The rapid rise of Bitcoin-focused exchange-traded funds (ETFs) from BlackRock and Fidelity has taken the investment community by surprise.

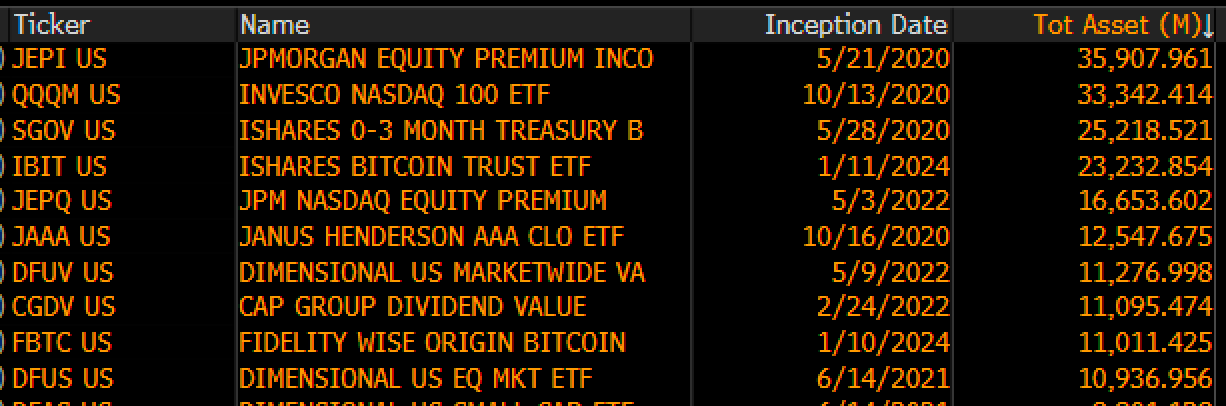

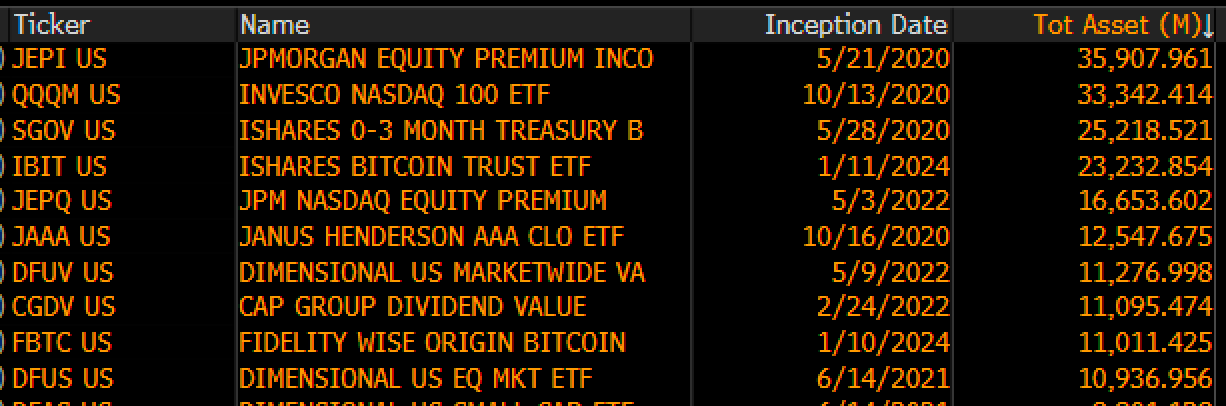

They now rank among the most prominent ETFs established this decade. In a fresh update today, Eric Balchunas, a senior ETF analyst at Bloomberg, shared data showing that both the iShares Bitcoin Trust ETF (IBIT) and Fidelity Wise Origin Bitcoin ETF (FBTC) have secured their place among the top 10 ETFs launched this decade based on total assets under management (AUM).

For context, both ETFs launched in January 2024, just ten months ago, making this remarkable achievement particularly impressive.

Bitcoin ETFs Dominate with Stunning Asset Growth

BlackRock’s IBIT has amassed $23.2 billion in total assets since its inception on January 11, making it one of the fastest-growing ETFs in recent memory. Based on this AUM, it trails behind only three legacy ETFs of this decade.

Similarly, Fidelity’s FBTC follows closely, reaching $11 billion in assets as of today after also launching in January. Balchunas noted that about 2,000 ETFs have been launched since 2020, but few have seen such rapid growth.

Competing with Legacy ETFs

The list of top ETFs by AUM includes well-known, low-cost, actively managed legacy funds from JPMorgan, Dimensional Fund Advisors, and Capital Group.

JPMorgan Equity Premium Income ETF (JEPI), launched in May 2020, currently leads the ETFs of this decade with $35 billion in assets. The Invesco Nasdaq 100 ETF (QQQM), launched in October 2020, follows closely with $33 billion in AUM. iShares’ 0-3 Month Treasury Bond Fund, also launched in May 2020, currently has total assets of $25.2 billion.

Meanwhile, BlackRock’s IBIT, which launched just ten months ago, has caught up, boasting $23.2 billion, ranking it as the fourth-largest ETF established this decade. Fidelity’s FBTC sits in ninth position with its $11 billion in total assets.

Essentially, these crypto funds are quickly joining the ranks of more established players in the traditional ETF market, marking a significant milestone for the cryptocurrency industry. Ultimately, the rise of Bitcoin ETFs shows how much demand for digital assets has permeated the broader financial markets.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.