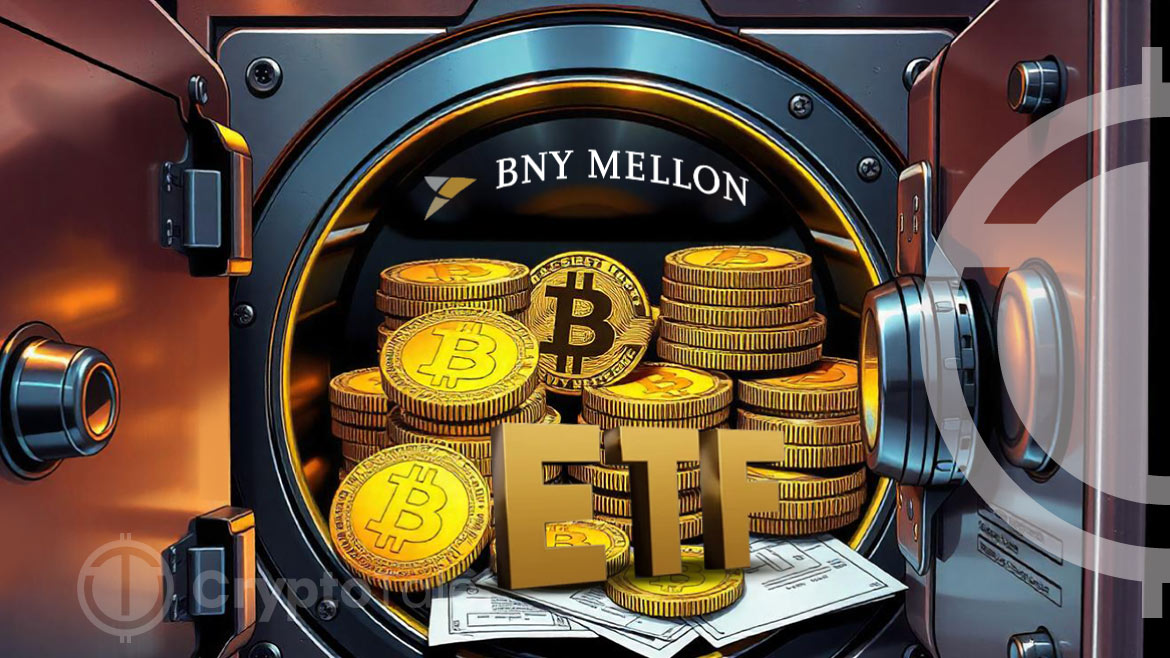

America’s oldest bank, BNY Mellon, is nearing providing custodial services for ETF clients. This development tracks a recent review by the Securities and Exchange Commission (SEC). The bank’s foray into this market marks its growing involvement in digital assets and might change the scene for crypto ETF custody.

SEC Review Clears Path

The SEC’s Office of the Chief Accountant conducted a review earlier this year. This review allowed BNY Mellon to avoid treating the custody of crypto assets for its regulated ETF clients as a balance-sheet liability. The decision granted BNY Mellon an exemption from the SEC’s Staff Accounting Bulletin No. 121 (SAB 121). This exemption opens the door for the bank to provide custody services for crypto ETFs.

BNY Mellon’s entry into the crypto custody market challenges existing players. Bloomberg estimates the current market value at around $300 million, growing 30% annually. Coinbase currently dominates this space, offering custodial services to most U.S. spot Bitcoin ETFs, including the largest one issued by BlackRock. BNY Mellon’s involvement could disrupt Coinbase’s market dominance.

SEC Approves Bitcoin Options Trading for BlackRock’s IBIT

Higher Fees for Digital Assets Custody

Crypto custody services come with higher fees compared to traditional asset custody. This is due to the security risks associated with digital assets. BNY Mellon’s entry into this market could capitalize on these higher fees. The bank has shown interest in digital assets since at least January 2023. CEO Robin Vince has previously called digital assets the bank’s “longest-term play.”

Already, BNY Mellon supports 80% of the Bitcoin and Ether exchange-traded instruments certified by the SEC. Through its fund services division, this support demonstrates the bank’s dedication to grow in digital assets. The current infrastructure and expertise could help it to move into offering custodial services.

Market Entry of BNY Mellon

This entrance could affect the competitive dynamics of the sector. The bank might draw ETF providers seeking for reputable regulated custodians. This shift could challenge Coinbase’s stronghold in the market.

The growing demand for secure and regulated custodial services also continues to rise. This demand is driven by the increasing institutional interest in digital asset products. As BNY Mellon strengthens its capabilities, its role in the digital asset ecosystem is set to grow.