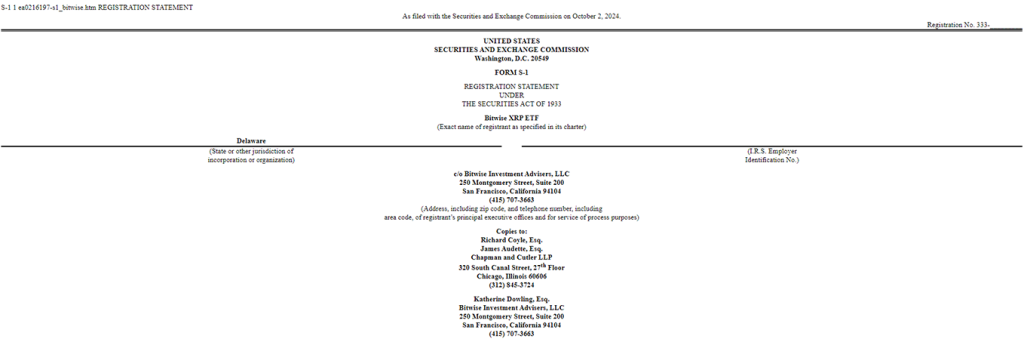

After a great success in Bitcoin and Ethereum ETF, Bitwise is now planning to become the first firm to launch an XRP product. In a significant development, Bitwise Asset Management has filed for an XRP Exchange Traded Product. The firm has submitted the Form S-1 to the U.S. Securities and Exchange Commission. If the SEC accepts this proposal, the ETP Fund will hold XRP directly. It is exciting news for Bitwise, investors, XRP and the whole crypto community. However, the launch depends on the approval by the SEC.

Why Bitwise is Betting on XRP

Hunter Horsley, the CEO of Bitwise, believes that blockchain technology is poised to bring about revolutionary change in the financial world. According to him, this technology could introduce apolitical monetary assets and create a range of new applications for investors. For over seven years, Bitwise has been paving the way for easier access to crypto opportunities, and their latest XRP ETP filing continues that mission. Bitwise’s move to submit a proposal for XRP ETP shows their commitment to stay at the forefront of the evolving crypto space.

Real World Use Cases

A large number of crypto people recognize XRP because of the SEC vs Ripple case however it has a huge real life use. The XRP token empowers the XRP Ledger which helps in lightening fast transactions. It helps in making faster and cheaper cross border payments. It processes transactions in seconds and consumes fees typically under a penny. The speed and affordability is the reason behind a strong reputation of XRPL. Currently XRP stands on seventh position in the crypto space with a $33 billion market cap.

What’s more, XRPL is expanding its capabilities, moving beyond payments to enter the world of decentralized finance (DeFi) and asset tokenization. With growing interest from institutional players, XRP could be well-positioned for future growth.

Expanding Bitwise’s Crypto Offerings

This filing is just the latest in a string of moves from Bitwise. Recently, they launched spot Bitcoin and Ethereum ETPs, and in August, they acquired ETC Group, a leader in European crypto ETPs. Today, Bitwise offers over 30 products, including exchange-traded products, index funds, and specialized investment strategies. Founded in 2017, the firm works closely with financial institutions, helping them navigate the fast-moving world of crypto assets.

With the filing for an XRP ETP, Bitwise is doubling down on its commitment to opening doors for investors. Now, we wait to see if the SEC will approve this bold new venture.