- Bitcoin bear market has consolidated its price within a specific range, jeopardizing the bulls’ chances for a rebound.

- If this dominance continues, BTC might drop to $40K. What are the odds?

Bitcoin [BTC] was trading above $57K at press time, a crucial level for a potential rebound. If bulls manage to defend this position, BTC could rally towards the $68K resistance.

However, if the Bitcoin bear market takes control and BTC loses the $55K support, a decline to $50K-$51K is probable. If this support fails, BTC could experience a deeper drop toward $40K.

Historically, September has been Bitcoin’s most bearish month, with only four positive years out of the past 13. Will this month follow the trend, or can bulls turn it around?

BTC faces uncertain bearish outlook

Adding to the uncertainty, analysts are warning that the Bitcoin bear market could regain control.

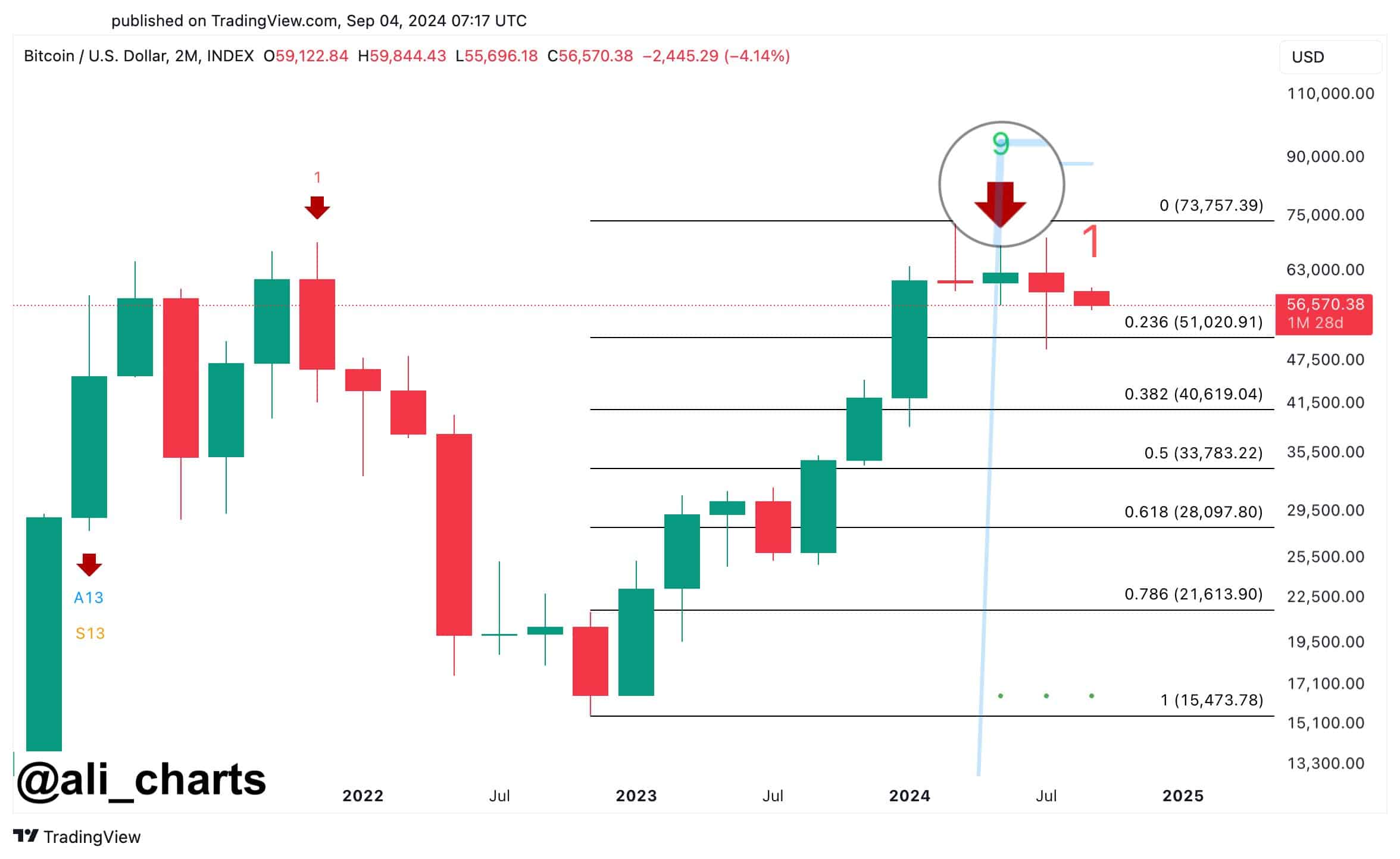

The TD sequential indicator on the Bitcoin 2-month chart is showing a sell signal, suggesting a potential drop. If BTC falls below $51,000, it might slide to $40,600 – a scenario bulls would want to avoid.

