Bitcoin SV (BSV) and Artificial Superintelligence Alliance (FET) are capturing the attention of traders, each exhibiting signs of potential price breakouts.

Top analysts on X (formerly Twitter) highlight a third attempt for BSV’s price to breach key resistance, while FET benefits from positive market sentiment tied to “utility season” and a capital shift from larger assets like Bitcoin.

Moreover, this technical analysis details the current positioning of both tokens and their potential upward movements within respective trading channels.

BSV/BTC Chart Analysis: Third Attempt to Break Resistance

Crypto analyst Mihir pointed out that Bitcoin SV’s (BSV) price is gearing up for a significant upside attempt against Bitcoin (BTC). The BSV/BTC pair has been moving within a well-defined descending channel, characterized by a lower red trendline acting as support and an upper green line as resistance.

The midline, represented by a white dotted line, has posed a formidable barrier, with two previous breakout attempts rejected at this level.

Currently, BSV trades near the lower support line, showing a double-bottom pattern, which often signals a potential reversal. The upcoming third attempt to breach the midline resistance could be pivotal. If BSV breaks through, it may signal the beginning of a bullish phase, with the channel’s upper boundary as a possible long-term target.

Celebrate Dogecoin and Make Big Gains with Doge2014!

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +FET Price Analysis: Utility Season Fueling Bullish Momentum

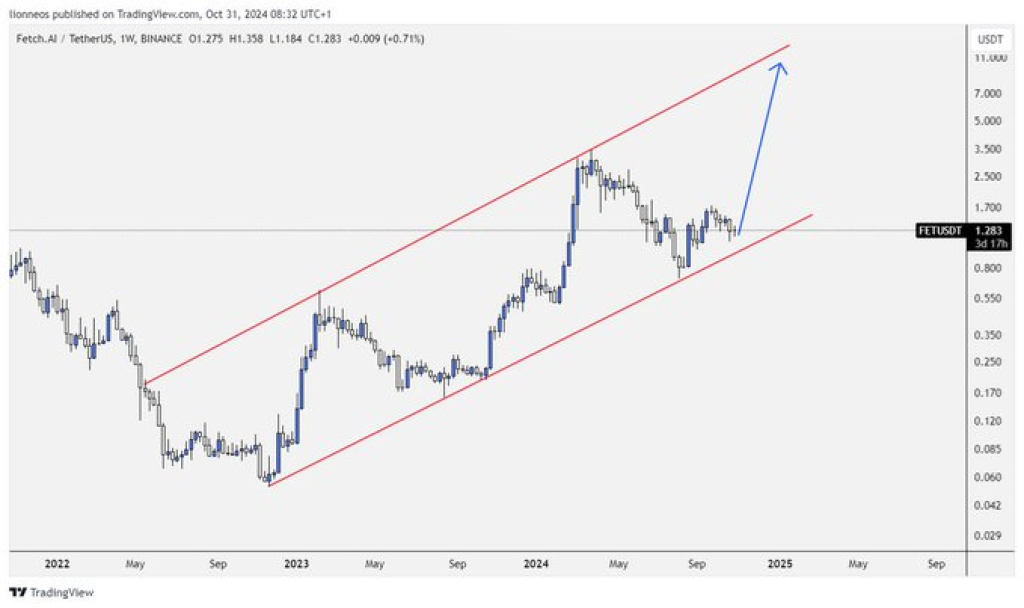

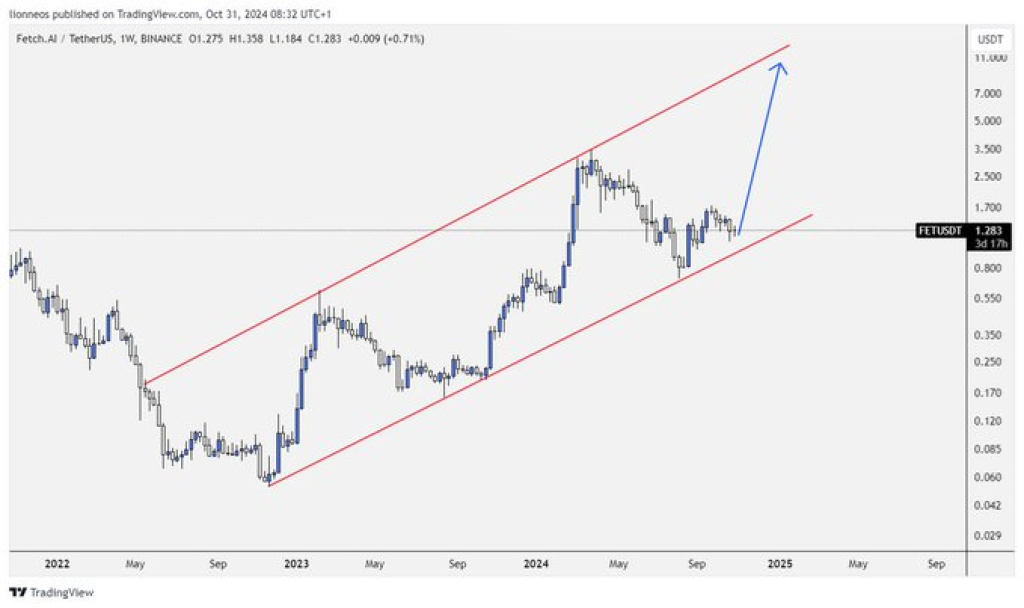

Artificial Superintelligence Alliance (FET) also shows positive signs, trading within an ascending channel against USD on the weekly chart. The FET price has been following a pattern of higher highs and higher lows, with support and resistance marked by two parallel red trendlines.

Currently positioned near the lower support trendline around $1.28, FET may be approaching a buying opportunity if this support level holds.

Moreover, tweets from influential accounts suggest strong market sentiment for FET. CryptoLeo00 mentions that an anticipated shift of capital from Bitcoin into lower-cap tokens could position FET for significant gains as “utility season” kicks in.

Another analyst, Moonboy, projects an ambitious target for FET’s price, predicting that it will hit $15 by Q1 of 2025. These bullish sentiments align with FET’s technical structure, where the top of the channel points towards a medium-term target of $7–$8.

Read Also: Bitcoin (BTC) Price Could Hit a New ATH Soon—But Will It Dip Before Surging? Expert Analysis

Technical Outlook: Key Levels to Watch

For Bitcoin SV, the midline in the descending channel remains at a critical level. If BSV’s price breaks through this resistance, the channel’s upper boundary may become its next target, signaling a potential trend reversal.

In contrast, for FET, the lower trendline around $1.25 serves as a key support, with the next resistance level set at the channel’s top, suggesting a bullish trajectory towards $7–$8.

Finally, Bitcoin SV and FET are in technical setups that could attract traders looking for upside potential. BSV’s third attempt at breaking resistance and FET’s alignment with market trends create an optimistic outlook for these assets.

Read Also: This Shiba Inu Indicators Signal Bullish Rally; SHIB Price Could Pump

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link