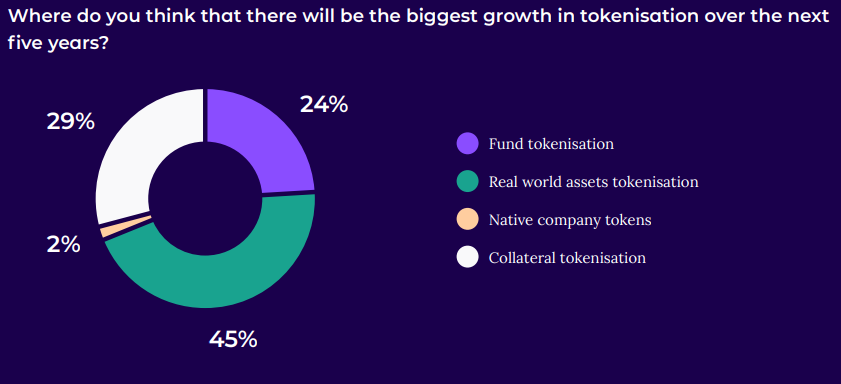

According to a recent report by Acuiti, real-world assets (RWA) tokenization is expected to dominate tokenization in the next five years with a 45% growth rate projection. Leading financial institutions like BlackRock have already jumped on the trend.

Others, including Fidelity, BNY Mellon, JP Morgan, Goldman Sachs, UBS, and HSBC, are already using blockchain technology to tokenize various assets, prioritizing securities, investment funds, real estate, and commodities.

BlackRock is at the forefront of RWA tokenization

BlackRock has emerged as an early leader in the RWA space, particularly with the launch of its BUIDL fund in March 2024. Backed by cash, U.S. Treasury bills, and repurchase agreements, the BUIDL fund had already amassed over $520 million in assets as of September 18th, 2024. This growth signals the firm’s growing involvement in tokenization in the same year it gained approval for its spot Bitcoin ETF.

Blackrock worked on the new token with Securitize, a financial giant-backed tokenization platform that utilizes the Ethereum blockchain for trades. Jiritsu, a layer one blockchain RWA platform, joined the pair in June, providing solutions to improve RWA coin management and verification.

Larry Fink, CEO of BlackRock, has repeatedly advocated for tokenization. He once said:

We believe that the next step will be the tokenization of financial assets, which means that each stock and each bond will have its own basic QCIP. It will be recorded on every investor’s ledger, but most importantly, through tokenization, we can tailor strategies to suit each individual.

~Larry Fink

BlackRock-backed securitize integrates Wormhole for cross-chain tokenization

Securitize just announced a new integration with the Wormhole Foundation, enhancing the cross-chain capabilities of its tokenized assets. The collaboration, announced in a Sept. 20 blog post, will enable future assets issued via Securitize to leverage Wormhole‘s blockchain framework.

Wormhole’s messaging protocol will now be customized by Securitize with its own smart contracts to meet asset managers’ regulatory requirements.

This partnership comes a few months after Securitize raised almost $50 million in a funding round led by BlackRock, further solidifying its position in real-world asset tokenization. Other investors, such as Hamilton Lane, ParaFi Capital, and Tradeweb Markets, also participated in the funding.

According to Carlos Domingo, the CEO of Securitize, the collaboration with Wormhole will help enable sub-second, sub-penny transactions and move them into an increasingly cross-chain ecosystem. He added that this was a great example of how public blockchains enable new use cases that had previously been unavailable.