Key Points

- Bitcoin’s liquidation levels and price-weighted equilibrium (pwEQ) could be crucial for potential price bounces.

- The 50-day and 200-day Moving Averages are nearing a Golden Cross formation, indicating potential upward momentum.

Bitcoin [BTC], the leading digital asset, continues to be the center of attention as its price movement attracts significant analysis.

Current market momentum has traders actively seeking opportunities, particularly in high risk-to-reward ratio zones.

Bitcoin’s Price Action and Market Momentum

During the recent weekly open, Bitcoin experienced a surge, creating two significant long liquidation levels due to high leverage. These levels aligned perfectly with the previous week’s equilibrium, also known as pwEQ.

However, the pump faced resistance as the bid-ask ratio heavily tilted towards the ask side, leading to a retracement that brought Bitcoin back to critical levels. These liquidation points and the pwEQ have become key areas for potential price bounces.

The bid-ask ratio now indicates a shift towards demand, with an increase in bids appearing within 2% of the current price. This suggests that entry levels around $62K to $63K could offer high returns if Bitcoin continues its upward trend.

Golden Cross Formation and BTC Supply

Further analysis of BTC/USD price action reveals the $62K to $63K zone as a crucial level. The 50-day and 200-day Moving Averages are nearing a golden cross formation, a bullish signal indicating possible upward momentum.

This pattern, along with the liquidation levels and pwEQ alignment, strengthens the case for further gains. The last time a similar golden cross occurred was the previous year, which was followed by a significant bullish run.

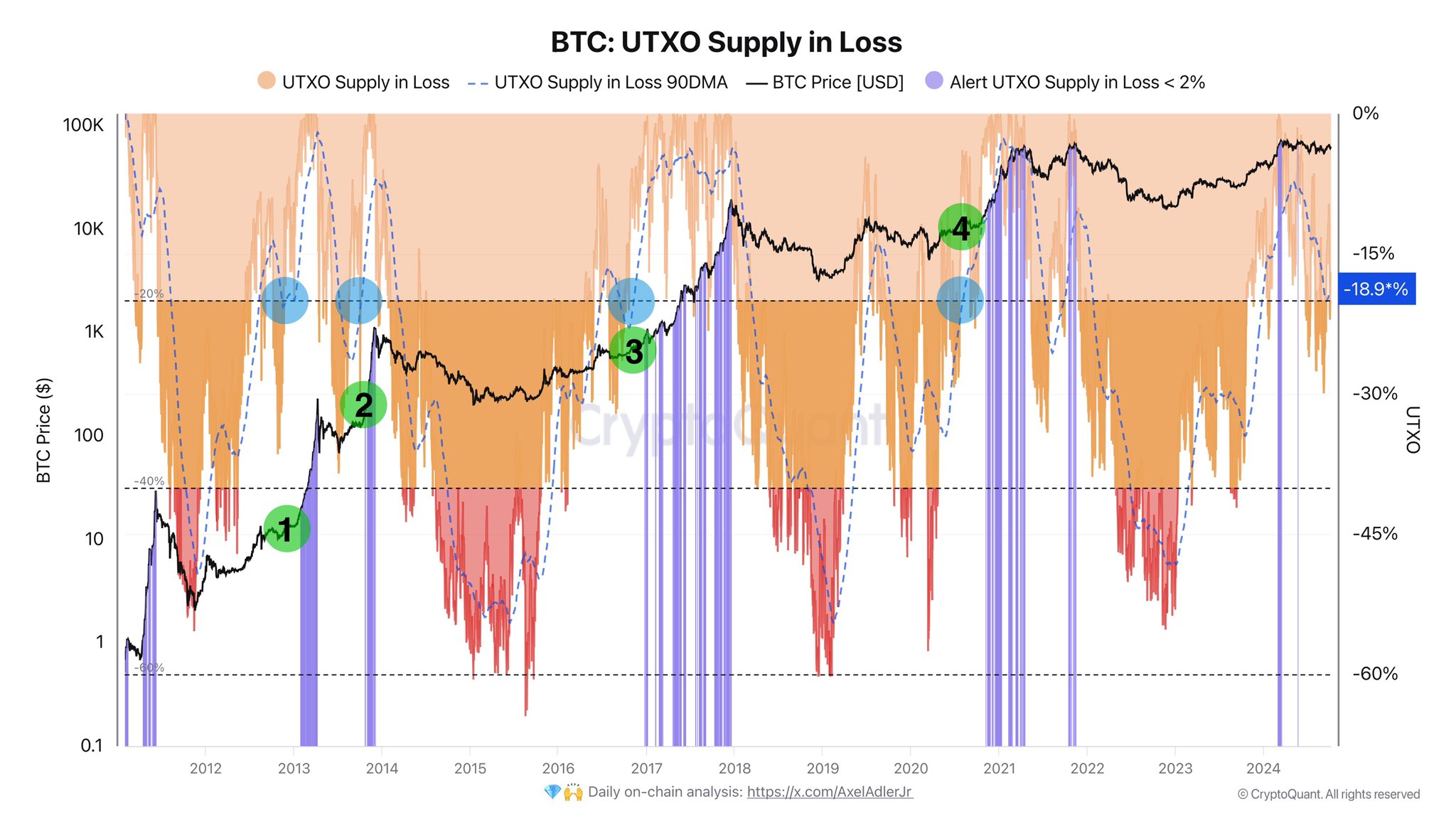

Short-term holder behavior analysis shows that weaker hands have been exiting the market, often panic-selling when Bitcoin’s price drops, typically resulting in losses. This is evident in an increase in purple bars on the chart, representing sell-offs during downturns. As weak hands exit, Bitcoin shifts to stronger hands, potentially stabilizing the market.

The short-term holder (STH) supply has significantly declined, especially after major sell-offs, suggesting that selling pressure has eased. This decrease in supply could create favorable conditions for accumulation, further emphasizing the importance of the $62K — $63K zone for high risk-to-reward opportunities.

The Momentum Short-Term Cap indicator, which measures the difference between Bitcoin’s market cap and realized cap over short-term periods, is showing signs of recovery, albeit slowly. This ratio is a reliable indicator of market peaks for short-term holders, highlighting potential price thresholds.

While the current ratio suggests that the market is warming up, macroeconomic factors and slow recovery in momentum imply that Bitcoin’s next major move may require time. However, once these conditions improve, momentum could return rapidly, potentially pushing Bitcoin’s price higher and signaling the top of the current cycle.

Bitcoin’s current price levels offer significant potential, especially with strong technical indicators like the golden cross and declining STH supply pointing toward a bullish outlook. With momentum building, BTC could see higher prices in the coming months.