Key Points

- Bitcoin price trades above $96,000, amidst growing optimism for the future in the crypto market.

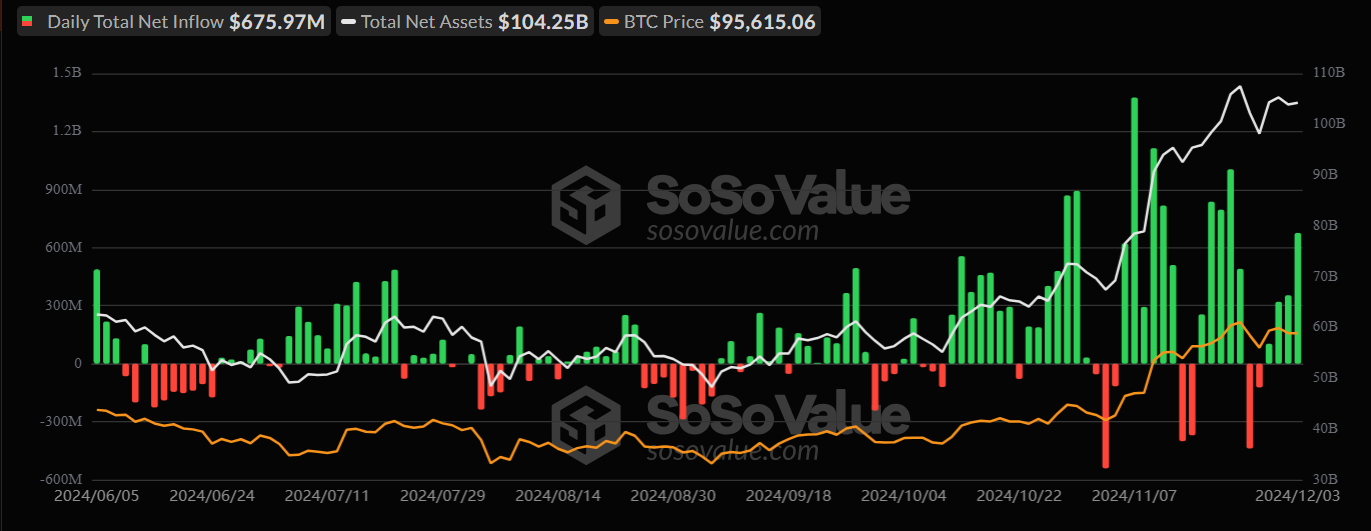

- Yesterday, the US BTC ETFs recorded almost $676 million in inflows.

Bitcoin’s price is getting back on track to the $100,000 important level, as the crypto market maintains optimism for upcoming crypto-friendly policies and Strategic Bitcoin Reserves in the US and abroad. Also, inflows in BTC ETFs signal continued institutional interest in the sector.

The upcoming US Fed meeting scheduled for December 18, is worth watching as well, as the interest rate cut decision could impact the price of BTC.

Bitcoin Price Holds Above $96,000

At the moment of writing this article, BTC is trading above $96,000, up by over 1% in the last 24 hours. The digital asset recorded a price dip on December 3 at $93,000 levels, ahead of a bounce back today.

Institutional interest in Bitcoin and related products continues to remain strong as shown by the Bitcoin ETFs in the US.

BTC ETFs Record Over $1 Billion Inflows This Week

Regarding Bitcoin-related products, the US BTC ETFs saw inflows of over $1 billion this week. On December 3, the crypto products recorded inflows of almost $676 million, and on Monday, they saw influxes of over $363.6 million.

Yesterday was the fourth consecutive inflow day for BTC ETFs since last week, on November 27. The total net assets locked in BTC ETFs as of yesterday were over $104 billion and the cumulative flows in the crypto products since their January launch are getting close to $32 billion, according to SoSoValue data.

Optimism around Bitcoin and the crypto market remains strong ahead of the new upcoming Trump administration in the US. Prospects include more crypto-friendly policies and Strategic Bitcoin Reserves in the US.

