Bitcoin is trading above $59,000 as of press time and has shown a 1.34% upward movement over the past day. As reported by the analytical platform CryptoRank, the overall cryptocurrency market is in decline, and most of the top ten assets are trading in the red zone. The decline in market capitalization and the rise of fear among traders suggest that the next few months may be unpredictable for digital assets.

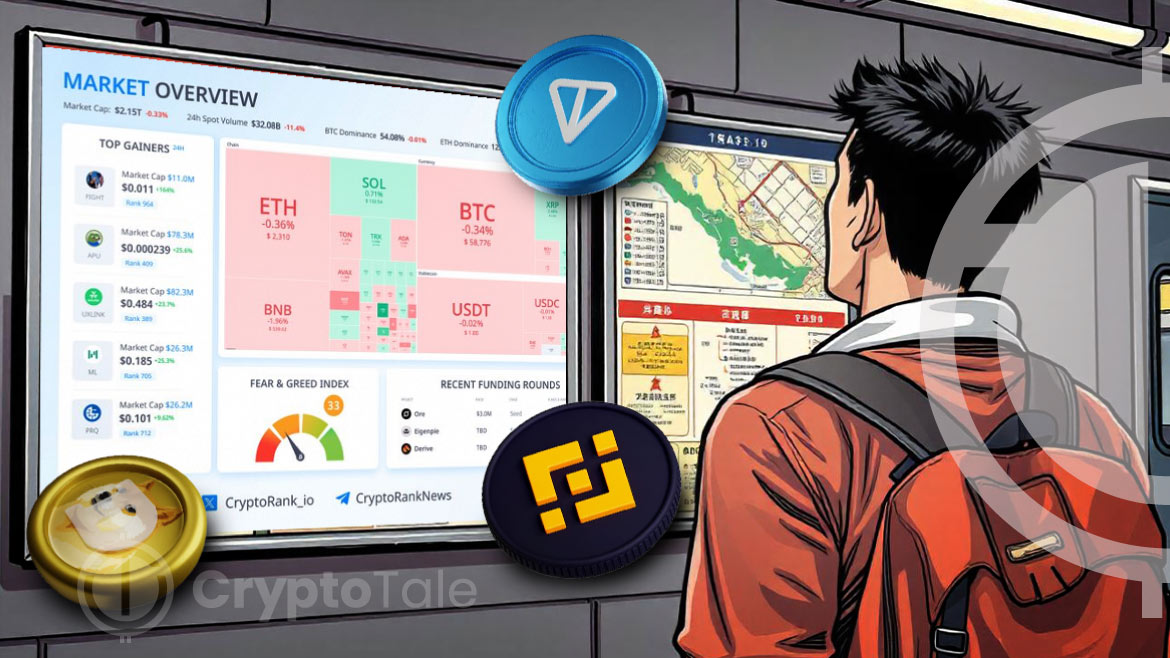

📈Market Overview

Bitcoin trades below $59K. The top-10 cryptos are traded in red zone:$BNB -2.03%$DOGE -1.64%$TON -1.16%

Market capitalization: $2.15T (-0.33%)

The BTC dominance: 54.08% (-0.01%)

Fear & Greed Index: 33 (Fear)👉 Top Gainers

Fight to MAGA $FIGHT +164%

Apu… pic.twitter.com/DXUY0BqrIK— CryptoRank.io (@CryptoRank_io) September 17, 2024

Top Cryptos in Red

According to platform findings, the current market situation indicates that all the top-10 cryptocurrencies are in the red zone. Binance Coin (BNB) dropped by 2.03%, Dogecoin (DOGE) by 1.64%, and Toncoin (TON) by 1.16%. This widespread negative performance indicates that bearish pressure remains the dominant force in the crypto market.

The total market capitalization of the global cryptocurrency market has now fallen to $2.15 trillion, down by 0.33%. This drop indicates that the market has been volatile recently due to price changes. The market capitalization of Bitcoin also slightly dropped to 54.08%, a decrease of 0.01%.

Fear Grips Investors

The present Fear & Greed Index, which gauges market sentiment, is at 33, which is in the ‘Fear’ zone. This is a sign of caution among investors since many are hesitant to open positions or place large amounts of capital into trades. The increasing volatility suggests that traders are waiting for more definitive moves before they enter new trades.

However, some altcoins have performed strongly and are not following the general bearish trend of the market. At the top of the list is “Fight to MAGA” (FIGHT), which has gained a remarkable 164% increase.

Altcoins Defy Trend

Other altcoins on the rise include Apu Apustaja (APU), which has risen by 25.6%, UXLINK, which increased by 23.7%, Mintlayer (ML), which increased by 25.3%, and Parsiq (PRQ), which rose by 9.62%. These altcoins prove that it is possible for some tokens to rally even in a bear market.

Fed’s Rate Cut Decision Creates Uncertainty for Bitcoin

The current status of the Fear & Greed Index at the “Fear” level indicates that the market is still not willing to take big risks in this bear market. However, the high performance of some altcoins suggests that the market still has potential, although it is highly volatile. Investors are now looking for clues that may suggest that the market is likely to bounce back.