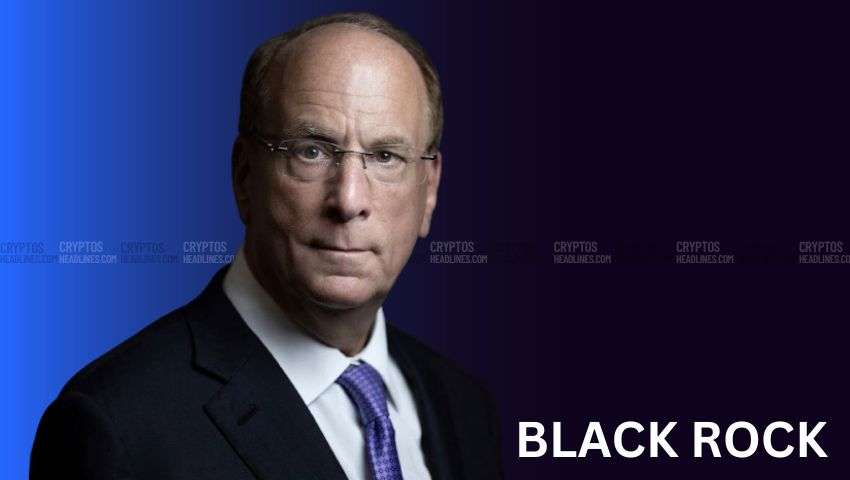

BlackRock CEO Larry Fink, who once called Bitcoin (BTC) a speculative asset and a tool for money laundering, has changed his stance. Since 2017, he has shifted his view and now sees Bitcoin as a significant player in the financial world.

In a recent CNBC interview, Fink admitted that his opinion of Bitcoin has evolved. After studying the cryptocurrency and its technology, he realized he was wrong in his earlier assessment.

Larry Fink’s Evolving View on Bitcoin: From Skepticism to Support

In a recent interview, BlackRock CEO Larry Fink shared his changed perspective on Bitcoin. He now considers Bitcoin a legitimate financial tool, acknowledging that while there may be instances of misuse, similar to any other asset, Bitcoin provides uncorrelated returns and serves as a valuable investment during economic uncertainty.

Fink, whose firm launched a Bitcoin ETF in January, emphasized Bitcoin’s role in investment portfolios. He compared it to digital gold and highlighted its significant industrial uses, which are often overlooked by investors.

His comments align with his previous positive views on Bitcoin, where he likened it to gold as a hedge against inflation and currency devaluation.

Larry Fink’s Evolving Bitcoin Perspective: From Skepticism to Strategic Asset

Over a year ago, BlackRock CEO Larry Fink highlighted Bitcoin’s advantage of having a limited supply, which caps its total creation. He explained that BlackRock’s aim with their spot Bitcoin ETF is to create a wealth storage instrument, linking Bitcoin to gold.

However, Fink’s interest goes beyond just comparing Bitcoin to gold. He views Bitcoin’s long-term potential as a significant factor, seeing it as a means to digitize gold and offer an alternative to traditional currencies. Bitcoin’s independence from any specific currency makes it a global asset capable of protecting wealth against inflation and economic uncertainties.

Recently, BlackRock achieved a milestone, with assets under management reaching $10.6 trillion in the first half of the year. Bloomberg reports that BlackRock saw substantial inflows, with clients adding $51 billion to its long-term mutual funds in the second quarter.

This highlights growing interest in BlackRock’s offerings, including its spot Bitcoin ETF, which has become a leading asset in terms of inflows in the newly approved market since its launch.

The daily chart shows BTC’s price surge experienced over the weekend. Source: BTCUSD on TradingView.com

As of now, Bitcoin (BTC) is trading at $63,000. It has risen by more than 5% in the last 24 hours and over 12% in the past week.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News