- BTC has seen price increases after past U.S. presidential elections, with notable gains in 2016 and 2020.

- The 2024 election coincides with Bitcoin’s scheduled halving, which could create scarcity and drive prices higher.

- BTC’s involvement in global finance makes it easier to events like presidential elections.

Bitcoin has earlier seen price movements following U.S. presidential elections, and 2024 may be no different. Market analysts have reported marks of price increases in the cryptocurrency space after political events, presenting questions about how much BTC will behave after the 2024 election.

Historical Trends and Bitcoin Movements

In a post via the X space by Bitcoin Magazine, BTC saw gains in the months following the U.S. presidential elections in the previous election. After the 2016 election, Bitcoin surged in value, continuing its upward move into the following year.

Similarly, in 2020, BTC saw growth, recording new highs as market conditions changed due to election momentum.

Factors Influencing Bitcoin’s Post-Election Performance

Several factors may drive up Bitcoin’s price. During election seasons, people often seek new investment options as political changes create uncertainty. This uncertainty can lead to more speculative trading, resulting in more extensive price changes in the cryptocurrency market.

Data from past elections shows that Bitcoin usually has price increases in the months after the results. Analysts expect the 2024 election to lead to similar outcomes. As candidates present their economic plans, market reactions may affect Bitcoin’s price. Economic uncertainty often drives investors to digital assets as a protection against financial instability.

Read CRYPTONEWSLAND on

google news

BTC has become more merged into the global financial system, making it more reactive to macroeconomic events like elections. The crypto market’s growth, along with institutional investment, could play a role in Bitcoin’s post-election performance.

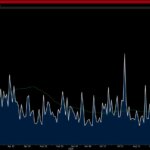

Bitcoin Market Price Movements

According to CoinMarketCap, Bitcoin data at the time of writing reads a trading value of $62,747.40, indicating a 0.71% decrease in value in the past 24 hours. The market cap stands at $1,239,729,428,431, which also saw a 0.71% decline within the same time. The 24-hour trading volume is $15,513,257,545, representing an 18.43% drop.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.