To prevent this, it’s crucial to maintain the $57K support level. AMBCrypto believes that alleviating overcrowding in leveraged positions is key.

In simple terms, a 10% reduction in open interest could help prevent sudden, sharp price movements.

Moreover, with less open interest, the market might stabilize, possibly resulting in a bear pullback or a bullish swing. So, is a drop coming?

Bitcoin bear market reigns supreme

Additionally, the Bitcoin bear market has outperformed the bulls at the start of September, keeping the price within the $59K – $57K range.

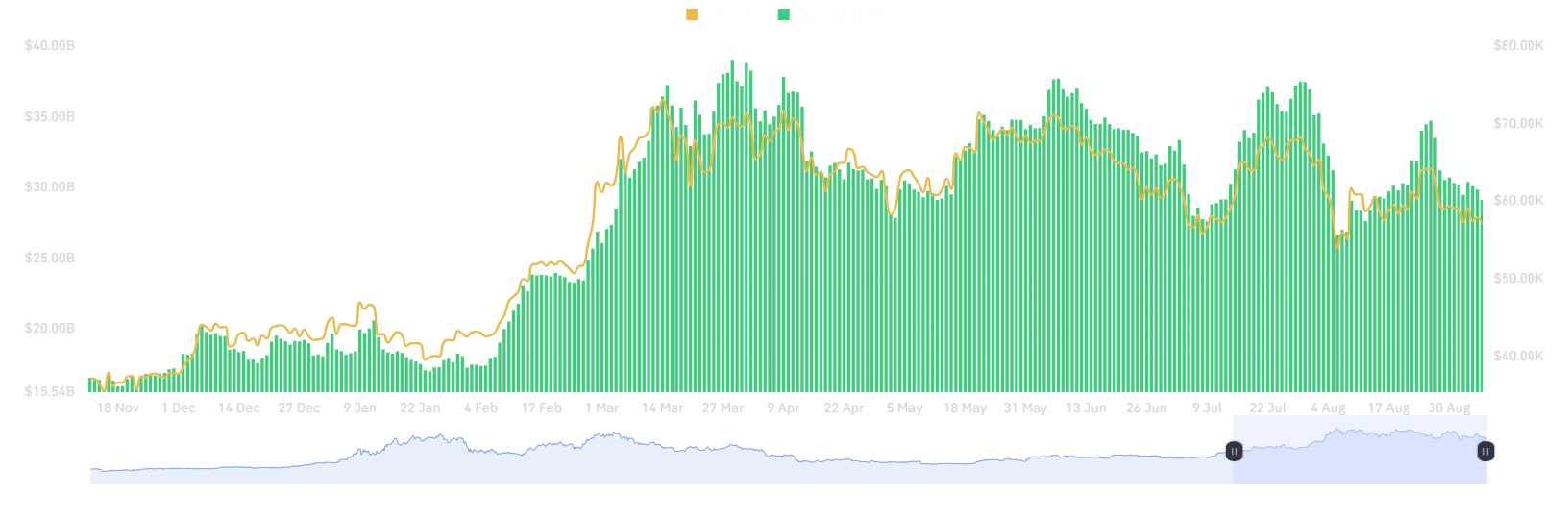

According to AMBCrypto’s analysis, on the 26th of August, when BTC tested the $64K ceiling, OI stood at around $34.72 billion. Since then, both BTC and OI have dropped significantly, suggesting that future traders have aggressively locked in profits.

However, approaching a zone with significant OI again could increase volatility. As participants near breakeven, if many exit, it may slow momentum and push BTC prices lower.

