- Ecoinometrics projects Bitcoin could reach six-digit values by 2025 if key factors like strong momentum hold.

- Bitcoin’s correlation with NASDAQ and on-chain data indicate continued bullish potential for the cryptocurrency.

Over the next 12 months, Bitcoin is predicted to show a notable increase, and if present momentum keeps, estimates indicate the value of the coin could reach six-digit figures.

Analysis from Ecoinometrics suggests that, given important elements like stable on-chain activity and high momentum for risky assets that remain maintained, Bitcoin’s price might reach over $130,000 by the end of 2025. With Bitcoin’s present price around $65,000, keeping this level is essential to induced a positive trend.

Maintaining Momentum and Breaking the Downtrend

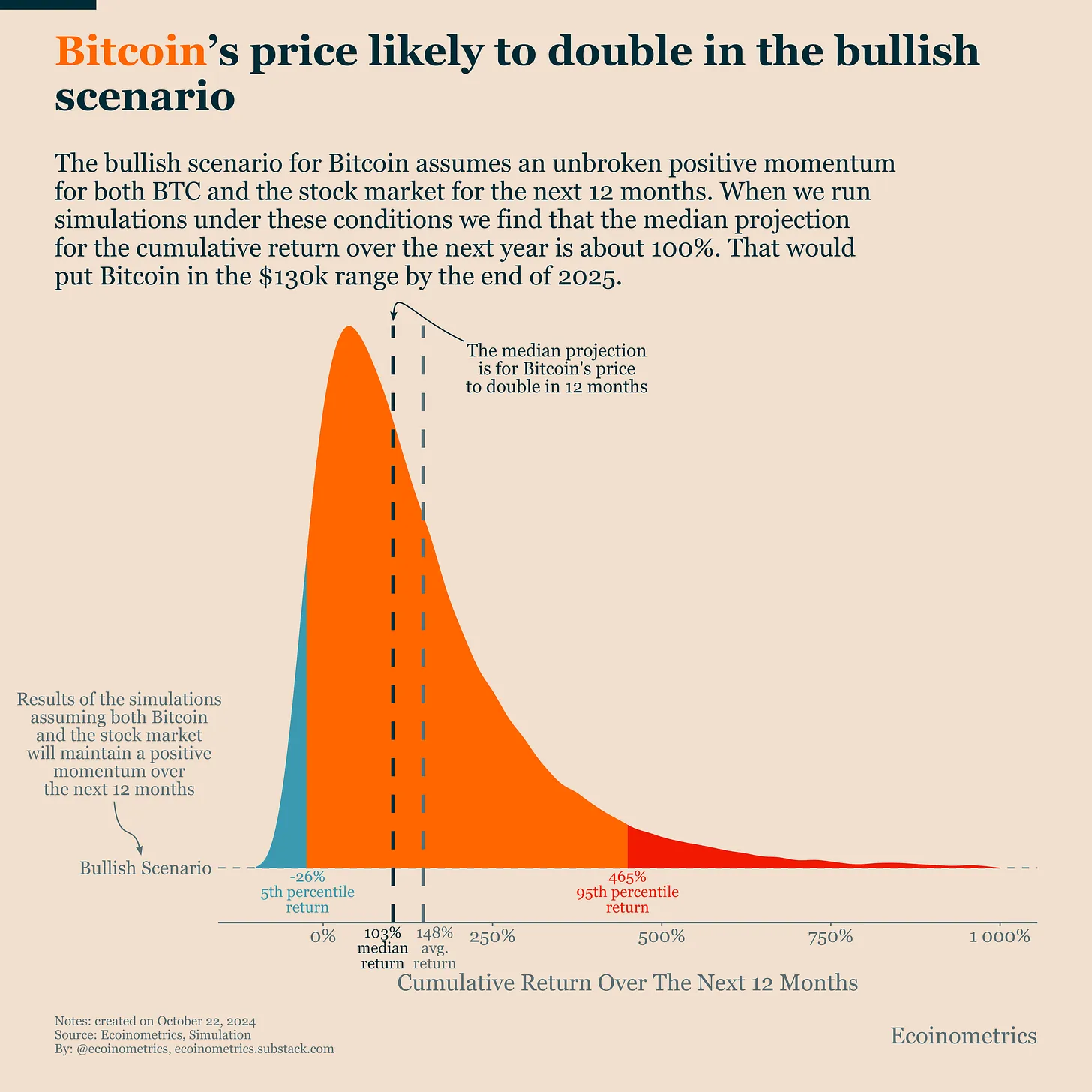

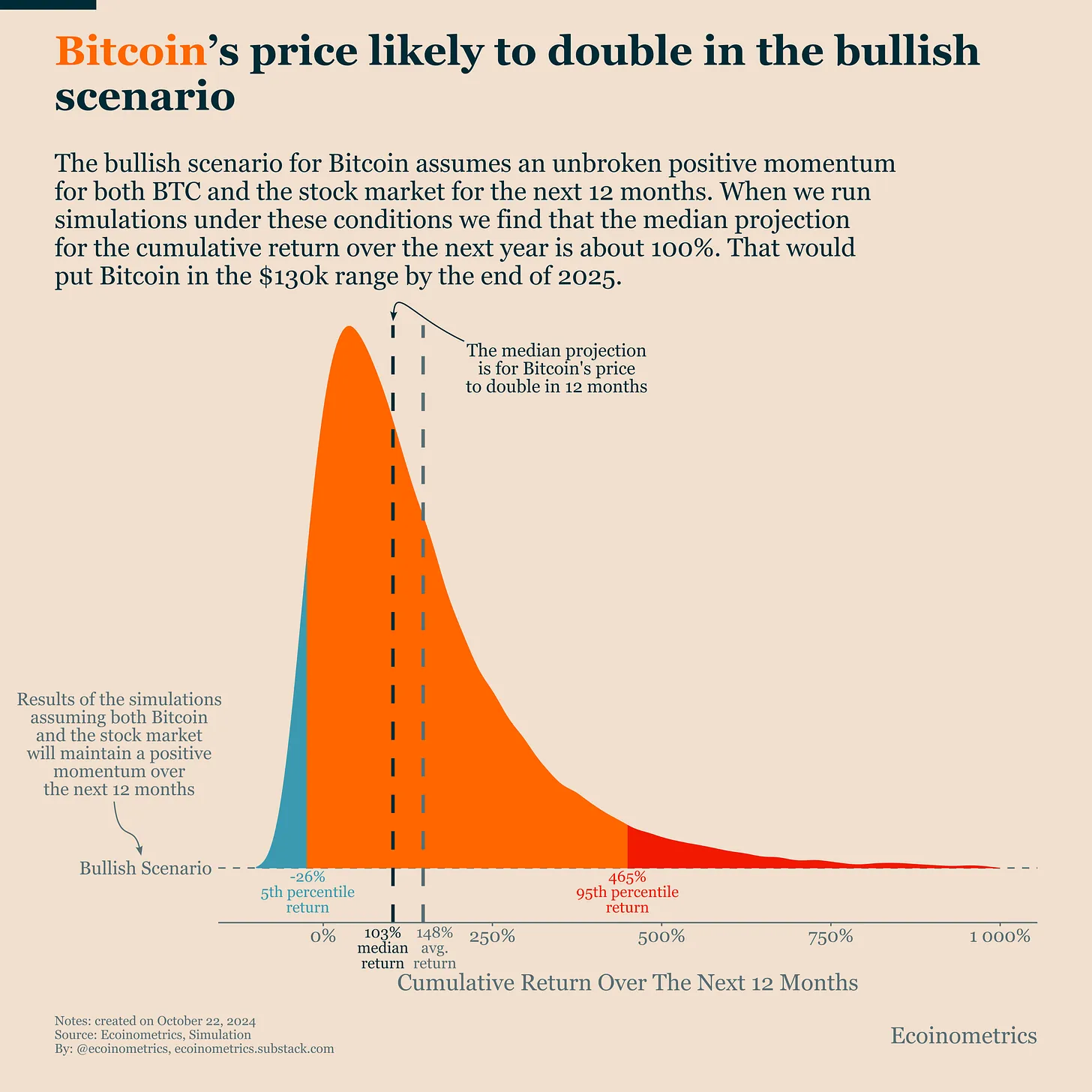

Based on a basic model evaluating four main elements—on-chain activity, Bitcoin price volatility, and momentum of both Bitcoin and other hazardous assets—ecoinometrics project.

With a median return prediction of roughly 103%, Bitcoin and related assets keeping their momentum might produce an average annual return of 148%, under an optimistic scenario.

Though there is a chance of a 26% decline in the worst-case scenario, the study also adds that Bitcoin’s possible upside in the next 12 months may reach 465%. Build upward momentum, analysts stress, depends on keeping Bitcoin’s price over $65,000.

