The quantity of bitcoin (BTC) supply that has remained inactive for the past two to three years has reached a two-year peak. This happened even as the asset’s price has been consolidating below $29,000, following a recent drop below that level more than a week ago.

Glassnode, a company that provides intelligence on blockchain data, brought public attention to this metric in a recent tweet. According to their data, the quantity of bitcoin that was last used or moved within the past two to three years is currently at 2.848 million BTC. This is the highest number recorded since 2021.

📈 #Bitcoin $BTC Amount of Supply Last Active 2y-3y (1d MA) just reached a 2-year high of 2,848,570.543 BTC

View metric:https://t.co/ov1FrjgNQz pic.twitter.com/XmcBoFqaAX

— glassnode alerts (@glassnodealerts) May 15, 2023

Glassnode shared a chart that displayed a decrease in this metric at the beginning of 2022 when the price of BTC fell sharply from its all-time high of $68,789, dropping below $40,000 in January of that year. The metric showed occasional declines throughout 2022 but started to rise again at the beginning of this year as bitcoin began its recovery.

Since January, this metric has consistently risen and now stands at 2.848 million BTC, which is equivalent to 14.7% of the total circulating supply of bitcoin. This metric suggests that more BTC holders are keeping their tokens for a longer time, often for investment reasons.

Furthermore, data concerning long-term holders (LTHs) of bitcoin indicates a positive trend. Notably, the BTC Binary CDD indicator reveals a relatively low level of activity on the blockchain from these long-term holders. This suggests that LTHs are presently holding onto their tokens rather than actively trading or selling them.

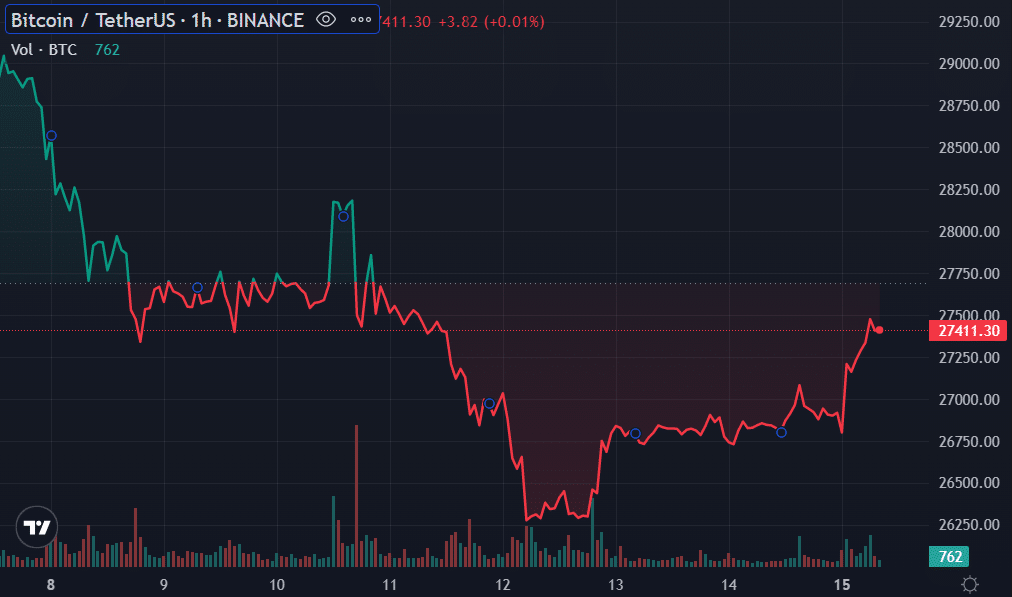

BTC consolidates below $29K.

Despite bitcoin’s ongoing consolidation below the $29,000 price level, the bullish trend has continued. Throughout the last week of April, bitcoin faced challenges in maintaining a position above $29,000 in order to protect against further declines.

BTC price – May 15 | Source: Trading View

After the first week of May, bitcoin faced a bearish turn due to concerns about high transaction fees caused by network congestion. As a result, BTC declined to a two-month low of $25,899 on May 12. From May 6 to May 13, the asset experienced eight consecutive days of losses, marking its longest losing streak since June 2022.

The asset is making a recovery, with a 2.12% increase in the past 24 hours, currently trading at $27,418 at the time of reporting. In order to reach the $29,000 mark again, BTC will need to surpass two important resistance levels at $27,500 and $28,100. Successfully surpassing these levels should offer enough support for the bullish trend to target $29,000.

This information is for general knowledge only and should not be considered as advice for investing or making financial decisions.