- BNB’s $1 billion burn can drive potential bullish momentum towards the $606 resistance

- Higher volumes and Open interest revealed strong market interest and optimism

The BNB Foundation recently completed its 29th quarterly burn, eliminating over 1.77 million BNB (worth around $1.07 billion) from circulation. This ongoing burn strategy is intended to reduce supply and enhance value for holders. In fact, prior burns have often sparked market reactions too.

For instance – The 28th burn led to a modest 0.5% price hike to $596, with trading volumes increasing by 22%. The 27th burn in April too saw Binance Coin [BNB] jump by 5% after burning 1.94 million BNB, valued at $1.17 billion.

Therefore, with each burn, the scarcity of BNB grows, potentially setting the stage for a significant market move.

Can BNB break through its key resistance?

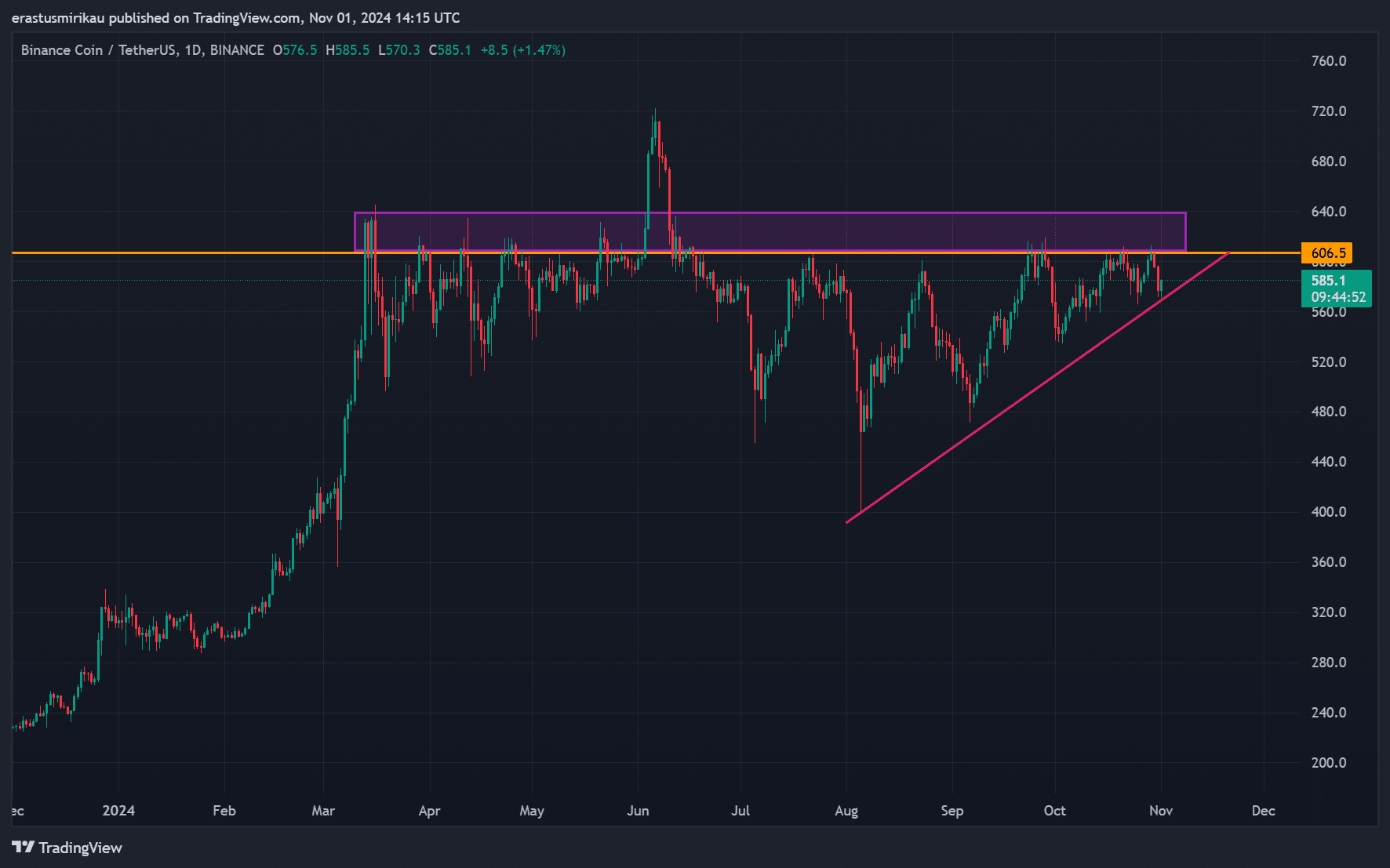

At press time, BNB was trading at $584.70 after appreciating by just under 1% in 24 hours. On the daily chart, BNB seemed to approach a crucial resistance level near $606 – A point it has struggled to surpass in the past.

However, its price was forming an ascending triangle pattern – A typically bullish indicator.

If it breaks above this $606 level, it could attract more buying interest, propelling it into a new uptrend. Conversely, if the resistance remains firm, Binance Coin might record a pullback, possibly testing lower support levels in the $560 range. Therefore, this level stands as a key battleground for the token.

A sign of market interest?

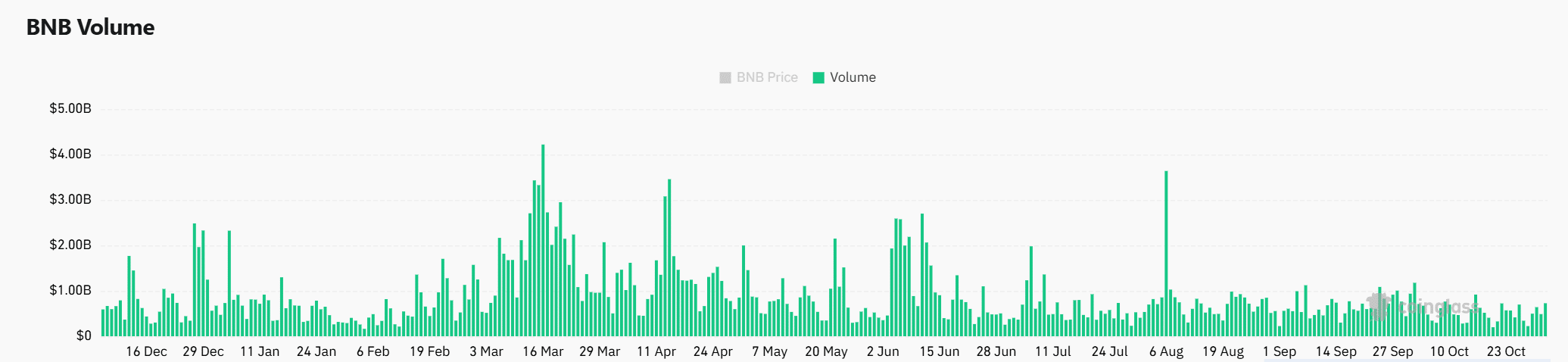

Besides the burn, trading activity has also surged.

