Key Points

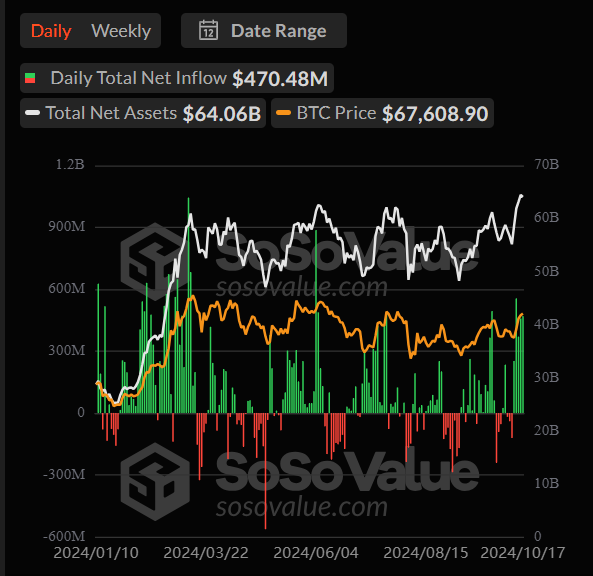

- Yesterday, the US BTC ETFs recorded over $470 million inflows, with IBIT leading at $309 million.

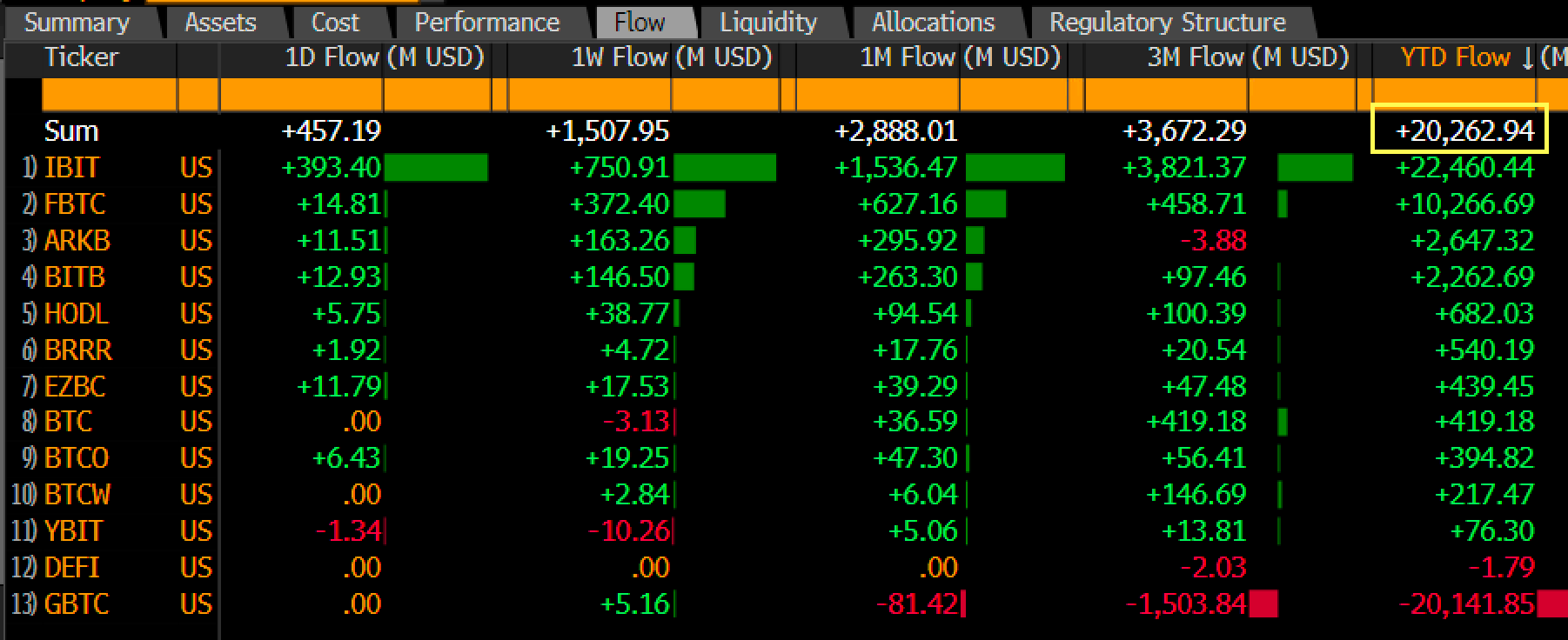

- BTC ETFs surpassed the important level of $20 billion in net flows.

The US-based Bitcoin ETFs continued their inflow streak this week, nearing $2 billion in inflows since October 14.