Recently, Satoshi Act Fund’s founder and CEO, Dennis Porter, confirmed that at least 10 states in the US will implement such BTC Reserves, with more to come.

More factors suggest that Bitcoin continues to remain on track to the important market of $100,000, including the expectations from the upcoming FOMC meeting this month and global adoption.

FOMC Meeting Interest Rate Cut Expectations

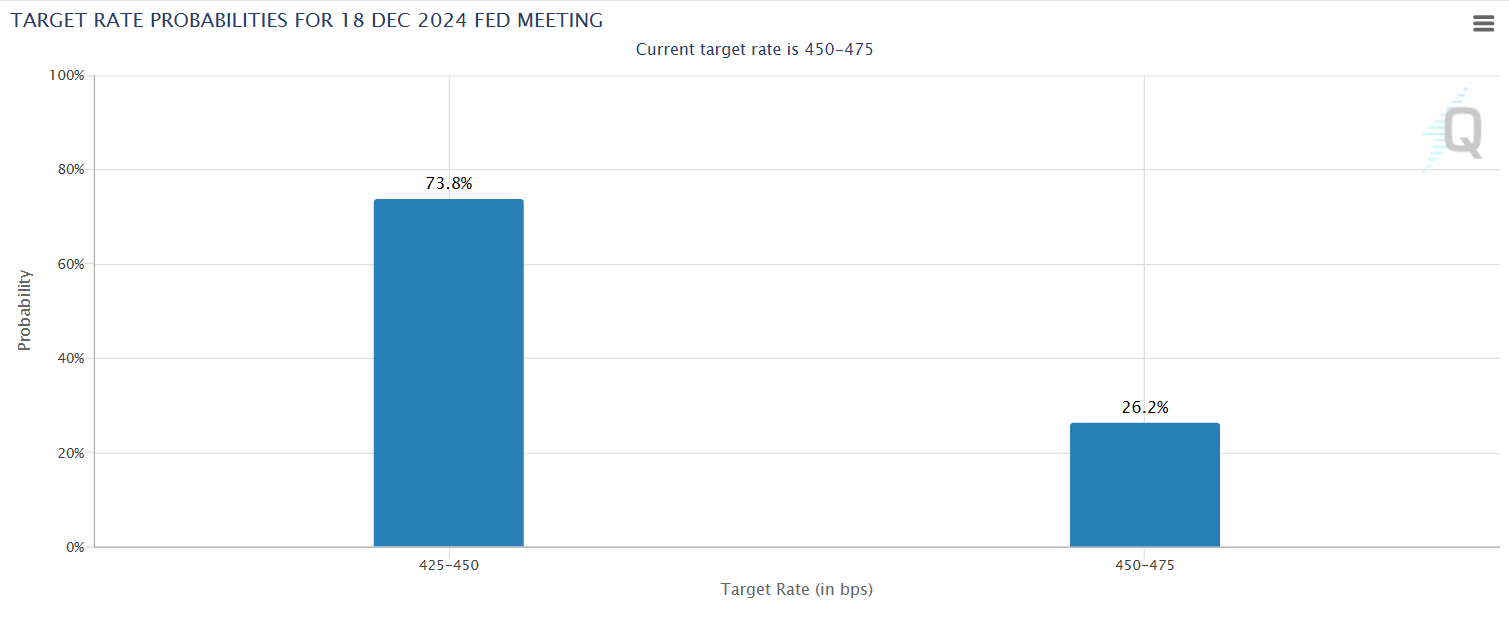

The next FOMC meeting is in around two weeks, and CME Group reveals the likelihood that the Fed will cut interest rates again this year.

According to their data, there is a probability of 73.8% of a 25 bps rate cut and a 26.2% probability of a 50 bps rate cut this month.

FOMC meetings and interest rate cut decisions have historically been important for Bitcoin’s price as well, with decisions to cut interest rates boosting the coin’s price.