Bloomberg analyst Mike McGlone cautions about challenges ahead for Bitcoin’s surge to $40,000, despite a positive outlook influenced by the BlackRock Bitcoin ETF.

Bitcoin reached a one-year peak at $31,400, matching its price before the 2022 Terra-LUNA crisis that affected the crypto market.

While experts foresee a potential rally in BTC price, Bloomberg Intelligence’s senior strategist Mike McGlone cautions about numerous challenges that may hinder Bitcoin from reaching $40,000.

Mike McGlone predicts Bitcoin’s price could either reach $20,000 or $40,000:

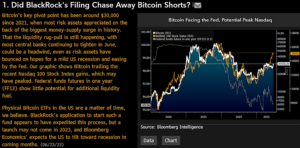

Mike McGlone, Bloomberg Intelligence’s senior strategist, shared insights from a crypto outlook report on Twitter. He believes that the introduction of Bitcoin ETFs, including BlackRock’s spot Bitcoin ETF, will not protect Bitcoin from potential challenges such as the first US recession, a possible equity bear market, and the actions of hawkish central banks.

According to Bloomberg Intelligence’s senior strategist, Mike McGlone, the short-term prospects for Bitcoin are favorable. However, he emphasized that the crucial pivot point for Bitcoin has been around $30,000 since 2021, despite significant increases in money supply. McGlone identified various challenges that could hinder Bitcoin’s price from reaching $40,000.

According to Mike McGlone, the senior strategist at Bloomberg Intelligence, the launch of physical Bitcoin ETFs in the US is inevitable, although it may not happen in 2023. The application by BlackRock for a Bitcoin ETF has likely accelerated the process. However, McGlone also mentioned that Bloomberg Economics predicts the US economy to lean towards a recession in the upcoming months.

Mike McGlone suggests that the US Federal Reserve’s ongoing interest rate hikes, along with weak US dollar liquidity and the Nasdaq 100 stock index nearing its peak, could pose significant challenges to the anticipated Bitcoin rally. Despite hopes for a mild US recession and potential easing by the Fed, the ongoing liquidity tightening by most central banks may act as a headwind for Bitcoin and other risk assets.

Source: Mike McGlone

Caleb Franzen, the founder of Cubic Analytics, supports Mike McGlone’s analysis and emphasizes the significant resistance zone for Bitcoin, which ranges between $31,000 and $35,000.

This is the next key grapple zone for #Bitcoin based on price structure over the past two years. I have to lean bullish going into this red zone, but we must acknowledge the threat of potential resistance here.

Probably best not to chase here, so just sit back & enjoy the show. pic.twitter.com/TdxYvV3K9r

— Caleb Franzen (@CalebFranzen) June 23, 2023

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community