Amid market uncertainty, Bitcoin (BTC) has been trading within a consolidation pattern in recent weeks.

The uncertainty in the cryptocurrency market was heightened as the United States Securities Exchange Commission (SEC) took legal action against Coinbase and Binance, two prominent cryptocurrency exchanges. The SEC alleged that these exchanges listed unregistered securities.

Despite the challenging circumstances, Mihai_Iacob, a cryptocurrency analyst on TradingView, highlighted Bitcoin’s impressive resilience. In a post on June 13, he noted that Bitcoin had held its ground remarkably well, maintaining its position amidst the volatility.

Bitcoin price analysis chart. Source: TradingView

Analyzing historical trends, Mihai_Iacob pointed out that when adverse news fails to significantly impact an asset and doesn’t cause a technical breakdown, it often paves the way for an upward trend. In the case of Bitcoin, it displays this characteristic, indicating the possibility of a potential turnaround in the near future.

Examining Bitcoin’s technical aspects, the analyst emphasized that the cryptocurrency’s price has encountered robust support at the $25,000 mark. This level is significant as it represents a convergence point formed by a trend line dating back to earlier this year and a horizontal support level.

Bitcoin’s Bullish Momentum

The analyst highlighted that Bitcoin’s bullish outlook would be confirmed if it reclaims the $27,000 level, with the cryptocurrency currently holding above $26,000. The strong confluence support at $25,000, formed by a trend line from the beginning of the year and a horizontal level, adds to the positive technical perspective. The recent drop from $30,000 is viewed as corrective, forming a falling wedge pattern. A move above $27,000 would validate the bullish sentiment, potentially triggering a retest of recent highs or even the formation of new highs around $35,000.

Despite the uncertainty surrounding Bitcoin’s price, its resilience in the face of recent challenges has generated optimism among investors and traders. The sentiment was further boosted by the news of BlackRock, the world’s largest asset manager, filing for a Bitcoin exchange-traded fund (ETF).

Regulatory actions by the SEC have contributed to a bearish sentiment in the crypto market, while the U.S. inflation rate unexpectedly dipped to 4%, briefly strengthening the U.S. dollar. However, the Federal Reserve’s decision to keep interest rates unchanged has increased market uncertainty. Traders are now navigating the potential long-term consequences of a tighter monetary policy.

Bitcoin price analysis

At present, Bitcoin is trading at $26,494, experiencing a minimal daily loss of less than 0.5%. On the weekly chart, Bitcoin has gained almost 3%.

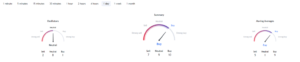

According to the technical analysis summary from TradingView, the sentiment is aligned with a ‘buy’ recommendation, with a score of 10. The moving averages indicate a ‘buy’ sentiment at 9, while the oscillators remain ‘neutral’ at 8.

Bitcoin technical analysis. Source: TradingView

The $30,000 level is currently a significant resistance level for Bitcoin, acting as a crucial barrier for the cryptocurrency.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community