Key Points

- This week’s IV remains at 55%, while Bitcoin’s dominance returns to the 2021 level.

- 40% of daily transactions come from block options, with an increasing trading volume.

The monthly crypto options expiration date is set for tomorrow, October 25, and as Greeks.live noted, the overall trend this month was not as expected.

In a post on X, they noted that the upcoming US elections scheduled for November 5, and the recent interest rate cuts in the US and beyond did not bring too much positive news and capital inflow into the crypto market.

Unchanged IVs and Rising Block Options Trading Volume

The IV during this week remained unchanged at 55%, and earlier options were significantly reduced due to the impact of position transfer and month change.

However, the trading volume of block options has increased significantly, and now, around 40% of daily transactions come from block options.

Bitcoin Dominance in the Options Market

According to data from Greeks.live, Bitcoin’s dominance in the options market has returned to the level seen in 2021.

They also bring up ETH which was clearly a weaker performer, leading to options market indicators reaching a point where they are looking almost at BTC data alone.

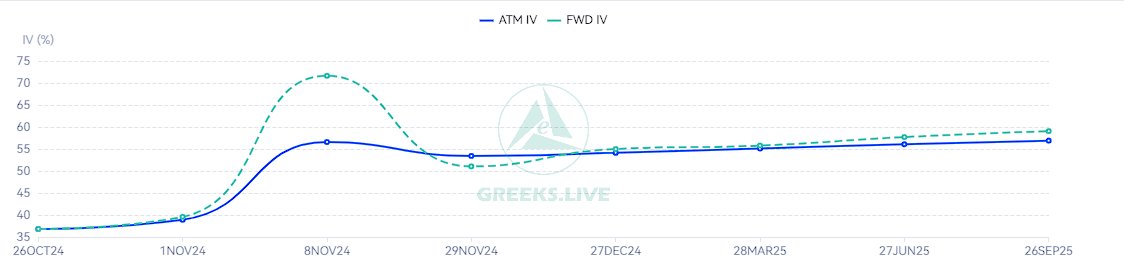

ATM IV and FWD IV are expected to peak following the US elections, according to a graph shared by Greeks.live.

The ATM IV is expected to remain close to 55%, while the FWD IV is expected to during above 70% right after the US elections scheduled for November 5.

ATM IV and FWD IV are two key volatility metrics used in crypto options trading, representing the implied volatility (IV) of options at different strike prices and expiration dates.

ATM IV (At-the Money Implied Volatility) is the implied volatility of an option with a strike price that is equal to the current spot price of the underlying asset.

Changes in ATM IV can significantly influence the options pricing.

FWD IV (Forward Implied Volatility) is the implied volatility of an option with a strike price that is different from the current spot price. This reflects the markets’ expectations regarding volatility at a future point in time.

Earlier today, we revealed that around $5.22 billion in crypto options will expire tomorrow.