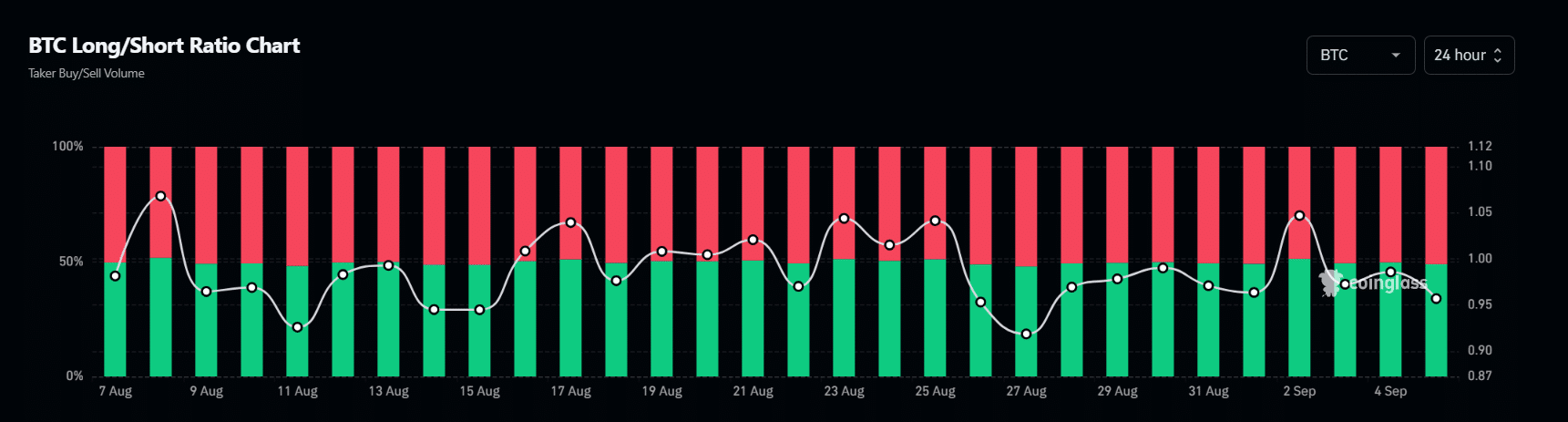

Moreover, shorts have been dominating longs for the past three days. As of now, shorts are still outperforming longs, making up 52% of the market.

If the Bitcoin bear market takes control and BTC tests the $56,572 price range, about $45 million in 100x leverage positions could be liquidated, potentially pushing the price closer to $51K.

Conversely, if BTC moves closer to $57,400, around $67 million in short positions could be liquidated.

Overall, high OI with shorts dominating the derivatives landscape could favor the Bitcoin bear market. Therefore, maintaining the $56K – $57K support level is crucial for a potential breakout – What are the odds?

Bitcoin institutions face bear threat

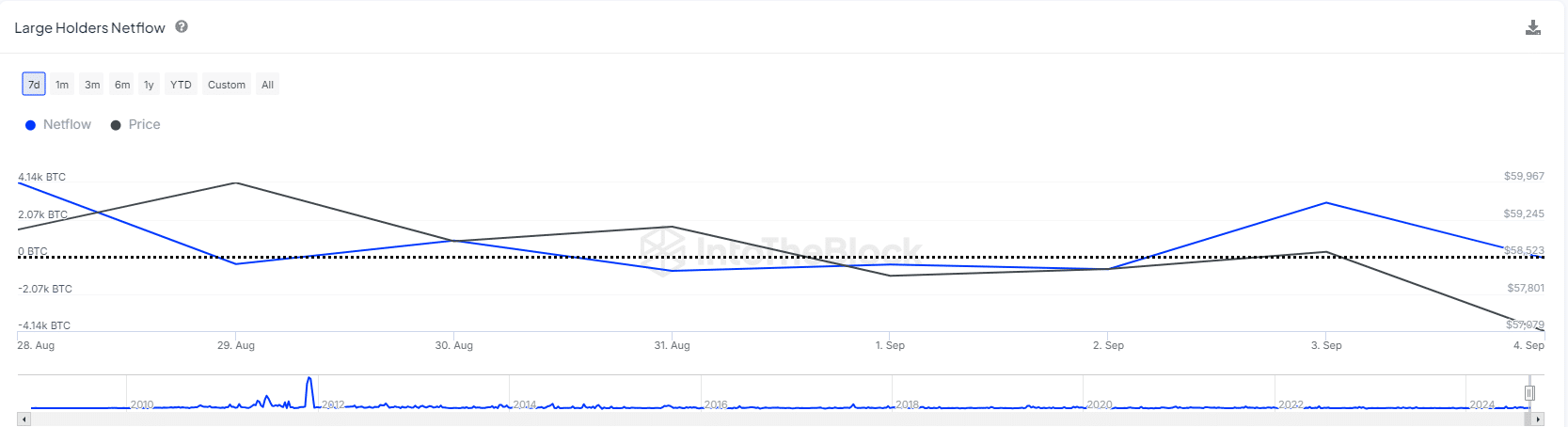

It appears institutions are selling BTC. Since the 26th of August, crypto asset management company Ceffu has deposited 3,063 BTC, worth $182 million into Binance. In fact, on the 3rd September, a significant positive net flow caused BTC to drop by 3%.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This chart suggests a lack of optimism among large holders. According to AMBCrypto, if this trend continues, it could trigger market panic.

To defend the $57K support and target $68K, long-term holders must avoid a selling spree. Otherwise, with the shorts dominating, BTC might fall to $51K and potentially below $40K.