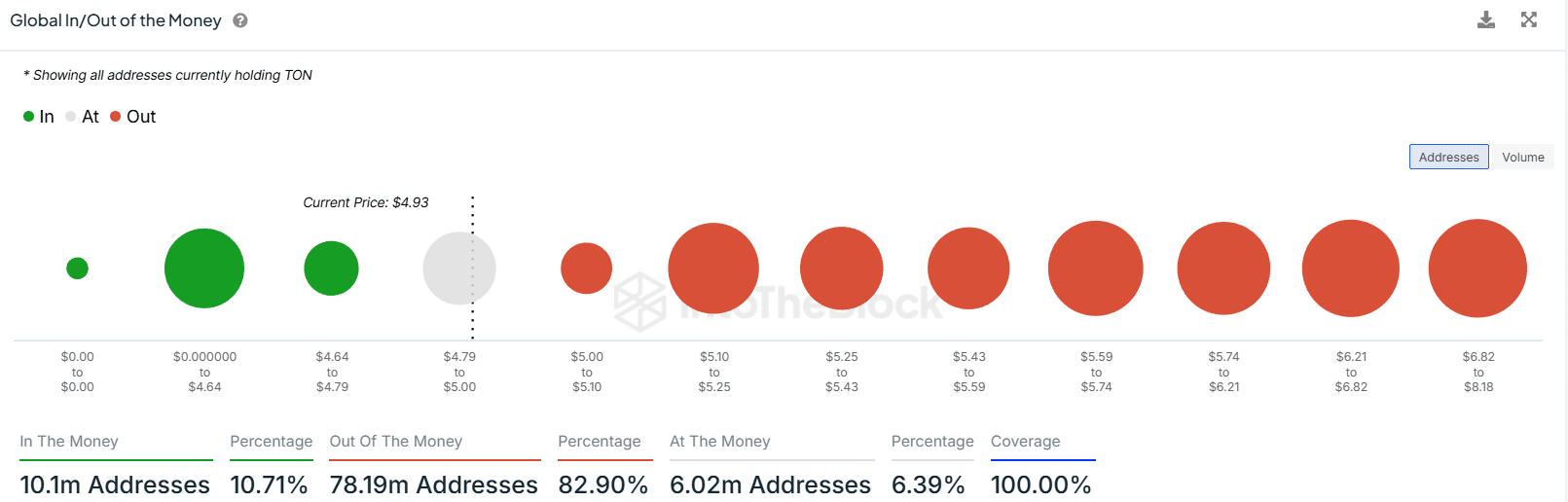

- Only 10.71% of TON holders were profitable at press time.

- Whales and large investors currently hold a substantial 91.52% of the total TON circulating supply.

Amid the ongoing price correction across the crypto landscape, Telegram-linked Toncoin [TON] appears bullish and is poised for a notable upside rally due to its positive price action.

However, this rally in TON is likely to occur once the market sentiment shifts from a downtrend to an uptrend.

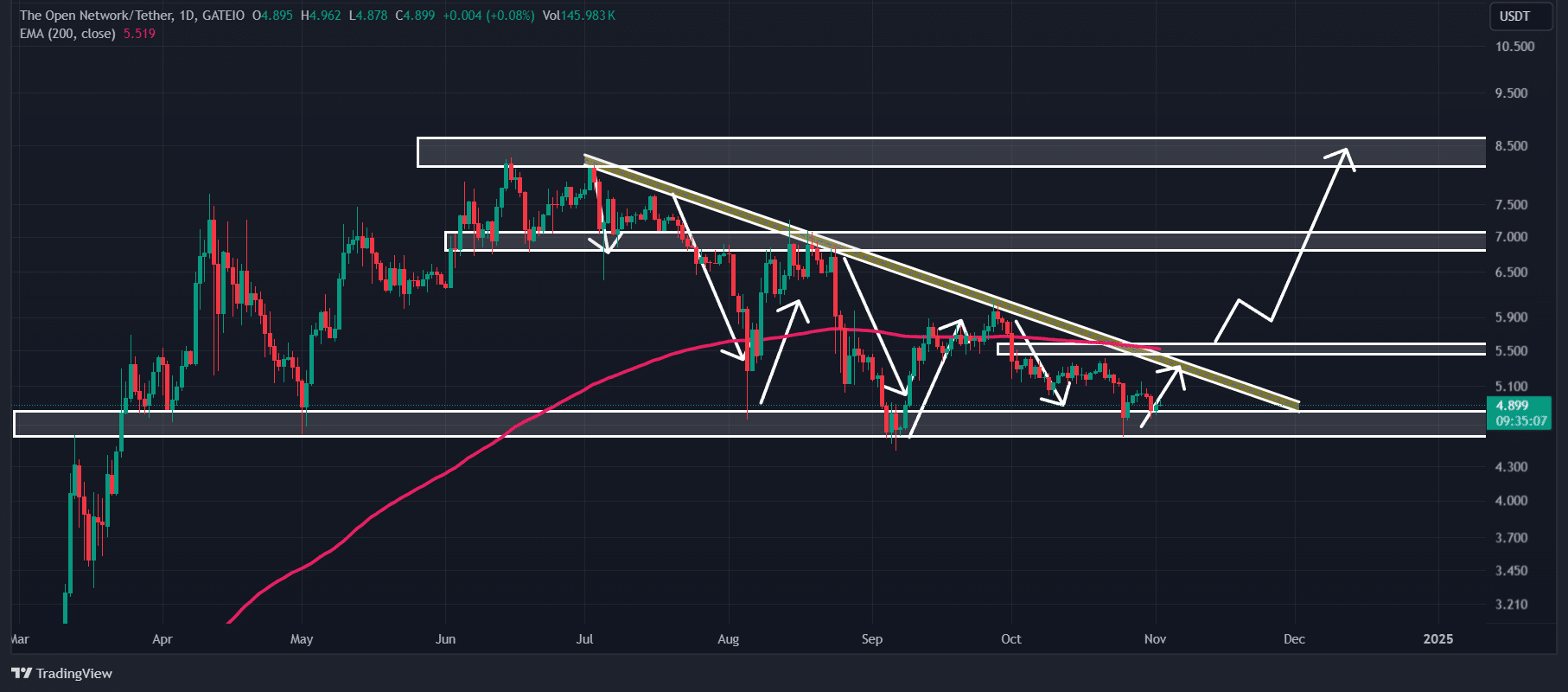

Toncoin technical analysis

According to AMBCrypto’s technical analysis, TON appears bullish and is currently at a strong support level of $4.9. This is a level where TON has historically experienced notable buying pressure and an upside rally.

Traders and investors are now expecting a similar move this time as well.

In addition to the support level, TON’s price has reached a narrow zone within a descending price action pattern and is expected to break out of this pattern.

If sentiment shifts and the price breaches the declining trendline, closing a daily candle above the $5.6 level, there is a strong possibility it could rally by 40% to reach the $8.15 level in the coming days.

TON is currently trading below the 200 Exponential Moving Average (EMA) on a daily time frame. The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

At press time, TON was trading near the $4.91 level and has remained unchanged over the past 24 hours. In the same period, its trading volume dropped by 20%, indicating lower participation from traders and investors.

Despite this bullish outlook, one major concern for retail investors regarding TON is the concentration of ownership among whales and large investors.

TON whales and investors concentration

According to the on-chain analytics firm IntoTheBlock, nearly 87 whales and large investors currently hold a substantial 91.52% of the total TON circulating supply. Retail investors hold only about 8.48%, significantly lower than the share held by whales and large investors.

With such a high concentration among whales and large investors, the chance of price manipulation or potential scams increases for these assets.

Is your portfolio green? Check out the Toncoin Profit Calculator

Despite significant holdings by whales and institutions, currently, only 10.71% of holders are profitable, while 82.90% of TON holders are in out-of-money territory.

Additionally, 6.4% are in the money. With lower profitability, there is a high chance that once the price rises, the chances of a price dump will increase.