Yesterday, the crypto products recorded influxes of over $470 million, with BlackRock’s BTC ETF, IBIT, leading the way.

Bitcoin ETF Inflows Reach $1.85 Million Inflows This Week

Yesterday, the US BTC ETFs recorded their fifth consecutive inflow day since October 11. This week alone, the crypto products recorded $1.85 million in inflows.

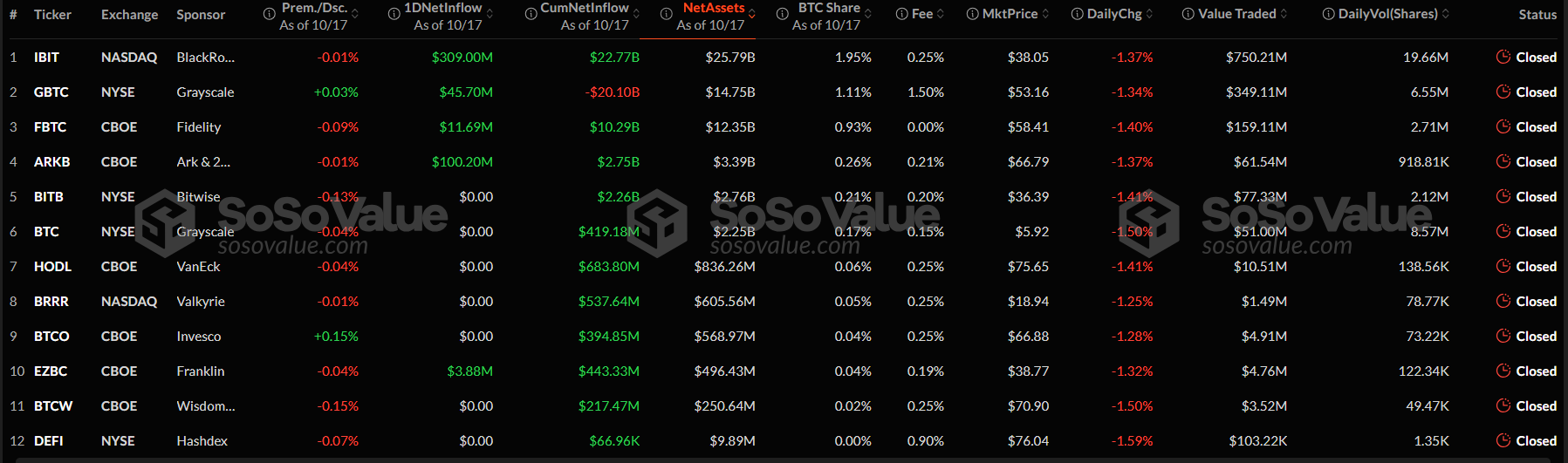

Here are the influxes in BTC ETF on October 17:

- BlacRock’s Bitcoin ETF, IBIT, recorded $309 million in inflows.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, saw over $100 million in inflows.

- Grayscale’s Bitcoin ETF, GBTC, recorded $45.7 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, recorded almost $11.7 million in inflows.

- Franklin Templeton’s Bitcoin ETF, EZBC, saw almost $3.9 million in inflows.

The other BTC ETFs in the US did not record any inflows or outflows the other day, according to SoSoValue data.

US Bitcoin ETFs Surpass $20 Billion in Total Net Flows

The total net assets in BTC ETFs as of October 17 topped $64 billion and the cumulative net inflow in the crypto products surpassed the important level of $20 billion.

As Bloomberg’s analyst Eric Balshunas noted in a post via X yesterday, this is the most important number and the most difficult metric to grow in the ETF world.

Balchunas said that it took gold ETFs about 5 years to reach the same number, while BTC ETFs required about 10 months. The crypto products were launched in the US in January 2024.

BlackRock’s Bitcoin ETF, IBIT, is the leader regarding the influxes in the crypto products, and the company’s CEO Larry Fink, acknowledged the huge success of IBIT back in March when he called it the fastest-growing ETF in history.

BlackRock’s IBIT Tops $1 Billion Inflows This Week

On October 17, BlackRock’s IBIT, saw significant inflows for the fourth day this week. Since October 14, IBIT recorded over $1.07 billion in inflows.

As of yesterday, the total net assets locked in BlackRock’s Bitcoin ETF were almost $25.8 billion, while the cumulative net inflows in the crypto products surpassed $22.7 billion.

BlackRock has been constantly buying Bitcoin, regardless of the coin’s price volatility, and since January, their BTC ETF, IBIT, recorded only five days of outflows on May 1, August 29, September 9, October 2, and October 10.

Regarding Bitcoin‘s price today, the coin is trading near the important level of $68,000, after kicking off a significant rally on October 14 fueled by constant ETF inflows and Trump’s rising chances to win the 2024 US elections.