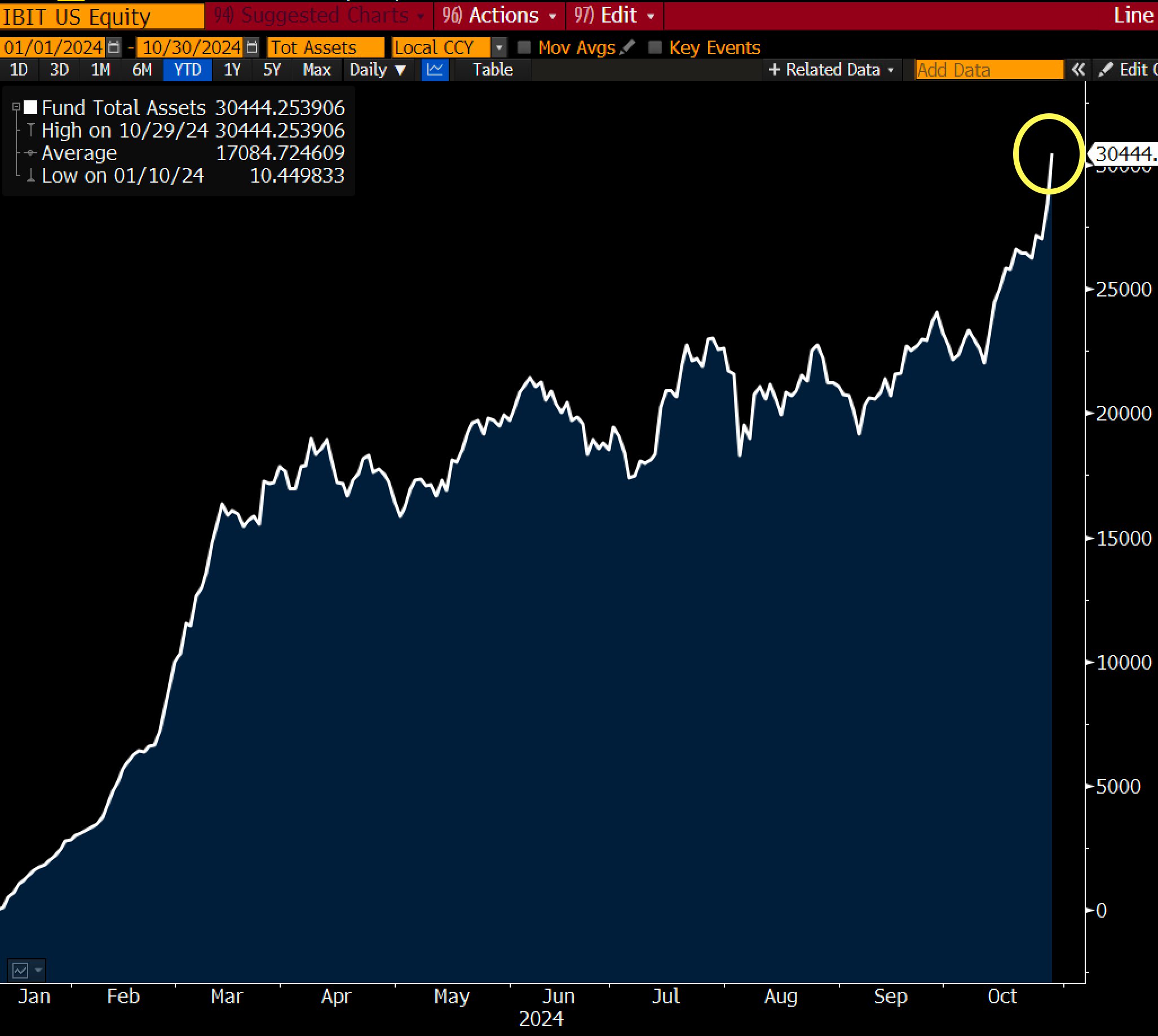

Bitcoin tokens held by BlackRock, particularly through its exchange-traded fund IBIT, have crossed the $30 billion mark, marking a historic record.

Eric Balchunas, Bloomberg’s senior ETF analyst, drew public attention to this record in a post on X today. He compared BlackRock’s holdings with those of the largest Bitcoin holders, placing BlackRock among the top three.

