopted a more measured approach, with many in the industry anticipating a period of regulatory clarity and support under her potential administration,” Klippsten added.

Former President Donald Trump has expressed support for the crypto industry, teasing at a keynote address in Nashville, Tennessee, how he would make the U.S. the “crypto capital of the planet” and Bitcoin a “superpower of the world.”

Vice President Kamala Harris has yet to reveal an official position on crypto, but in her 2024 policy platform, she refers to “digital currencies” and outlines plans to “encourage innovative technologies like AI and digital assets while protecting our consumers and investors.”

Post-election Bitcoin price likely tied to whoever wins

Greg Magadini, director of derivatives at Amberdata, told Cryptopolitan that depending on who wins the election, the Bitcoin price could receive a spike in either direction, “with a +1.5-Sigma, $6,000 to $8,000 price range, as a result of the post-election price reaction.”

“Therefore, major price levels are $60,000, Kamala wins dip, or a $75,000/$77,000 a Trump win that brings spot right back to the all-time highs, then through them, as election enthusiasm breaks the high seen last week,” he said.

Bitcoin has surged approximately 9.46% in the past 24 hours, reaching an all-time high of $75,011 as vote-counting progresses, with Donald Trump taking an early lead in the polls. At the time of writing, Trump has 95 wins out of the 135 electoral votes counted so far