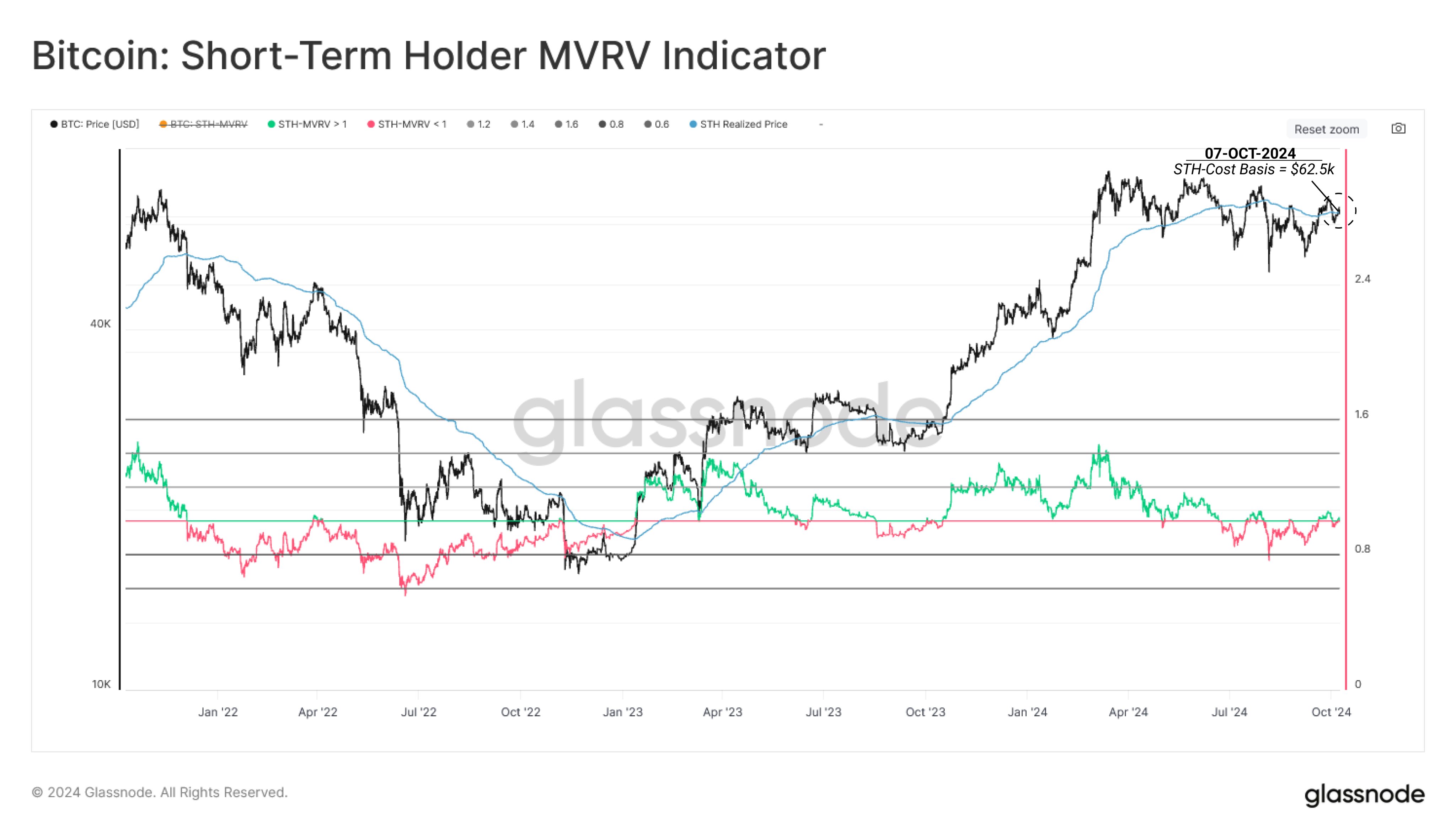

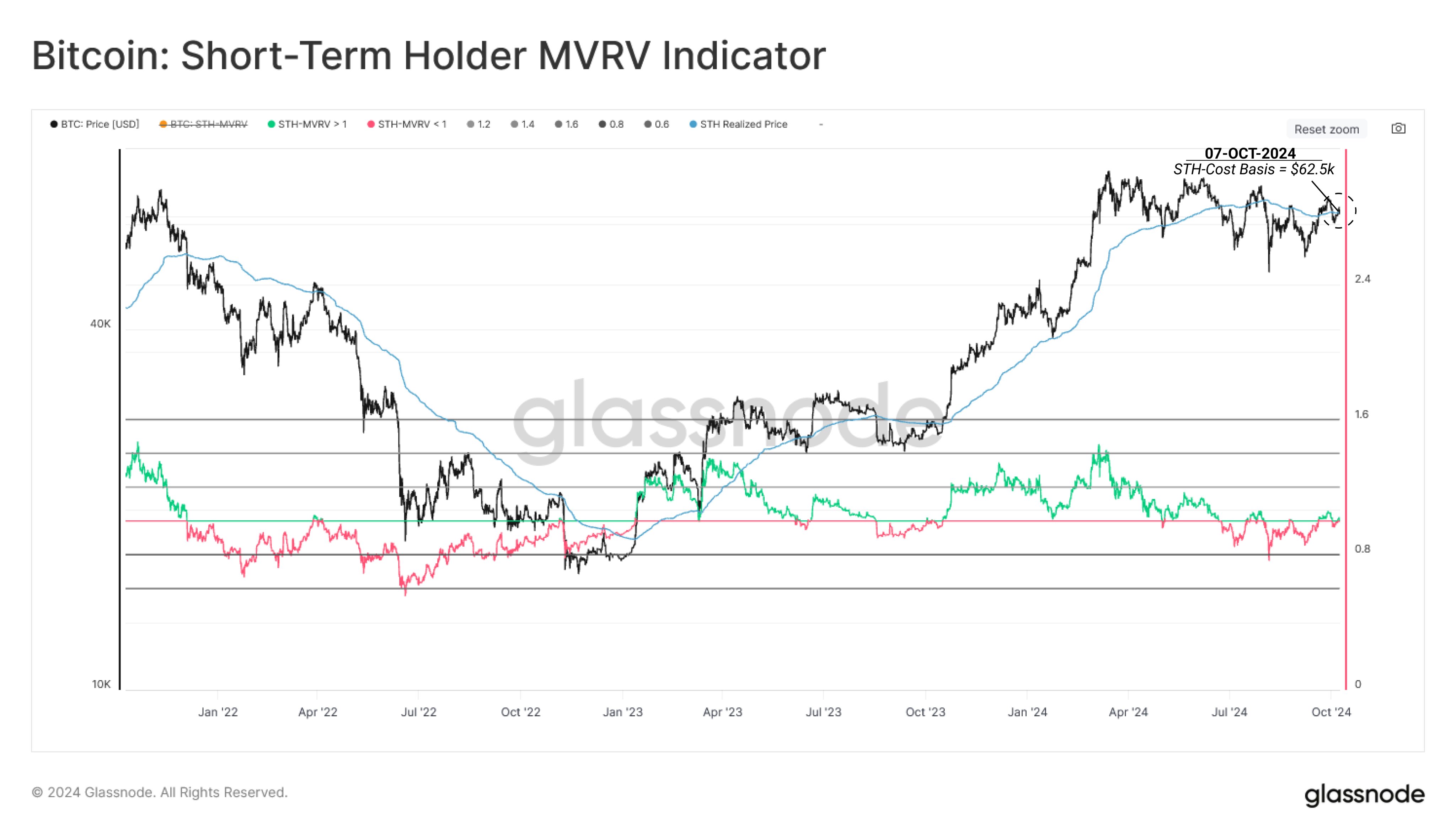

Bitcoin is fighting to maintain its Short-Term Holder (STH) cost basis to hedge against further market pressure following a 10% correction.

In its latest weekly report, blockchain analytics firm Glassnode noted that this STH cost basis currently sits at $62.5K. They confirmed that Bitcoin movements and investor behavior show resilience and vulnerability as BTC tries to stabilize around this important level.

Bitcoin Price Rebounds but Faces Market Pressure

After dropping into the $60K region at the beginning of October, Bitcoin bounced back to the $63K mark over the weekend, and eventually surpassed it on Monday. Glassnode data shows that this level syncs with the STH cost basis.

For the uninitiated, the STH cost basis is an important zone for gauging the short-term health of the market. If Bitcoin fails to hold above it at $62.5K, recent buyers could come under intense pressure.

At press time, Bitcoin currently trades for $62,443, slightly below the STH cost basis, and desperately looking to reclaim and maintain it. The price hovering near this level suggests the market is at a crossroads.

