Key Points

- Today’s FOMC meeting will reveal the decision to cut interest rates, potentially affecting Bitcoin’s trajectory.

- BTC is currently trading above $74,000.

Later today, the US Federal Reserve Chair, Jerome Powell, is expected to hold a press conference, ahead of the Federal Open Market Committee’s decision regarding interest rates cuts.

The Fed will not alter its policy path, based on the recent election results in the US, and it’s expected to cut interest rates, a decision that will most likely trigger volatility in the crypto market.

FOMC Meeting – Rate Cuts Expectations

Today’s expectations of a 25 bps rate cut are at 97.5%, according to data from CME Group.

The Fed’s rate cut decision will not be impacted by the US election results which came in yesterday, with Donald Trump as the winner, Barron’s notes.

Today’s FOMC meeting is set to deliver a quarter-point interest rate cut and the focus will continue on what happens at the central bank’s next meetings and whether the Fed will slow down the pace of upcoming rate cuts.

The next decision and FOMC meeting is scheduled for December, according to official notes.

The Fed’s inflation target is 2% and officials are confident that the US is moving in the right direction, judging that the risks to achieving the employment and inflation goals are in balance, according to the USA Today.

The annual inflation rate in the US was 2.4%, as of October, a level seen in February 2021.

The Fed Chair, Jerome Powell, previously said that officials could slow down or speed up the pace of interest rate cuts based on how the economy and inflation evolve in the country.

Today’s FOMC decision is expected to trigger market volatility, and based on historical data, new rate cuts could fuel a rally for Bitcoin’s price. The Fed cut interest rates the last time in September which propelled bullish moves for BTC.

Bitcoin Trades Above $74,000

At the moment of writing this article, BTC is trading above $74,000, up by over 2.5% today.

On November 6, Bitcoin recorded a price rally above $75,000 as the US election results were coming in, showing Trump the winner.

Today, BTC briefly climbed above $76,000, hitting a fresh ATH, fueled by all the excitement in the US and renewed inflows in BTC ETFs among other factors.

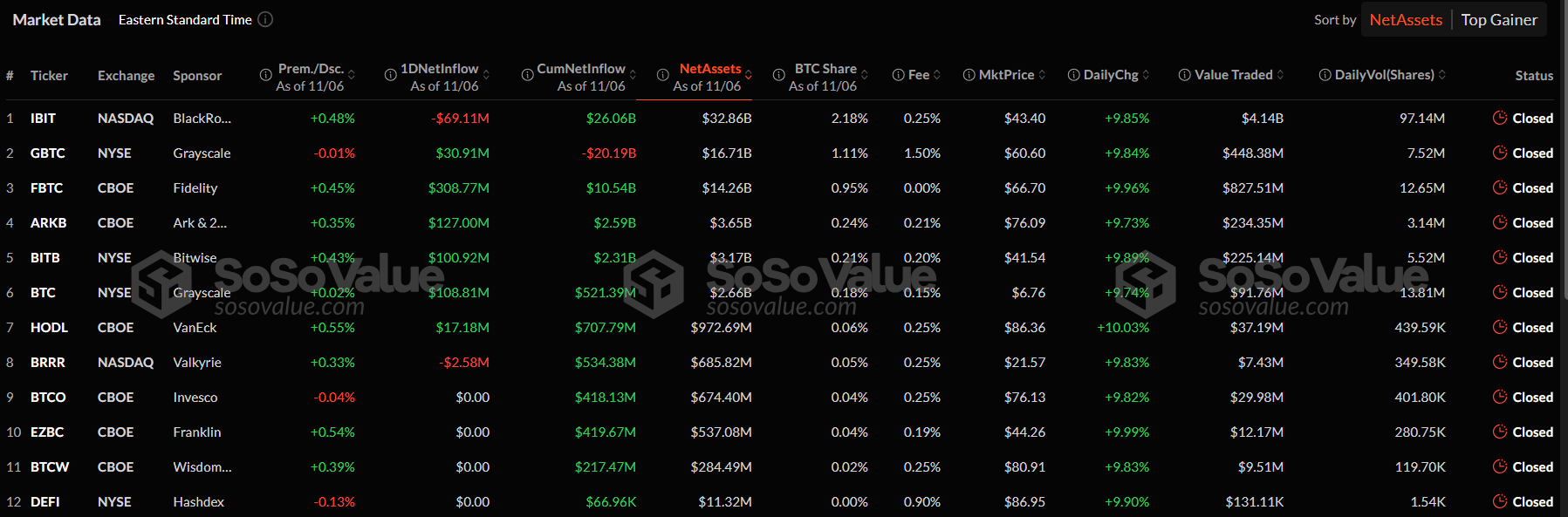

Yesterday, the crypto products recorded inflows of almost $622 million, and the only BTC ETFs that saw outflows were BlackRock’s IBIT, at $69 million, and Valkyrie’s BRRR with outflows of over $2.5 million.

Also, the highest inflow was recorded by Fidelity’s Bitcoin ETF, FBTC above $308 million, according to SoSoValue data.

The head of research at K33 Research, Vetle Lunde, believes that inflows in BTC ETFs will continue these days.

More than that, futures markets also suggest that Bitcoin’s rally could continue gaining momentum, according to Bloomberg.

Predictions around Bitcoin are optimistic considering that the US has a pro-Bitcoin and crypto President, who made important promises for the industry.