- BONK burst out beyond the six-week range highs on high trading volume.

- A price dip below $0.00003 in the coming days was likely.

Bonk [BONK] gained 39.26% on Tuesday, the 12th of November, reaching as high as $0.00004 before retracing by 17.46% from that point in the past ten hours. The dip might not be at an end, as the liquidation heatmap indicated another 6.5% move lower was likely.

Yet, with the backdrop of Bitcoin [BTC] in the price-discovery phase, dips in BONK price are for buying. “Buy everything you can” was the advice from Bernstein Research for crypto investors.

BONK achieves the 100% Fibonacci extension target

The OBV soared past local highs from late September as the meme coin broke out beyond the six-week range. A deviation below the range lows was seen in the first week of November.

The events since then, such as a pro-crypto U.S. president elected, have spurred bullish conviction in assets across the market.

The RSI was resetting after a move to 81 on the daily chart, levels it previously reached in March 2024. Back then, BONK rallied 333% in nine days. The recent move from the range breakdown (deviation) was 133% and took eight days before the dip started.

BONK price prediction- deeper short-term dip expected

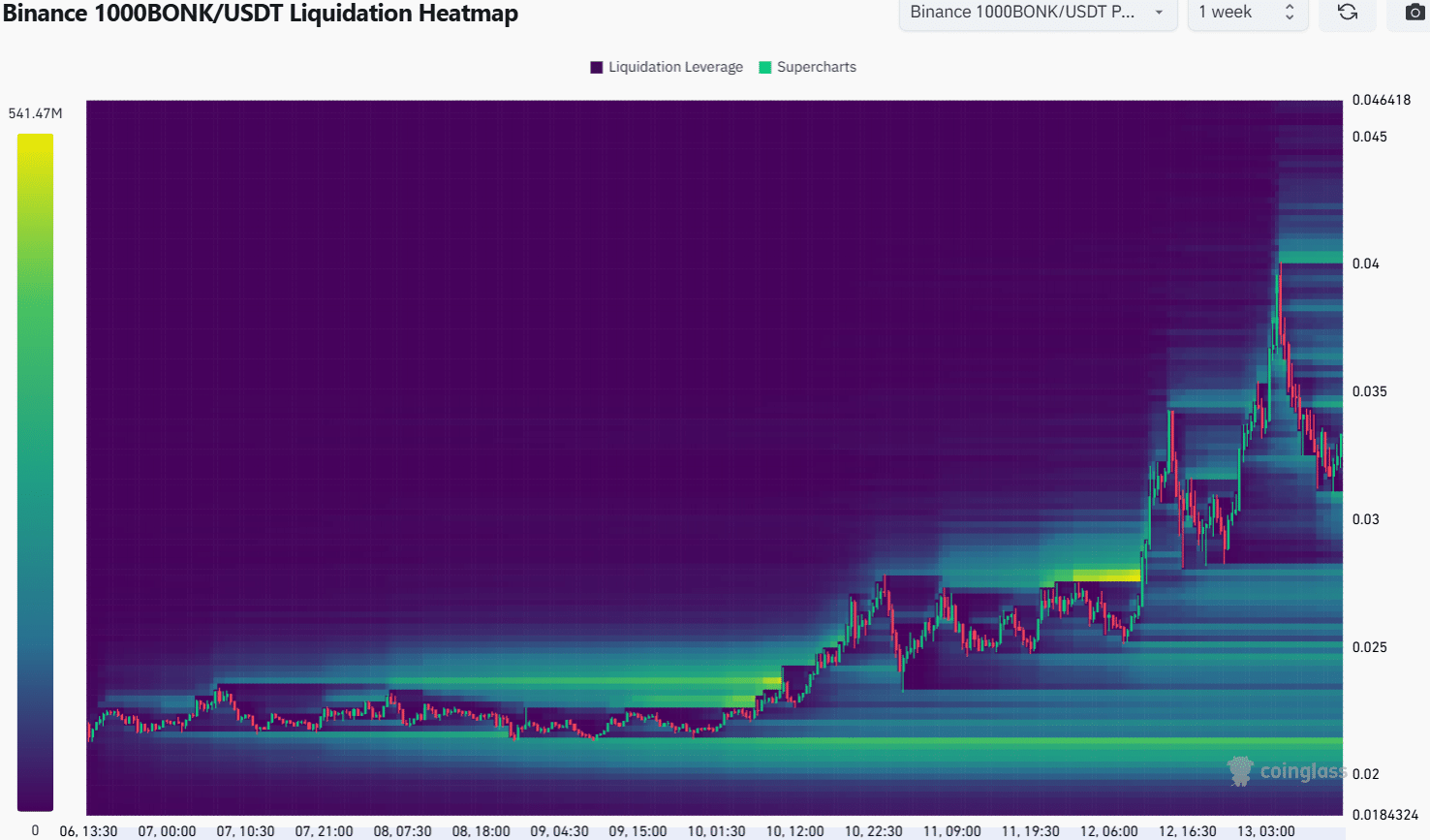

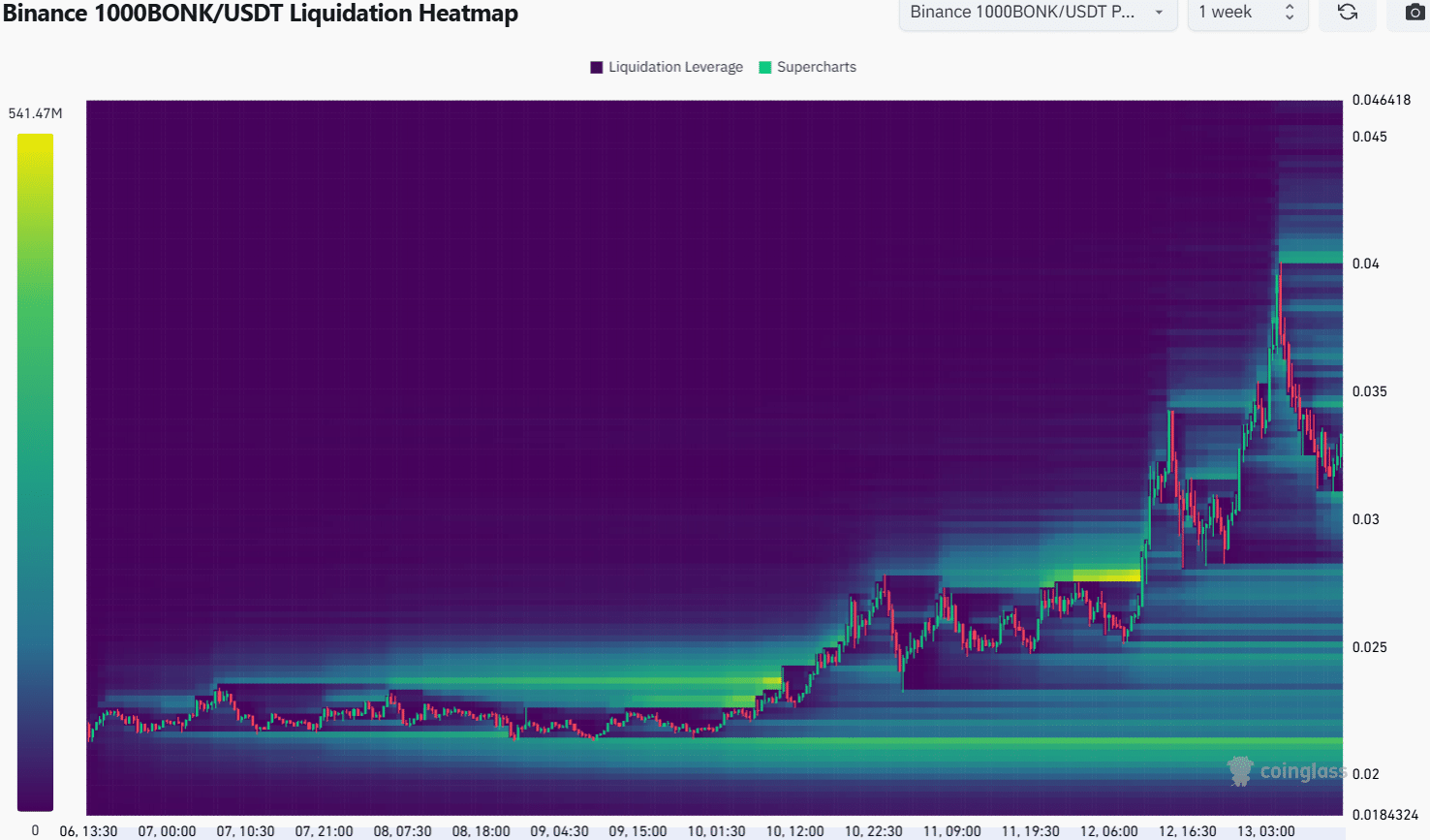

Source: Coinglass

The 1-week look-back liquidation heatmap highlighted the $0.0000307 and $0.0000345 levels as the closest magnetic zones for BONK. A deeper move to $0.0000276 is also possible, especially if BTC falls below $85.5k.

Is your portfolio green? Check the Bonk Profit Calculator

More gains are highly likely but the timing of it is less clear. Bitcoin gained 34% in a week and was consolidating around $87k at press time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion