- Bonk (BONK) could become the first meme coin to launch an Exchange-Traded Product (ETP) after plans were unveiled at the Solana Breakpoint event.

- Market experts debate the possibility of a meme Exchange-Traded Fund (ETF), looking at the volatile nature of the asset class.

Bonk Inu (BONK) is on the verge of setting a historical precedent after it was announced at the Solana Breakpoint event that the meme coin could launch an Exchange-Traded Product (ETP) in the U.S. According to reports, this could be done in collaboration with New York-based company Osprey Funds. It is important to note that Osprey Funds significantly streamed one of the first Exchange-Traded Funds (ETFs) and Solana Trust.

Based on the information privy to us, the ticker would be the same (BONK), and the launch could be announced by the end of the year.

Bonk’s (BONK) Price Reaction to the ETP Announcement

Despite this exciting development, the price of BONK continues to wallow in the bearish trend as it declines by 4% in the last 24 hours and 17% in the last 30 days to trade at $0.00001722.

Regardless, analysts foresee a 200% surge as the BONK/USDT pair touches its crucial support level three times. The last time this happened, the asset witnessed an 182% run from April to May 2024. Coincidentally, this bullish signal is confirmed by the Moving Average Convergence Divergence (MACD) indicator, which shows an increase in buying momentum. Positive sentiment also remains high as the asset trades above the Bollinger Band.

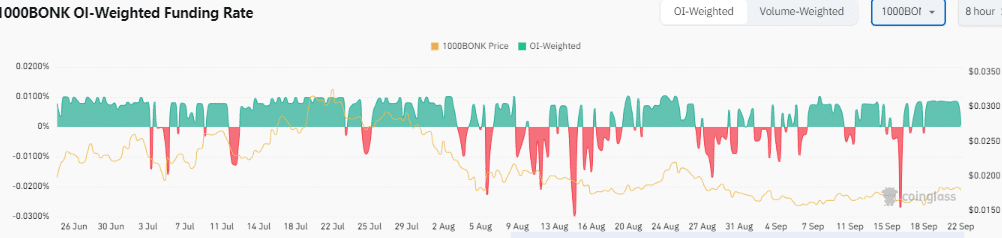

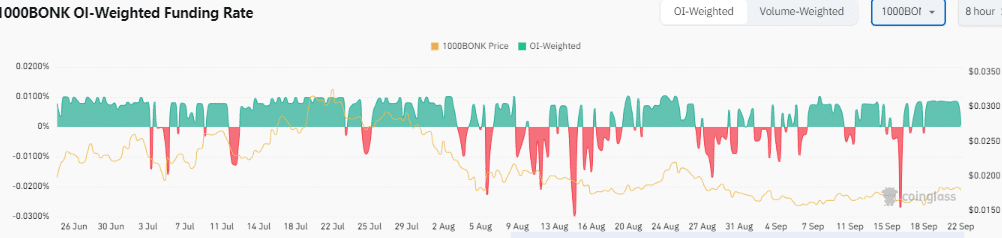

Looking at other indicators, such as OI-weighted funding rates, it was obvious that long-term traders are becoming more optimistic about the price potential as the reading stood at 0.0006%.

Would the Market Witness a Memecoim ETF?

According to market experts, BONK’s unprecedented move could set the ground for the first-ever meme coin ETF. Bitwise’s Chief Investment Officer, Matt Hougan, labels the current dispensation an ETF era. He said the current outlook could extend to meme coins despite their volatile nature.

Many ETFs exist as trading tools and are widely used. Why not allow people to gain exposure to meme coins in a secure, familiar ETF package? Broadly speaking, I think that would be great.

Commenting on this, Shiba Inu’s marketing lead, Lucie, highlighted the benefit the meme ETF could bring. With a specific focus on SHIB, Lucie pointed out that such development could simplify the process of both traditional and institutional investors navigating around the complex interface of exchanges to acquire the asset. According to her, SHIB ETF could lead to security and compliance benefits in addition to diversification.

BloFin Research analyst Edward also weighed in on the possibility of a meme coin ETF, claiming institutions would need to work on extra regulatory considerations before embarking on such a move.

SHIB, as a meme coin, is often viewed as a more speculative and volatile asset. TradFi institutions may need to put extra regulatory consideration when considering SHIB as a potential ETF. Institutions are eager to access the crypto market through a compliance pathway, and the addition of institutions can bring liquidity to the crypto market. However, since institutions will hold a large amount of SHIB to issue ETFs, the centralized risk and high probability of collapse risk brought by this move are not recognized by community members. When the community attitude is low, the price of SHIB is more likely to go down.

No spam, no lies, only insights. You can unsubscribe at any time.