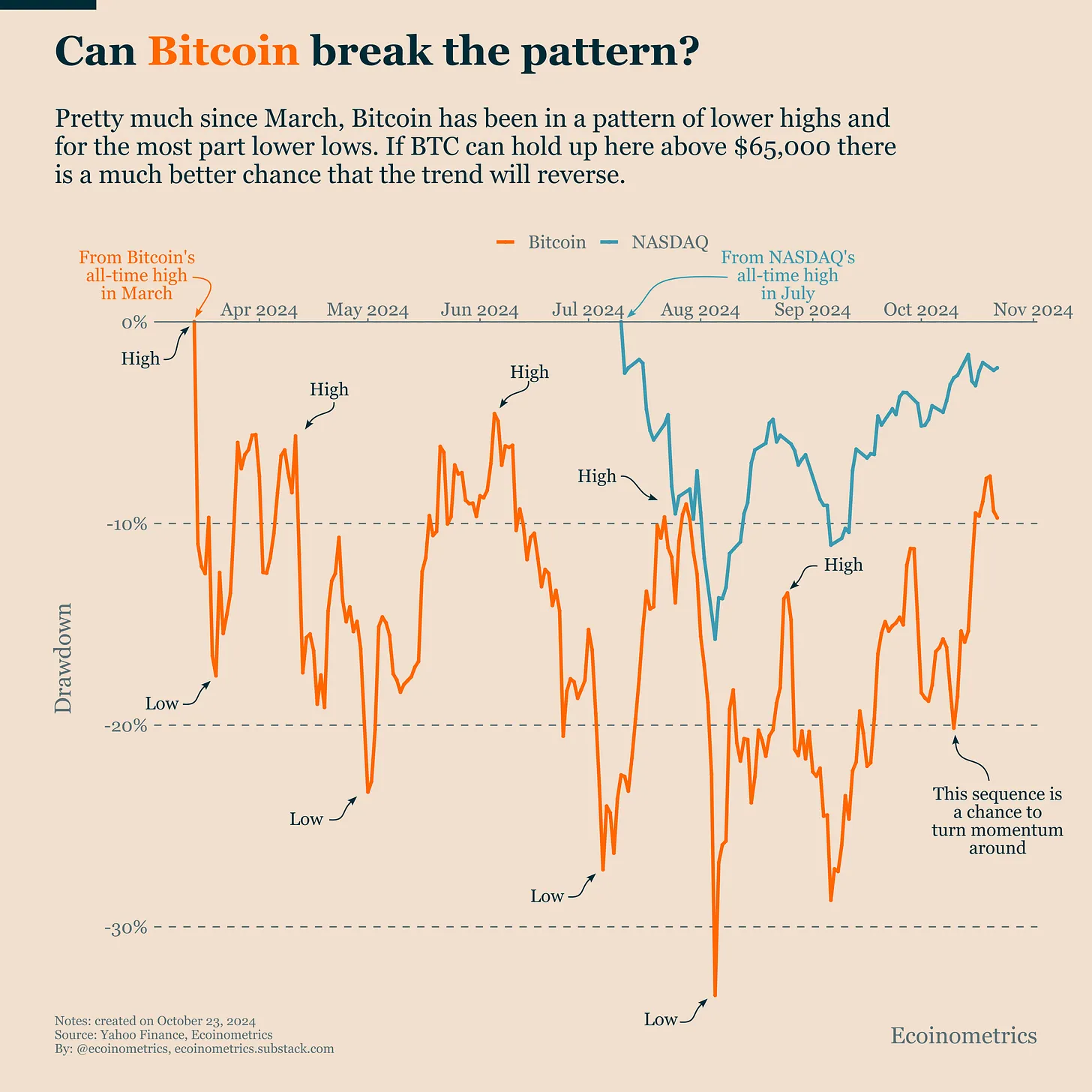

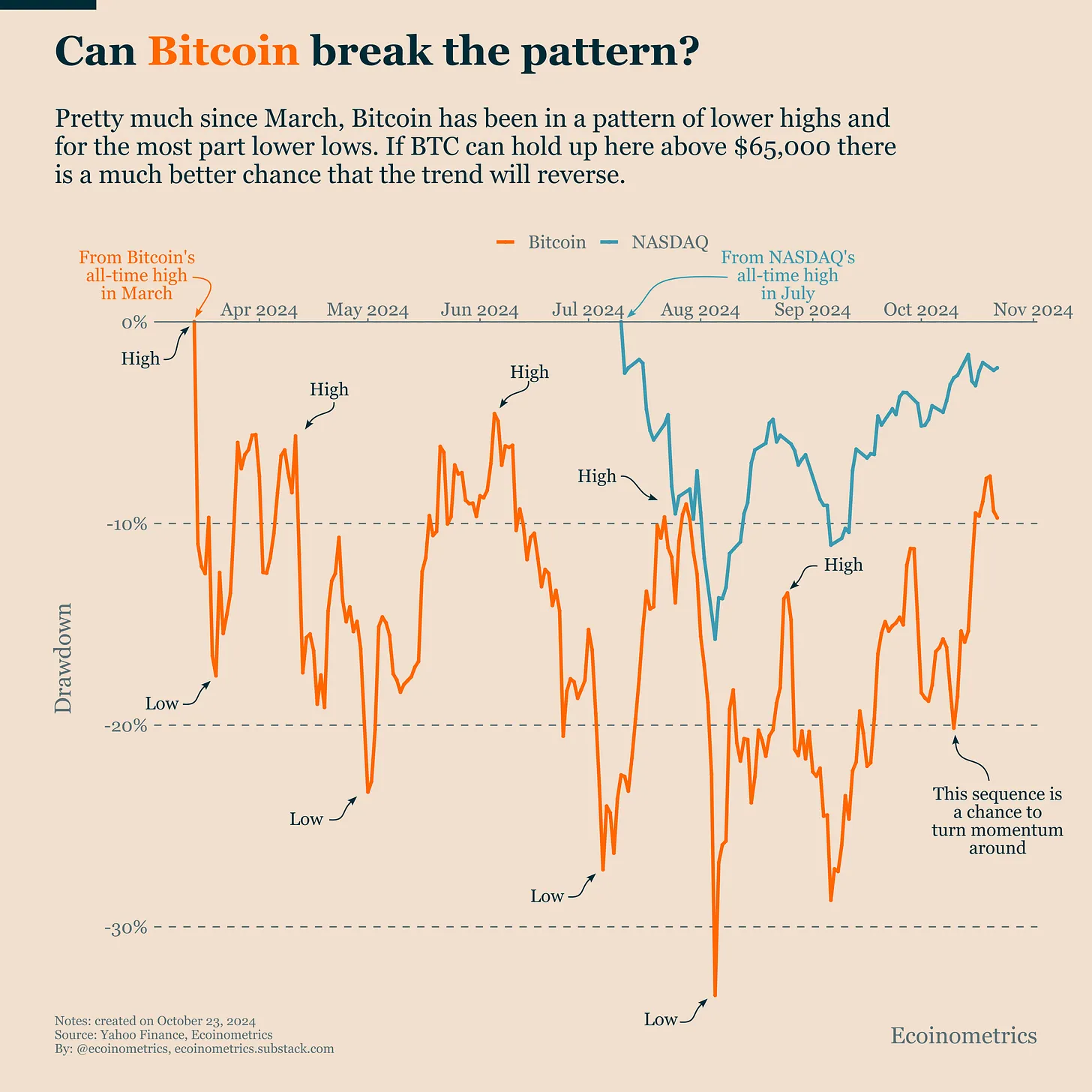

Apart from these technical aspects, Ecoinometrics emphasizes how Bitcoin’s capacity to keep a price above $65,000 might disrupt the trend of lower highs and lower lows noted since March.

If not disturbed, this pattern can point to a continuous downtrend. But if Bitcoin avoids this and keeps either sideways or positive motions, the digital asset may undergo a major turning point.

Bitcoin: Correlation with Stock Markets and the U.S. Money Supply

The BTC price has increased in line with the NASDAQ 100 since August, implying a closer link with the US stock market. Analysts think that if more general stock markets show an increasing tendency, this link will help Bitcoin.

Moreover, recent on-chain data supports the theory that Bitcoin owners are mostly keeping their positions, which is encouraging for the future price movement.