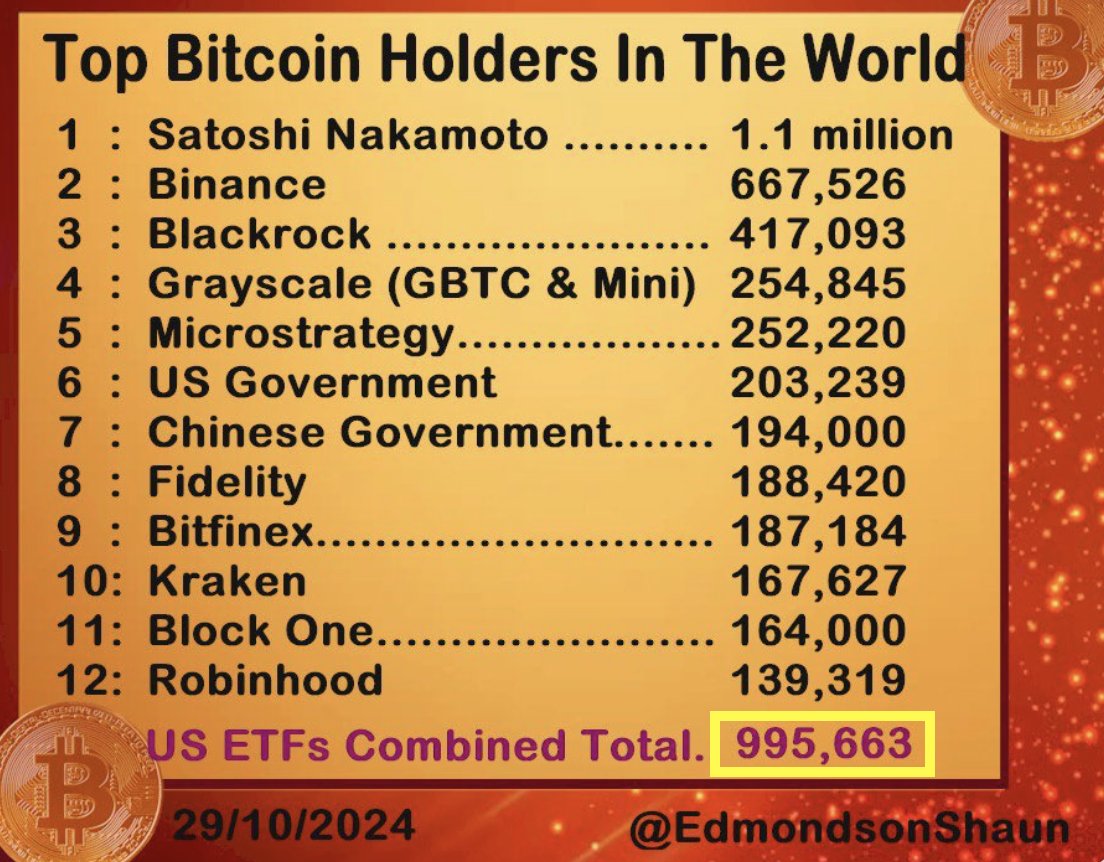

The analysis disclosed that BlackRock now holds 417,093 BTC. At Bitcoin’s current value of $72,000, BlackRock’s holdings amount to about $30 billion. The company, led by Larry Fink, now trails only Binance and Satoshi Nakamoto in Bitcoin holdings.

While Binance’s portfolio sits at 667,526 BTC, Satoshi Nakamoto is far ahead with 1.1 million tokens. Following closely behind BlackRock is Grayscale, through its GBTC and Mini ETF shares, and MicroStrategy, both of which hold Bitcoin valued over $18 billion.

BlackRock Breaks JPMorgan’s Record

Commenting on BlackRock ETF’s latest record, Balchunas described the achievement as “unreal,” considering the growth trajectory and timeline it took older ETFs to reach the same milestone. For context, BlackRock’s ETF launched just ten months ago—293 days—and has already reached $30 billion in value, an all-time record.

Balchunas highlighted that the previous record holder was JPMorgan’s Equity Premium Income ETF (JEPI), which took 1,272 days, or over three years, to achieve this milestone. Before JEPI, the SPDR Gold Trust (GLD) took 1,790 days to reach the same benchmark.

Notably, BlackRock crossed the $30 billion mark after welcoming inflows of $642.9 million on Tuesday, maintaining a streak of 12 consecutive trading days with positive inflows. This Tuesday’s inflow coincided with Bitcoin’s surge, which traded at $73,600 earlier today, its highest point in seven months.

U.S. ETFs Targeting 1 Million Bitcoin in Holdings

Other U.S. Bitcoin ETFs have also seen significant inflows in recent days as Bitcoin prices surged. The net inflow for yesterday reached a record $870 million, the highest since June. Aside from BlackRock and Grayscale, notable holders include Fidelity’s FBTC, which holds 186,577 BTC, ranking it ninth among the top Bitcoin holders.

Currently, U.S. ETFs collectively hold 995,663 BTC, valued at over $71.68 billion. Balchunas believes this figure will exceed the 1 million mark after the close of business today. He argues that, with the current momentum, they could aim to surpass Satoshi’s holdings by next month, just two months before their first birthday.

COUNTDOWN: US spot ETFs are scheduled to hit 1 million bitcoin held by next Wed and pass Satoshi by mid-December (before their first birthday, amazing). They’ve been adding about 17k btc a week. That said, anything can happen, eg a violent selloff and all this is delayed albeit… pic.twitter.com/lsU1xSP2Zd

— Eric Balchunas (@EricBalchunas) October 29, 2024

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.