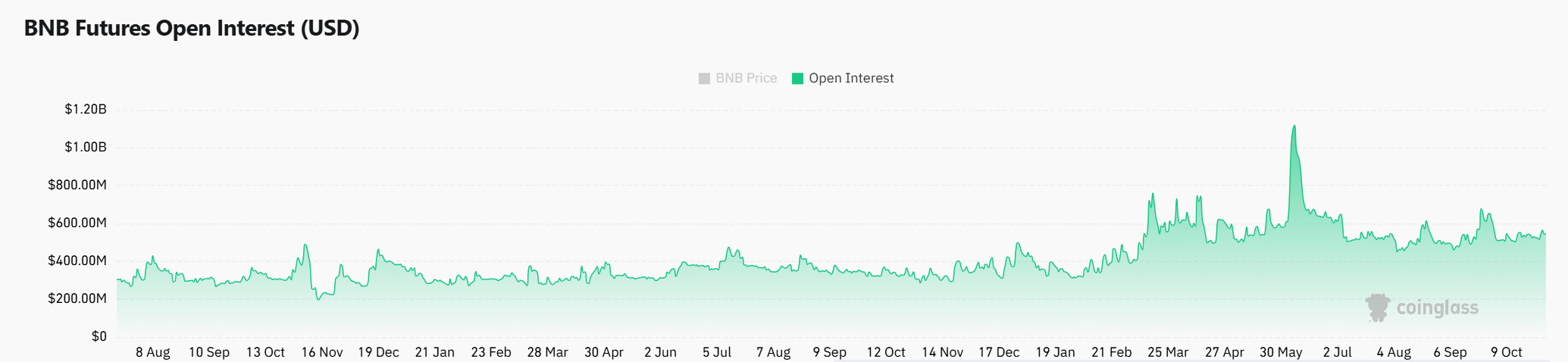

Derivatives trading volumes rose by 21.97% to $697.49 million, while Open Interest saw a 2.3% uptick, reaching $543.60 million. This surge in volume and Open Interest suggested growing interest among traders, perhaps as they prepare for a decisive move.

Higher volume often means greater market activity, and a simultaneous hike in Open Interest generally indicates strong conviction among traders.

Therefore, this heightened activity may hint at an imminent breakout—Whether to the upside or downside depends on BNB’s ability to clear the $606 level.

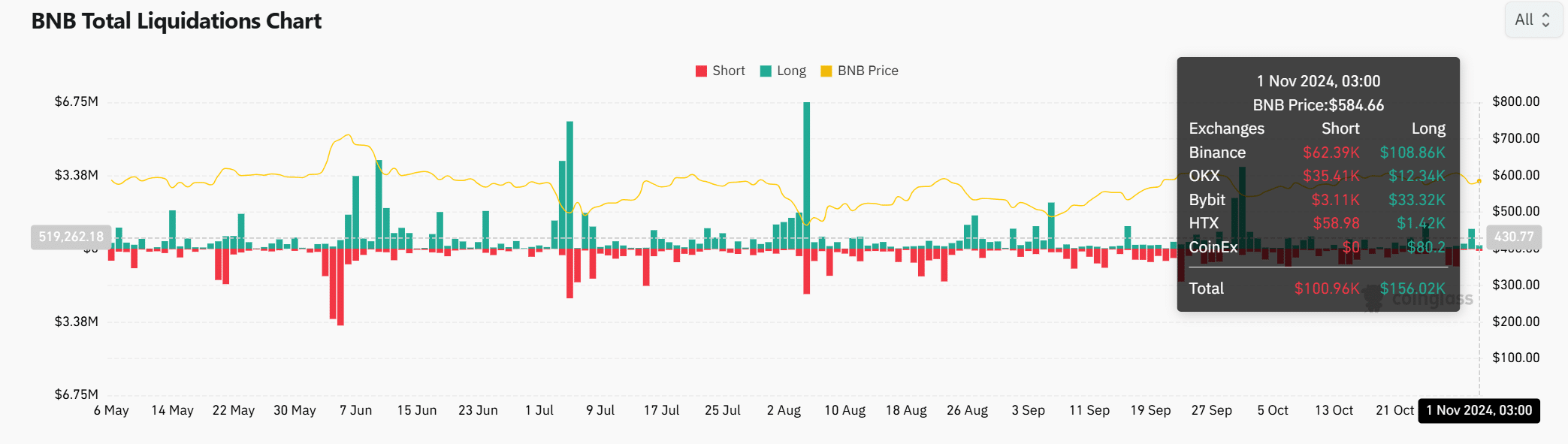

BNB liquidations – Shorts on alert?

Finally, the latest datasets showed $156.02k in long liquidations versus $100.96k in shorts, hinting at a slightly bullish sentiment.

With Binance Coin inching closer to its resistance, short positions have reduced, indicating cautiousness among bears. If BNB breaks out, we may see higher short liquidations, potentially fueling further upside.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Will this burn be the catalyst for BNB’s needs?

With Binance Coin nearing a crucial resistance and trading volume on the rise, the 29th burn may serve as a turning point. Previous burns have triggered bullish momentum, and a break above $606 could open doors for a new rally.

However, if it fails to clear this level, consolidation or a slight dip may follow.