BlackRock’s Bitcoin ETF options will finally go live on the Nasdaq stock exchange, maybe as soon as tomorrow.

Alison Hennessy, Nasdaq’s head of ETP listings, dropped the news on Bloomberg’s ETF IQ. “Getting these options listed on IBIT into the market I think will be very exciting for investors because that’s really what we have heard from them,” she said.

The Bitcoin ETF option has been in the works for ten months, and the review process wasn’t easy. The Commodity Futures Trading Commission (CFTC) had to jump in and clear the Options Clearing Corporation to oversee this market. That green light was essential. Without it, this launch wouldn’t happen. Now, it’s all systems go.

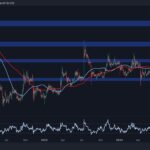

Bitcoin’s wild weekend ride

Bitcoin decided to have a little drama of its own. Over the weekend, the world’s most famous crypto suffered its biggest two-day drop since the U.S. election. It dipped almost 3% before pulling itself together and stabilizing at $90,100 by Monday morning.

Traders are on edge, trying to figure out what President-elect Donald Trump’s crypto promises will actually mean. Trump’s to-do list for crypto sounds like something straight out of fiction.

A U.S. Bitcoin stockpile, a regulatory framework that’s friendly to blockchain, and a bold plan to make the United States the global crypto hub. But is any of this even possible?

Trump’s business-friendly image might help push these plans forward, but the market isn’t buying in without a fight. Inflation fears, trade tariffs, and deficit-spending concerns are adding to the uncertainty.

And then there’s the Federal Reserve, which might not be cutting rates again anytime soon. All of this affects Bitcoin’s speculative appeal. Some analysts think Bitcoin got a little too hot too fast after its post-election rally.

Trump’s crypto playbook

Let’s talk about Trump’s crypto agenda for a second. The president-elect was once a hardcore crypto skeptic, but now he’s all in. Why? Because crypto companies threw a ton of money at his campaign to push their interests.

Trump responded by promising them everything they’ve ever wanted. JPMorgan strategists think we will definitely see crypto legislation pass under Trump. They predict a complete pivot from the old regulation-by-enforcement model to something more collaborative.

Banks might get more room to engage with crypto. Venture capital, mergers, and IPOs could see a boost. It all sounds great on paper, but some promises, specifically that Bitcoin stockpile, feel like a long shot. JPMorgan’s analysts called it a “low-probability event.”

Still, the markets remain on fire. From November 8 to November 15, Bitcoin-focused ETFs pulled in $4.7 billion in net inflows. By the end of that week, $771 million had exited.

Matt Hougan, CIO of Bitwise Asset Management, called Trump’s election a “massive win for crypto.” He predicts an explosion of crypto applications and financial products under a more supportive regulatory environment.

Matt Sigel of VanEck agrees. He’s betting big on a friendlier SEC and even predicts a Solana ETF could hit the market by next year. “We would expect the SEC to approve more crypto products than they have in the past four years,” he said.

The global stage

Europe’s crypto ETF market is thriving, and it’s setting a high bar for what’s possible. CoinShares, Europe’s largest provider of digital asset ETFs, sees Trump’s election as a chance for the U.S. to finally catch up.

Townsend Lansing, the company head of product, thinks the highly-expected new SEC chair could bring about stable, comprehensive crypto legislation.

“They are trying to fit crypto into these models, but crypto fits unevenly into this,” he said. One of the biggest obstacles for America crypto innovation has been the SEC itself. Gary Gensler’s enforcement-heavy approach has driven much of the crypto activity abroad.

“The SEC was sued like a deadbeat parent who didn’t pay child support,” said Matt Sigel, referencing Grayscale’s legal win over the SEC. He added that: “We are really looking forward to the U.S. becoming a hub for product development.”

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap