- A great decline in whale transactions for BTC and ETH observed, with volumes nearly halving since March 2024.

- Despite reduced transaction activity, whales continue accumulating assets, indicating confidence in long-term crypto prospects.

- ETH outpaces BTC in recent price gains but exhibits greater volatility, reflecting shifting market dynamics.

In a recent post by Santiment, the cryptocurrency market has recorded a decline in investor activity across major assets like BTC and ETH. Whale transactions, defined as those surpassing $100,000, have decreased, bringing interest in the behaviour of large holders and the possible effects on the crypto space.

Read CRYPTONEWSLAND on

google news

Sharp Drop in Whale Transactions

According to data from Santiment, both BTC and ETH transactions have declined from their high levels earlier in 2024. In the week of March 13 to 19, Bitcoin recorded a considerable 115.1K whale transactions, whereas by August 21 to 27, this number had dropped to 60.2K, nearly half of the earlier figure.

Similarly, Ethereum recorded a sharp decline, with whale transactions falling from 115.1K in mid-March to just 31.8K by late August. This trend has raised questions about the current behavior of top crypto holders and the overall market dynamics.

Understanding Whale Behavior

Historically, whale activity has often surged during periods of high market volatility rather than in more stable periods. The current reduction in transaction volume might suggest a period of relative market calm, where major players are less active on exchanges but are still maintaining significant positions.

Despite the reduction in large transactions, data from Santiment indicates that whales are still accumulating assets. Despite decreased transaction activity, this steady accumulation has caused different analysts to argue that the large holders are positioning themselves strategically, possibly in anticipation of future market movements.

Bitcoin and Ethereum Price Movements

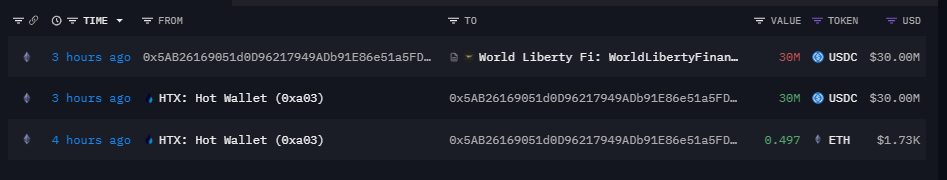

Source: CoinMarketCap

According to CoinMarketCap’s comparative price movements of Bitcoin BTC and ETH, Ethereum is currently outpacing Bitcoin, achieving a peak gain of close to 4% with a trading price of $2517.21. However, as the period progresses, both cryptocurrencies exhibit a downward trajectory.

Despite this decline, Ethereum has consistently maintained a higher percentage gain than Bitcoin, which is trading at 58,947.54. In contrast, Bitcoin’s price remains relatively stable, hovering between 1-2%, while Ethereum displays greater volatility throughout the period at the time of writing.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.