The Bitcoin price remained stable amidst news of major financial firms, including Blackrock, filing for spot Bitcoin ETFs.

CryptosHeadlines.com has launched its own crypto store

CryptosHeadlines.com has unveiled its crypto store, Crypto Emporium, enabling users to buy and sell real-world products using the EMT Token, the platform’s native currency. Join the EMT token pre-sale now to secure early EMT Tokens.

EMT Pre Sale Link: cryptosheadlines.shop

The cryptocurrency market is eagerly awaiting the July 26, 2023 Federal Reserve meeting to see the outcome on interest rates. Traders anticipate a 25 bps increase in the target rate by the Federal Open Market Committee (FOMC), which could be the final hike in the current cycle. Meanwhile, the Bitcoin price is showing signs of a bullish trend, finding support in a crucial area and potentially gearing up for the next upward movement.

According to the CME FedWatch Tool, which assesses the probability of the Fed altering the target rate in the upcoming meeting, the market is highly confident about a 25 bps increase from the current rate of 500-525 bps. Approximately 99.2% of respondents believe that the US central bank will implement an interest rate hike during the July meeting.

Low Bitcoin Volatility: What Does It Mean?

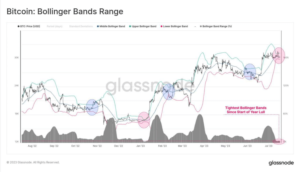

The leading cryptocurrency is experiencing a six-month low in volatility due to recent sideways movement prompted by financial giants like Blackrock filing for spot Bitcoin ETFs with the SEC.

According to Glassnode data, the last time Bitcoin witnessed such tight volatility was in January 2023, leading to a significant 30% surge in the crypto market. Historically, such tight squeezes from sideways movement have often preceded a subsequent bullish trend.

Bloomberg analysts observed that these circumstances typically serve as a precursor to a breakout move due to the cyclical nature of volatility. Goldman Sachs analysts had previously predicted that the July 2023 Fed meeting might be the final rate hike in the current monetary tightening cycle. As a result, any indication of relief during US Fed Chair Jerome Powell’s post-FOMC press conference could potentially push the Bitcoin price closer to the next resistance level, near $33,000.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News and Threads App