Key Points

- BItcoin price debuted this week above $69,000.

- Last week’s BTC rally continues fueled by multiple factors including BTC ETFs’ 3rd largest inflow week.

Bitcoin price began this week above $69,000, a price level that has not been seen since June.

At the moment of writing this article, BTC is trading near $69,000, up by over 1% in the past 24 hours.

Earlier, BTC reached prices above $69,400, ahead of a slight correction to $68,600, followed by a price rebound above the $69,000 level.

Last week’s rally continues fueled by multiple factors including continuous BTC ETF inflows, whale accumulation, and rising Trump odds at the upcoming US elections.

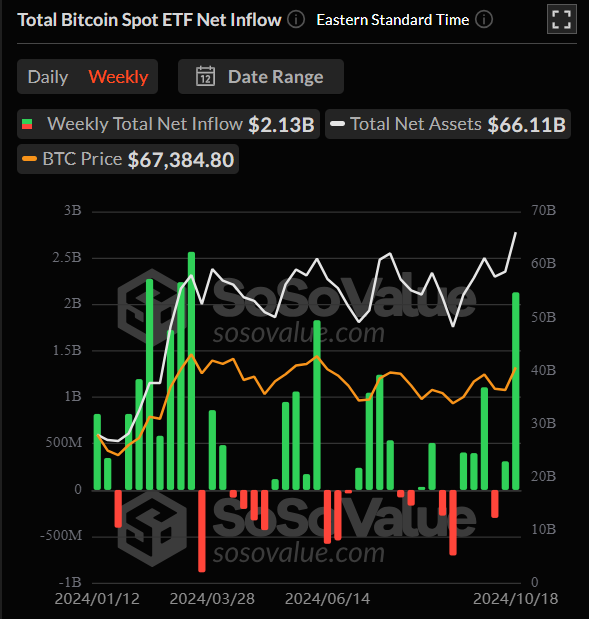

US BTC ETFs Saw Their 3rd Biggest Week

Last week, Bitcoin ETFs in the US recorded continuous inflows, topping $2.13 billion – their third most significant week since the crypto products’ launch back in January.

The biggest inflow week for the crypto products was the March 11-15 week, when the BTC ETFs saw $2.57 billion in inflows, followed by the February 12-16 week, when the crypto products recorded $2.27 billion in inflows.

Last week, BlackRock’s Bitcoin ETF, IBIT, recorded the most inflows topping $1.14 billion in inflows.

The total net assets in BTC ETFs in the US were over $66.1 billion as of October 18, and the cumulative net inflow in the crypto products was nearing $21 billion, according to data from SoSoValue.

Continuous flows in BTC ETFs represented a factor fueling BTC’s price rally. Other factors include whale accumulation and the upcoming US elections.

