Bitcoin (BTC) whale transactions have dropped significantly since its price peak in March this year. Recent statistics show that large transactions of $100,000 or above have decreased by 33.6%.

This slowdown has been a major shift in market dynamics, especially from the groups that have been known to push the price substantially. This is, however, in line with the general trend of lowered market activity, especially from the significant Bitcoin holders.

Bitcoin’s price soared to a record of $73,679 in March but then declined. While transactions are reducing, Santiment has noted that whale inactivity could not be a sign of a bearish market.

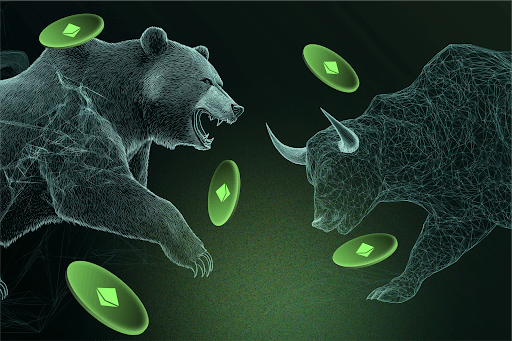

Ethereum Whale Activity Mirrors Bitcoin’s Market Decline

Similarly, large transactions in Ethereum (ETH) have also dropped significantly in the last few months. Santiment shows that large Ethereum transactions above $100k have dropped by 72.5% since the middle of March.

This sharp drop, along with the situation in Bitcoin and other cryptocurrencies, points to a general stagnation in the market. Similar to the bitcoin whales, these Ethereum whales usually have a great impact on market trends.

They usually act when the market is highly emotional, either in fear or greed, to make significant shifts. Although this may look like a decline, these whales may be waiting for an opportune time to return to the market with a close eye on sentiment, as reported.

Bitcoin Prices Hover as Fear Dominates Market

While the whales’ activity went down, the overall market sentiment shifted toward the fear zone. The index that measures investors’ sentiment, the Crypto Fear & Greed Index, stands at 31, which shows that investors are still quite careful.

In the past, more experienced investors have always considered markets dominated by fear as good places to invest.

Bitcoin has fallen 0.97% since mid-August and is now hovering around $58,360. However, according to some analysts, Bitcoin prices may continue to struggle in the short term. 10x Research’s head of research, Markus Thielen, has predicted that Bitcoin may fall to the $40,000 range before commencing the next upward trend.

Reduced Active Addresses Signal Lower Bitcoin Interest

The network activity of Bitcoin has also dropped tremendously, which has yet to be witnessed in the last three years. The number of active addresses on the Bitcoin network has now fallen to 744,000, the lowest level since 2021, CryptoQuant shows. This is evidenced by the decrease in active addresses in the table below.

A smaller number of active addresses usually indicates less interest in engaging the Bitcoin network. The number of new addresses added to the blockchain was at its highest, almost 1.2 million, in the middle of March and has gradually reduced.

This decline in network activity is in tandem with the decrease in whale transactions, indicative of reduced market interest.

Nonetheless, experts say that the reduced activity of whales in the market today should not be seen as a long-term trend. Further, Santiment pointed out that large Bitcoin holders typically remain inactive and wait for the market extremities to make large-scale decisions.

If Bitcoin drops to $45,000, it can cause fear, uncertainty, and doubts in investors’ minds. On the other hand, if Bitcoin climbs back to $70,000, it is likely to cause a FOMO among investors who may be eager to join the market. The cryptocurrency market is still somewhat tense, and many large investors and wha̕les are carefully observing the situation.