Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

The price of major cryptocurrency Bitcoin (BTC) is once again the main attraction, as it always is, to be honest. New day, new reason, and this time it is the fact that the price has made its way back above the crucial level of $60,000 per BTC.

Having lost this point during the news-driven massacre on the cryptocurrency market worth at least $180 million yesterday, the price of Bitcoin briefly found itself as low as $58,946, according to the Binance chart.

However, buyers showed their hand, and over the next 12 hours, this imbalance, as they see it, was restored, with Bitcoin now trading as high as $61,200.

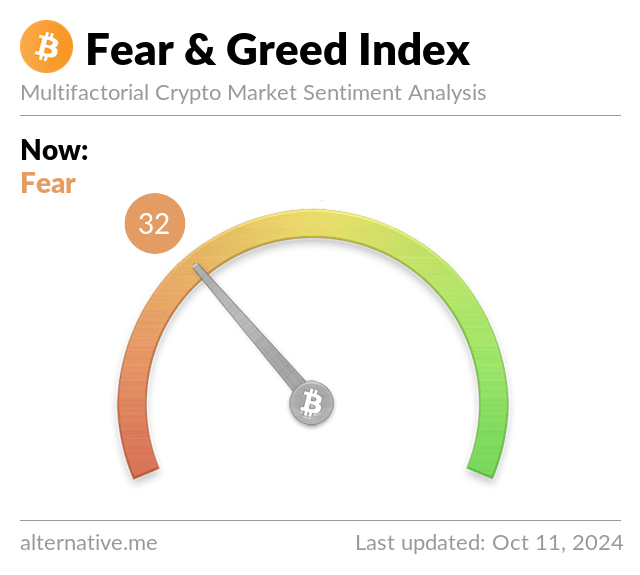

It is interesting to note the divergence between what is happening on the price chart of Bitcoin and the sentiment of market participants as, according to the Fear and Greed Index, we are now entering the period of the latter, with a figure of 32 on the radar of this popular indicator.

Fear or delayed greed?

For comparison, it was flashing 39 yesterday and 41 last week. It is therefore safe to assume that yesterday’s collapse in cryptocurrency prices has led to a serious deterioration in sentiment among market participants.

On the other hand, Bitcoin was able to regain important local price levels and was supported by buyers. Is it really a divergence, and while fear prevails, the bravest take advantage? What’s more important – price action or market sentiment?

Without getting too philosophical, the only thing that matters is where Bitcoin goes next. There are really only three options: a march toward the dynamic resistance level currently at around $65,000, a further drop below $60,000 or a prolonged sideways chop that will eventually lead us to the first two options.