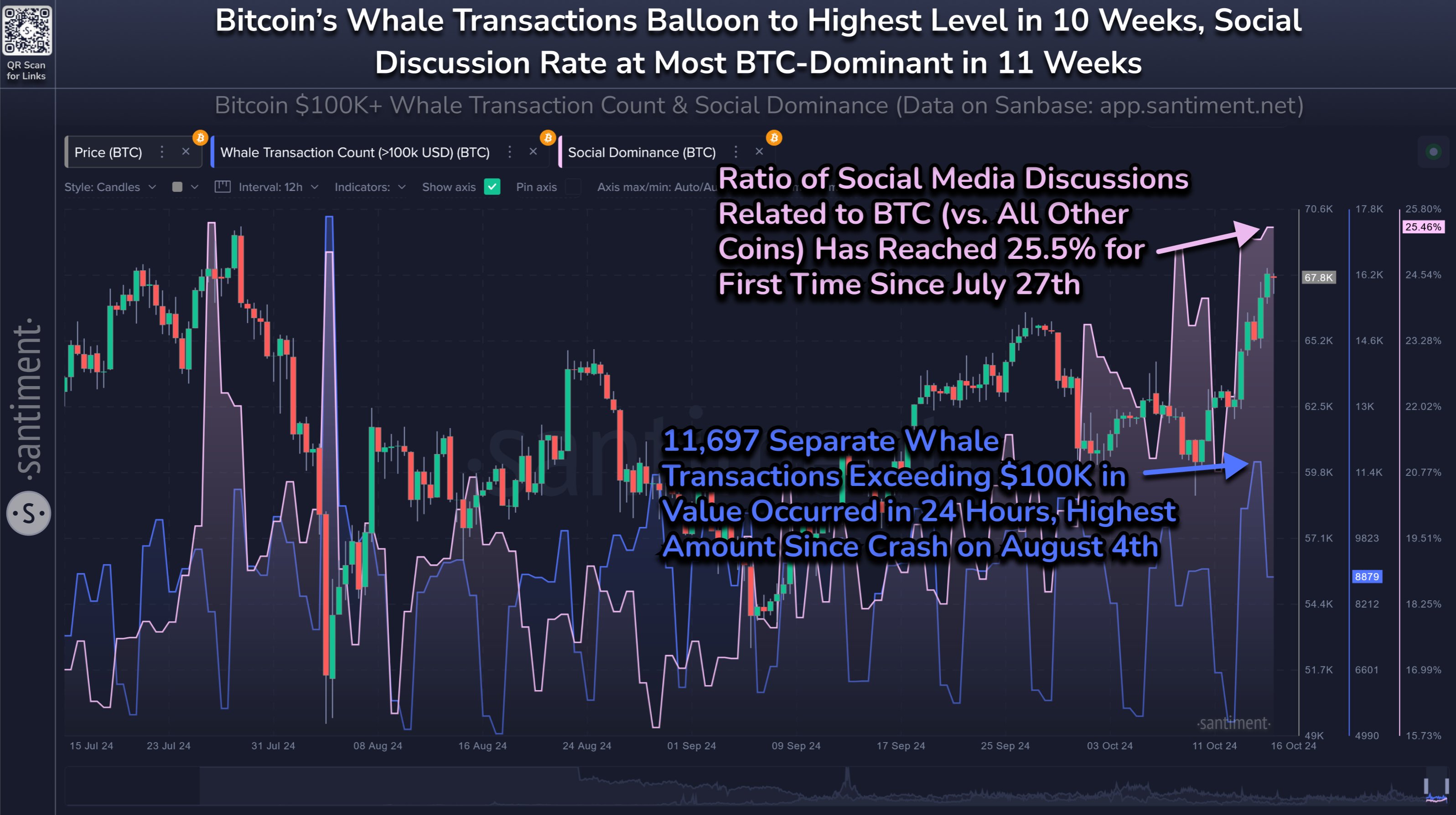

BTC Whale Accumulation Spiked

Last week, Bitcoin’s whale transactions spiked on October 15 to their highest level in over 10 weeks, with almost 11,700 transfers worth over $100,000 on the network, according to Santiment data.

They also noted that conversations across social media turned to BTC over altcoins., becoming the most dominant in 11 weeks.

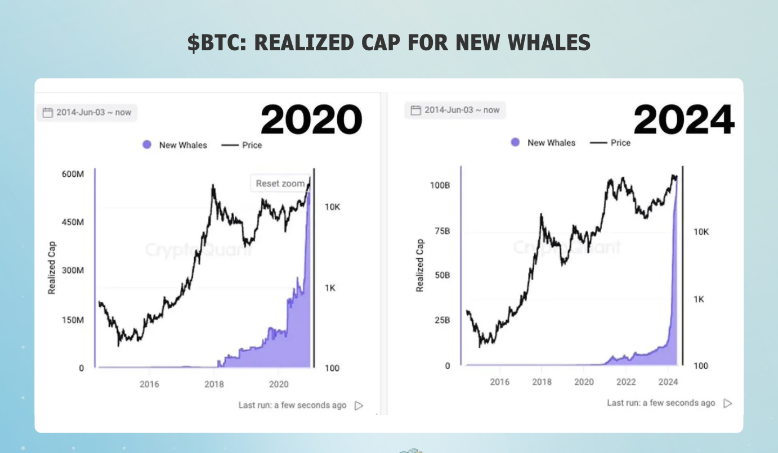

Also, data from CryptoQuant showed that new whales have been accumulating at a pace that hasn’t been seen since 2020 right before BTC’s price skyrocketed.

According to a CryptoQuant post via X on October 18, Bitcoin’s apparent demand was also a key factor in sustainable price rallies.

Another important catalyst for the price of BTC involves the upcoming US elections.

BTC Price Rally Correlated With Surging Trump Odds to Win Elections

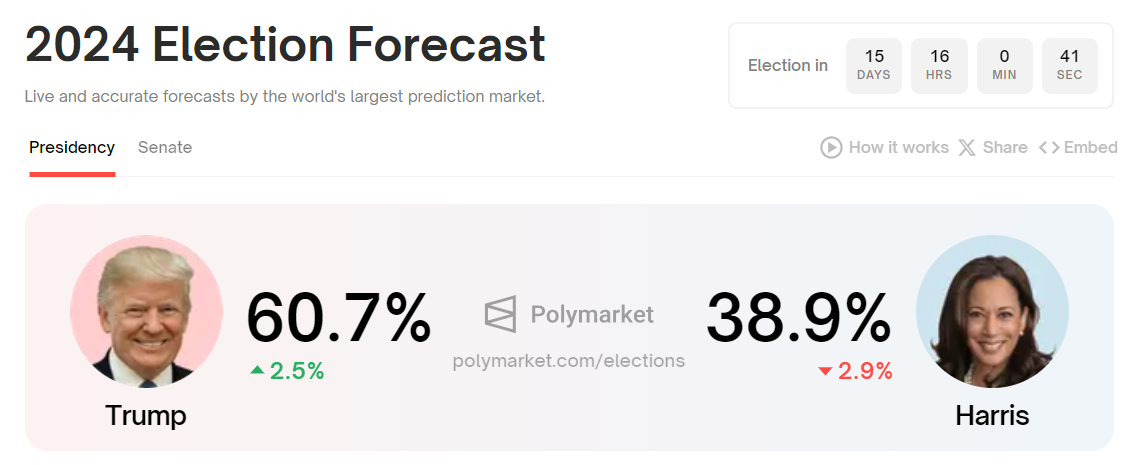

Last week’s Bitcoin price rally has also been strongly correlated with Trump’s rising odds to win the US elections, as highlighted by Bernstein analysts.

Today, according to data from Polymarket, Trump continues to lead Kamala Harris, by 60.7% to 38.8%.

The markets are already pricing in a potential Trump victory in the US elections, highlighting the correlation between Bitcoin’s October rally and markets’ anticipation of the Republican candidate’s victory.