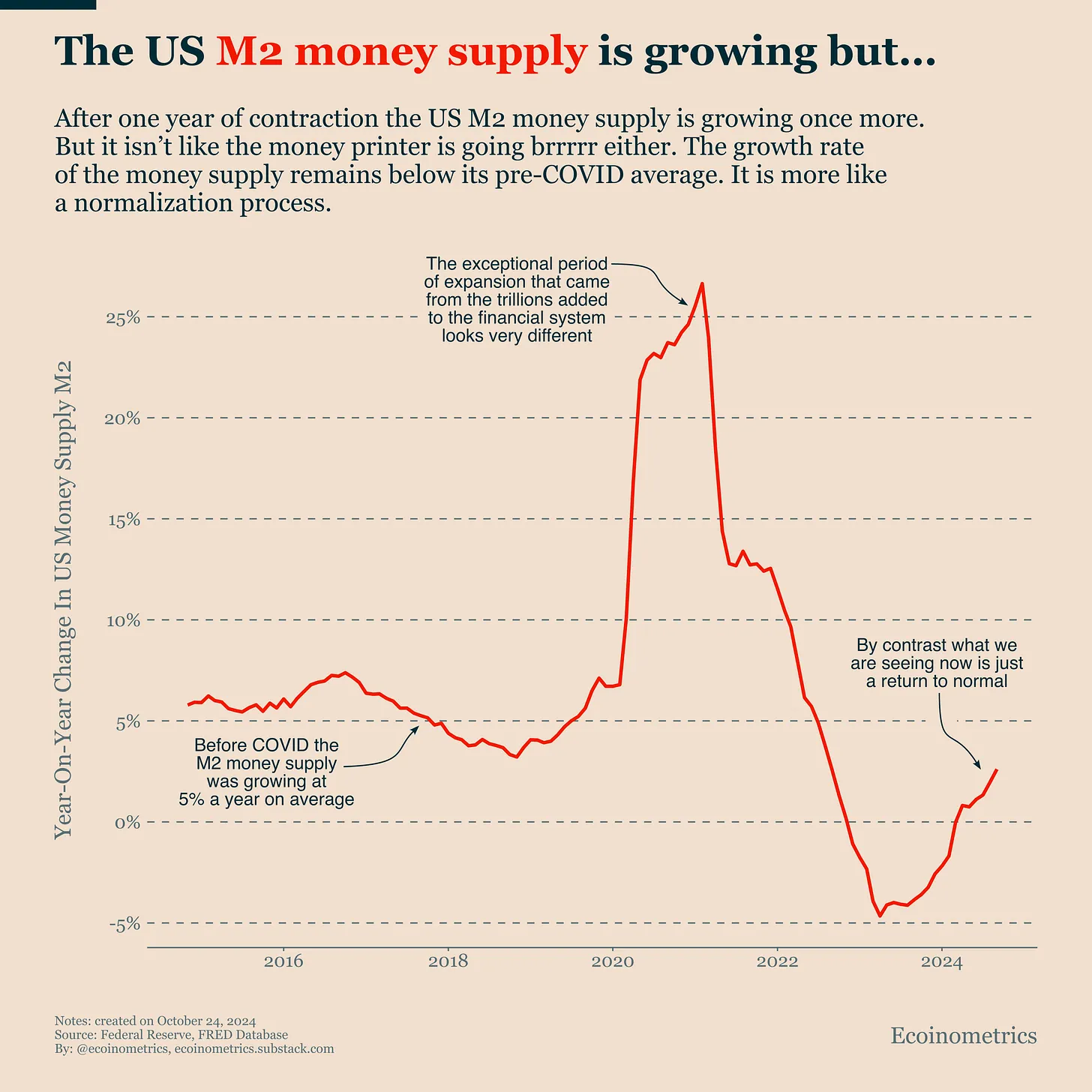

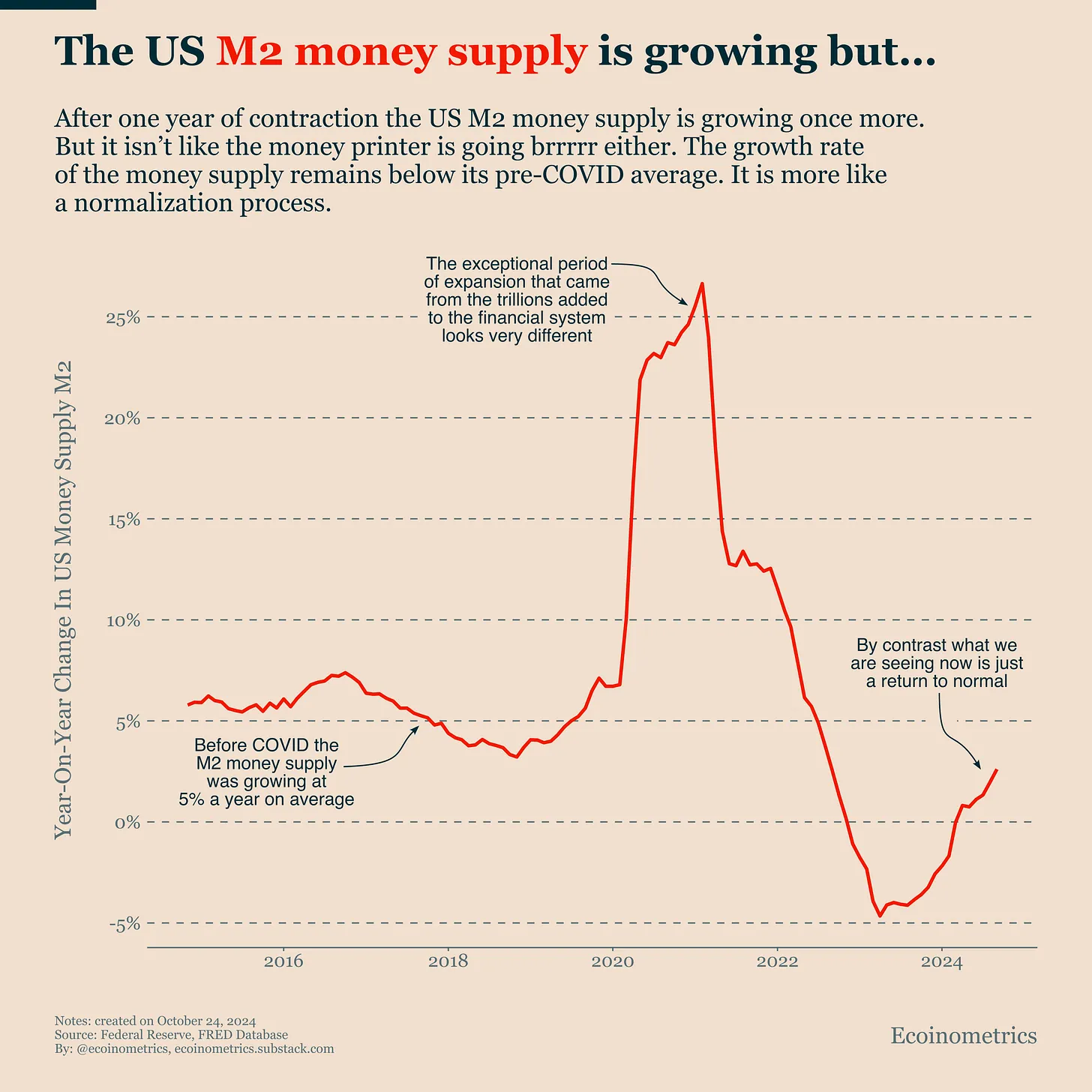

Apart from technical research, Ecoinometrics notes that the BTC price might change depending on the expansion of the U.S. money supply (M2). Although M2 is once more increasing, experts warn that its increase has not matched the explosive speed observed during the COVID-19 epidemic, when M2 grew fivefold.

Ecoinometrics claim that the present rise in the money supply is a normalizing phase following the epidemic era rather than a new phase of expansion. Although the increasing money supply could still be good for Bitcoin investors, it is not the kind of quick expansion observed in 2020 and 2021.

Bitcoin Role as a Hedge Against Fiat Currency Devaluation

Ecoinometrics claims, however, that Bitcoin can still provide consistent profits without having trillions of fresh cash flooding the economy.

Driven by budget deficits and rising government debt, the ongoing devaluation of fiat currencies remains a concern; thus, the function of Bitcoin as a hedge against the devaluation of fiat currencies becomes more important than ever.

“Bitcoin has thrived in periods of fast money creation, but even without excessive money printing, it remains a strategic hedge,” an Ecoinometrics analyst said, underscoring Bitcoin’s ongoing attraction as a safe haven from the fall of fiat currencies.

On the other hand, a CNF report highlighted Ki Young Ju, CEO of blockchain analytics company CryptoQuant, who projected that Bitcoin would become a widespread currency by 2030.

Ju expects growing institutional interest and rising mining difficulty will help to drastically lower the volatility of Bitcoin before the end of this decade.

Meanwhile, having declined 1.39% over the last 24 hours, Bitcoin was trading at $67,039.04 at the time of writing with a daily trading volume of $39.80 billion.