Despite a 50% decrease from its peak value of $69,000 against the U.S. dollar, Bitcoin has achieved new all-time highs when measured against some of the world’s most inflation-prone fiat currencies.

In a span of 30 hours on October 23 and 24, the price of one Bitcoin reached record levels when denominated in the Argentine peso (ARS), Nigerian naira (NGN), Turkish lira (TRY), Laotian kip (LAK), and the Egyptian pound (EGP).

#Bitcoin just hit an all-time high in Argentina, Turkey and Nigeria. 🚀 pic.twitter.com/sKRNUaBMX8

— Miles Deutscher (@milesdeutscher) October 26, 2023

Inflation Fuels Bitcoin’s Highs in Emerging Markets

The recent record highs of Bitcoin in some countries can be attributed to the ongoing devaluation of their local currencies, which was further worsened by a 16% rise in Bitcoin’s price.

The Nigerian naira (NGN) and Turkish lira (TRY) reached their lowest points against the U.S. dollar on October 24 and 25, while the Argentine peso (ARS) is just 0.85% away from its all-time low against the U.S. dollar.

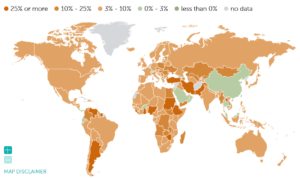

Data from the International Monetary Fund (IMF) reveals that the Venezuelan bolivar leads with an annual inflation rate of 360%, followed by the Zimbabwean dollar (314%), Sudanese pound (256%), and ARS (122%). The Turkish lira and Nigerian naira are ranked sixth and 15th, with annual inflation rates of 51% and 25%, respectively, according to the IMF.

Heat map of countries in the world with corresponding annual inflation rates. Source: IMF

Cryptocurrency enthusiasts have long considered digital assets like Bitcoin and stablecoins as a hedge against soaring inflation, and the recent data supports this belief.

Nigeria, Turkey, and Argentina are among the top countries in cryptocurrency adoption, ranking 2nd, 12th, and 15th, according to a September 12 report by Chainalysis.

With inflation at 99% in #Argentina, it’s 99% likely that the citizens of that beautiful country would benefit from #Bitcoin.

— Michael Saylor⚡️ (@saylor) February 15, 2023

Shifting Attitudes of Governments Towards Cryptocurrencies

In these countries, the relationship between their governments and the cryptocurrency industry has been somewhat rocky.

Nigeria, for instance, has become more open to cryptocurrencies after its central bank prohibited local banks from offering services to crypto exchanges in February 2021. In December 2022, Nigeria indicated its intention to pass a bill recognizing cryptocurrencies as “investment capital,” aiming to align with global practices.

In Turkey, where there is significant interest in cryptocurrencies, the central bank banned the use of cryptocurrencies for buying goods and services in April 2021. The country has also been working on introducing a digital version of the Turkish lira, called a central bank digital currency (CBDC), over the past few years.

#Bitcoin fixes this👇🇹🇷

I'm back in my beautiful country, Turkey, after 6 months. Shocked to witness the same goods costing 3–4 times more already. Rents, food, public transport, and more costs skyrocket regularly. High inflation's devastation is real and alarming. pic.twitter.com/X4N4Axuh1n— Gülben Gözü (@gulbengozu) August 28, 2023

Meanwhile, Argentina’s inflation crisis may be influenced by its upcoming presidential election in November. One of the presidential candidates, Javier Milei, is set to face off against his rival, Sergi Massa, in a final run-off vote on November 19.

Massa, who currently serves as the country’s minister of economy, is eager to launch a central bank digital currency (CBDC) as a solution to the country’s long-standing inflation problems.

Argentina's present provides a glimpse into America's future, where the central bank raised interest rates 15 percentage points to 133% on Oct. 12. But with #inflation running at 138% and budget deficits and debt rising, the rate hikes will have no effect on reducing inflation.

— Peter Schiff (@PeterSchiff) October 26, 2023

Differing Views on Currency in Argentina’s Presidential Race

In the lead-up to the presidential election in Argentina, the candidates have contrasting views on currency and the role of the U.S. dollar.

Sergi Massa, one of the candidates and the current minister of the economy, aims to establish a central bank digital currency (CBDC) to address the country’s inflation challenges. He encourages Argentinians to support the Argentine Peso and not rely on the U.S. dollar.

In contrast, Javier Milei, another candidate, has a different approach. He advocates for the adoption of the U.S. dollar and the abolition of Argentina’s central bank.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News