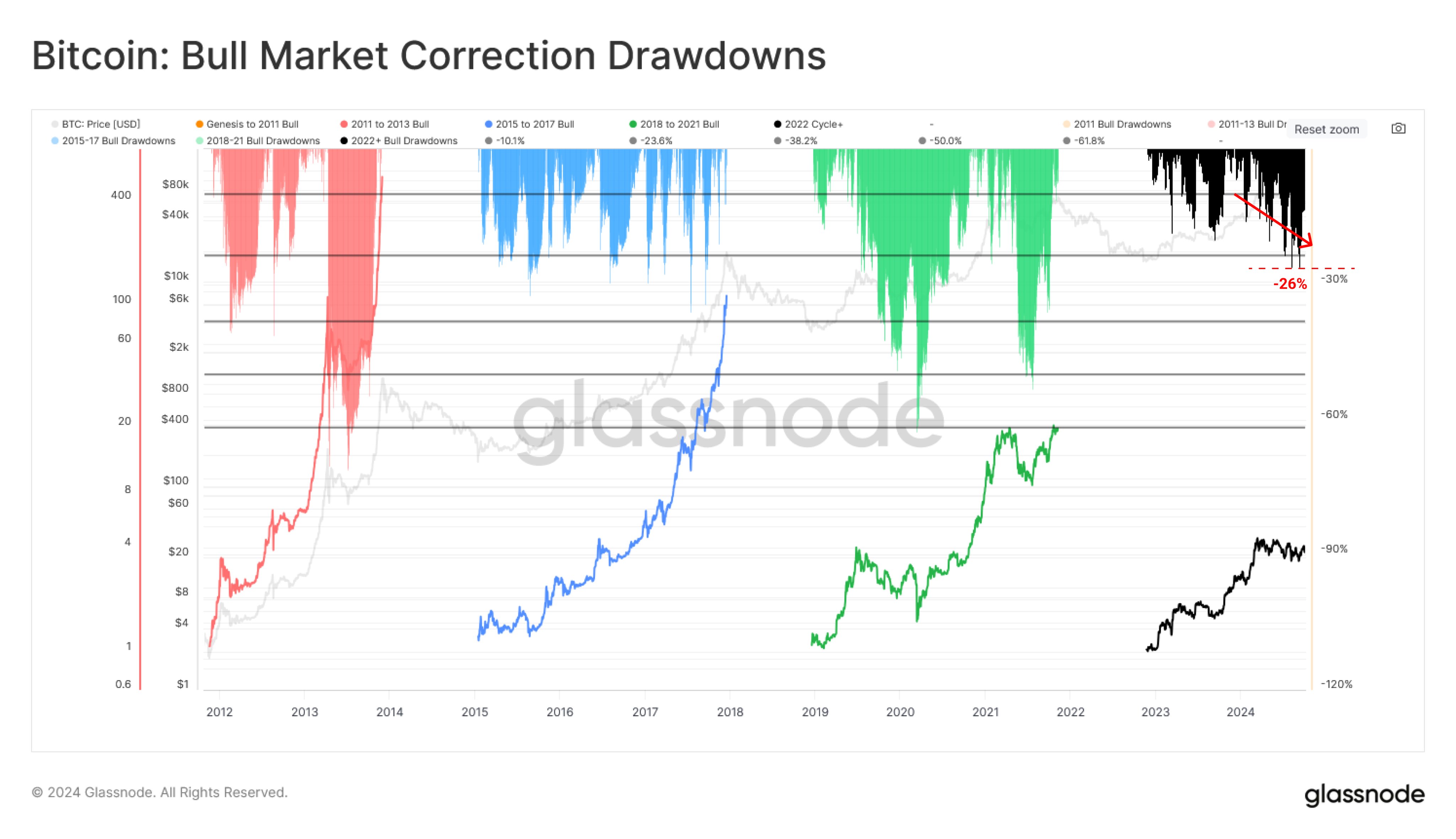

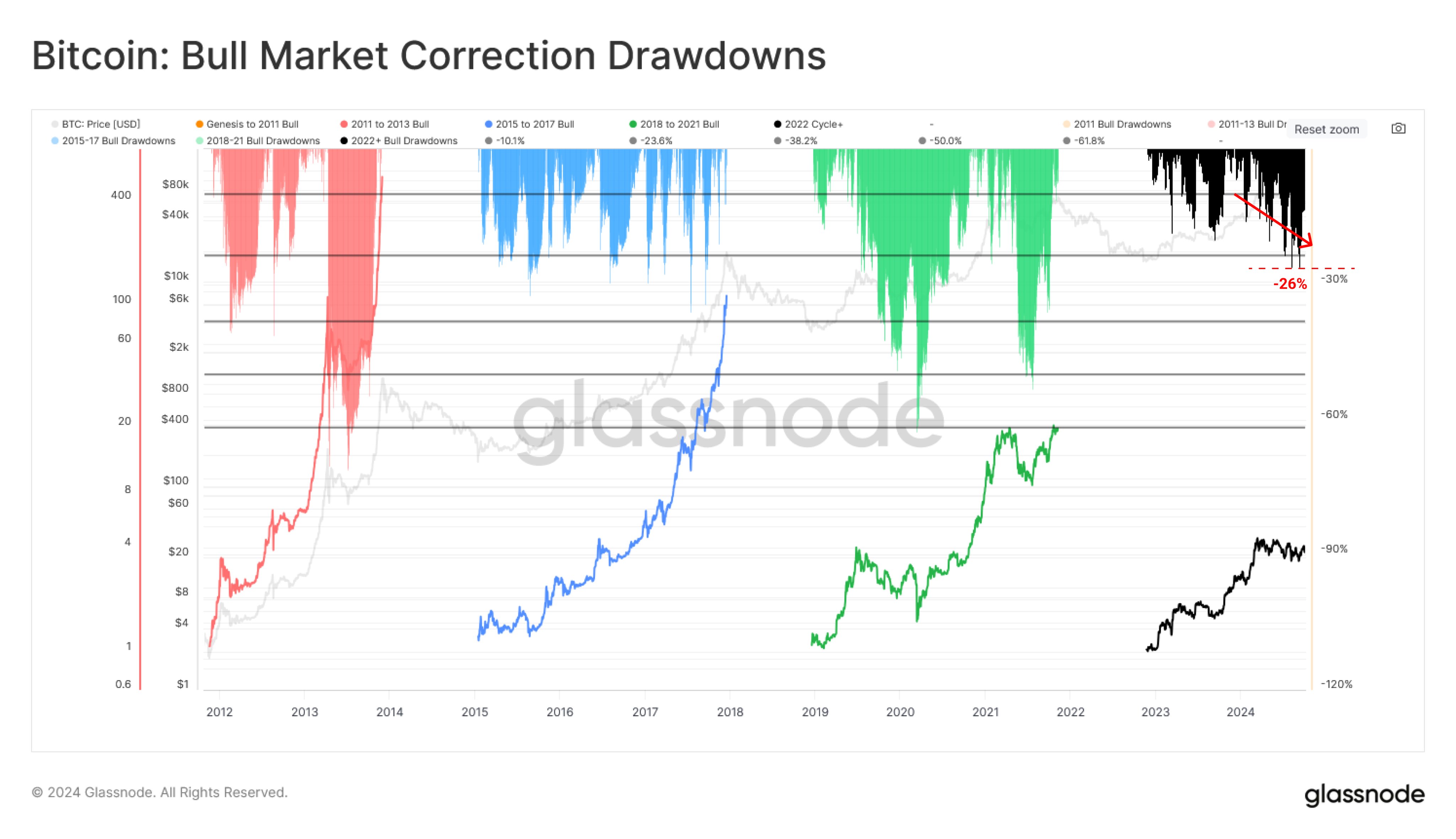

However, according to Glassnode, the 26% drawdown from the highs above $73K this year is notable but not catastrophic. The report confirms that this slump is less deep than what BTC observed in past cycles.

Despite this, the past few months have presented some of the most bearish conditions since the time of the FTX implosion in the fourth quarter of 2022. This is possibly due to economic uncertainties and geopolitical tensions. Notably, Bitcoin is down 12% since April.

Bitcoin STHs in a Profitable Position

Notably, Short-Term Holders (STHs) are often crucial in determining near-term market action. These investors are currently in a profitable position, with the ratio of their supply in profit versus their supply in loss now at 1.2.

At the same time, the STH-MVRV ratio, which measures the unrealized gains or losses of short-term holders, has bounced back after a dip in August. This indicates that new investors in the Bitcoin market are recording improved profitability.

However, with gains accumulating, there is an increasing incentive for STHs to lock in profits, which could lead to selling pressure if Bitcoin struggles to maintain its current levels.

Price Levels Indicating Bitcoin’s Market Health

Meanwhile, Glassnode stressed that besides the $62.5K STH cost basis, two other figures are important in assessing market health. These are the True Market Mean, which stands at $47K, and the Active Investor Price, currently at $52.5K.

Bitcoin generally remained above these two levels throughout 2024, except for a brief dip below the Active Investor Price due to selling pressure in August. The fact that Bitcoin is above these support levels indicates that the market is still healthy and capable of weathering retracements.

The report also shows that speculative activity has decreased in the derivatives market. The weekly cost of leverage for long positions, which peaked at $120M during Bitcoin’s all-time high in March, has dropped to just $15.3M.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

![Constellation [DAG] crypto cools after 20% surge in 24 hours – What’s next?](https://cryptosheadlines.com/wp-content/uploads/2024/11/Dag-crypto-FI-150x150.jpg)