Chainlink (LINK) recently saw a remarkable 46% surge in the past month, bringing its price to $11.30. Despite this stall, a trader known as Cryptonary believes that Chainlink has significant room for growth.

LINK is showing a bullish pennant pattern, suggesting a potential move to $13.38. If LINK experiences a drop, long-term investors might consider entry points around $9.67. While there’s a chance of a retest at $11.46, there’s also the possibility that the token may struggle to maintain that price.

Cryptonary, on X (formerly Twitter), suggested that LINK’s connection with Bitcoin (BTC) might lead to a correction for the token. However, the analyst also pointed out that this potential dip could present a good opportunity to buy LINK.

Using the bullish pennant pattern as a guide, Cryptonary mentioned that $9.67 could be a favorable entry point for traders looking to target $13.38 and $17.74 in the mid-term.

A bullish pennant pattern occurs when an upward price trend takes a pause and moves within a range bounded by support and resistance lines. Typically, this pattern leads to a continuation of the upward price movement.

Looking at LINK’s 4-hour chart, the price has been stuck in a range between $10.81 and $11.46. There’s solid support at $10.81 and resistance at around $11.28, confirming the analyst’s earlier view.

LINK/USD 4-Hour Chart (Source: TradingView)

Additionally, the Moving Average Convergence Divergence (MACD) indicator indicates a bit of a tug-of-war between buyers and sellers, with the MACD at 0.016 at the time of writing.

The MACD reading suggests the possibility of a retest of the $11.46 area, but any surge might be short-lived due to the presence of sellers. The On Balance Volume (OBV), compared to its reading two days ago, has decreased. The OBV reading at 32.26 million indicates a decline in trading volume. Therefore, a move downward could be likely if LINK first tries to retest its previous high.

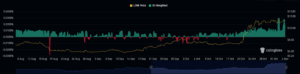

On the derivatives side of the market, traders have become less bullish. Currently, the LINK weighted funding rate has dropped to 0.013%. This rate measures market sentiment by tracking the number of long and short open positions. An increasing funding rate indicates a dominance of long positions, while a decreasing rate suggests shorts are taking control.

LINK Funding Rate (Source: Coinglass)

So, LINK’s funding rate implies that traders have turned bearish on the price action. Derivatives data from Coinglass reveals that traders are eyeing levels as low as $11.15 for LINK.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News