Bitcoin has seen a significant change in market dynamics over the past month. Large-scale holders, known as whales, have been accumulating substantial amounts of BTC.

On-chain data shows that nearly 404,448 BTC, worth around $23 billion, have been moved into “permanent holder addresses,” indicating an accumulation phase. This trend comes amid global market uncertainties and fears of further declines.

Bitcoin Whales Accumulate Amid Market Uncertainty

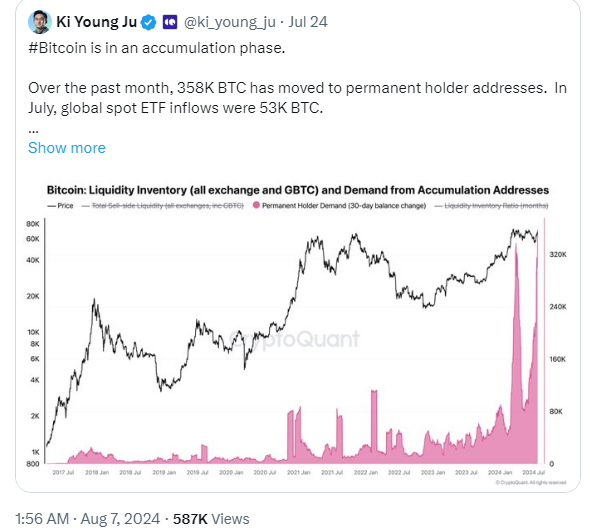

Ki Young Ju, the founder and CEO of CryptoQuant, highlighted the significant accumulation of Bitcoin by whales in a series of posts on X. He suggested that this substantial inflow into permanent addresses indicates a strategic accumulation by institutional entities, companies, or even governments. “We’ll know within a year,” Ju stated, hinting at possible future announcements from these entities regarding their Q3 2024 Bitcoin acquisitions.

Source: X

The accumulation gained momentum after a market dip on August 5, when Bitcoin’s price fell to $49,800. Since then, Bitcoin has rebounded by nearly 14%, reaching around $57,000 at the time of reporting.

Despite this recovery, market sentiment remains cautious. The Bitcoin ‘Fear and Greed’ index has only slightly improved from ‘extreme fear’ to a level of 29, reflecting ongoing uncertainty in the market.

Whales Accumulate 30,000 BTC Amid Market Dynamics

On August 6, on-chain analyst Ali Martinez revealed that Bitcoin whales had acquired over 30,000 BTC, valued at approximately $1.62 billion, within just 48 hours. This significant accumulation was reflected in increased outflows from exchanges and a corresponding decrease in the supply of BTC held on trading platforms.

Source: X

Interestingly, these recent inflows are not linked to ETF wallets but are primarily housed in custodial wallets with no outgoing transactions, further underscoring the strong holding behavior among these large investors.

As Bitcoin hovers around the $57,000 mark, market watchers are keenly observing whether it will break out of its current consolidation range. Ki Young Ju previously suggested that if Bitcoin’s price manages to stay above the $45,000 level, it could push the cryptocurrency to a new all-time high within the next 12 months.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News

Join our official TG Channel: https://t.me/CryptosHeadlines