- A technical analyst predicted that NEAR’s price could reach $15 long-term if it maintains its current support levels.

- Increased Total Value Locked (TVL) and heightened retail investor activity indicated that NEAR might be ready for a rally.

Despite a 2.74% decrease in the last 24 hours, Near Protocol [NEAR] has been searching for a level that could stimulate additional buying pressure to boost its current monthly gain of 4.67%.

According to an analysis by AMBCrypto, NEAR’s trajectory is expected to ascend, with the recent one-day price drop viewed as a simple retracement.

$15 target projected for NEAR

Analyst Michael Van De Poppe forecasted a bullish trend for NEAR, noting the cryptocurrency’s market structure showed promising patterns for an imminent rally.

He explained,

“The markets are shaping up for a reversal.”

This optimistic view was reinforced as NEAR reentered a critical support zone that Van De Poppe had previously identified as key for substantial buying activity.

He commented,

“Provided the $2.75-3.40 range holds, we can expect to see NEAR hit $15 within the next 3-6 months.”

Reaching $15 would be noteworthy for NEAR, which last traded at this level on the 26th of April 2022, as discovered by AMBCrypto.

Though this long-term forecast may appear optimistic, a combination of solid fundamentals and a significant reduction in Bitcoin’s dominance could underpin NEAR’s potential rise.

AMBCrypto has explored the key drivers behind NEAR’s anticipated rally.

Retail investors fueling NEAR’s rally

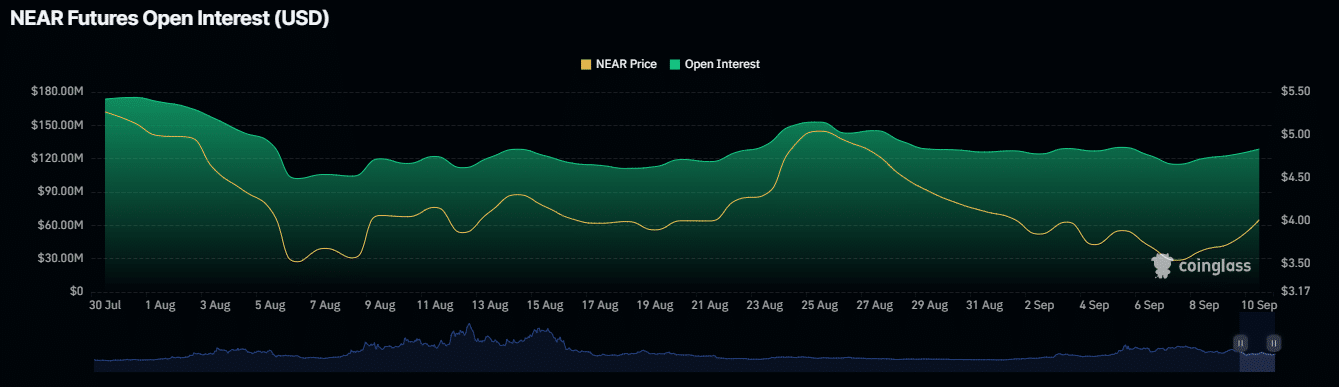

AMBCrypto, using insights from Coinglass, found that retail investors were optimistic about NEAR, pushing the cryptocurrency higher as both Open Interest (OI) and OI-Weighted Funding Rates continued to climb.

Open Interest represents the total unsettled contracts in derivatives trading, while the OI-Weighted Funding Rate helps align perpetual contract prices with the spot price based on this open interest.

At press time, NEAR’s Open Interest peaked at $130.26 million, recovering from a drop to $114.95 million on the 7th of September.

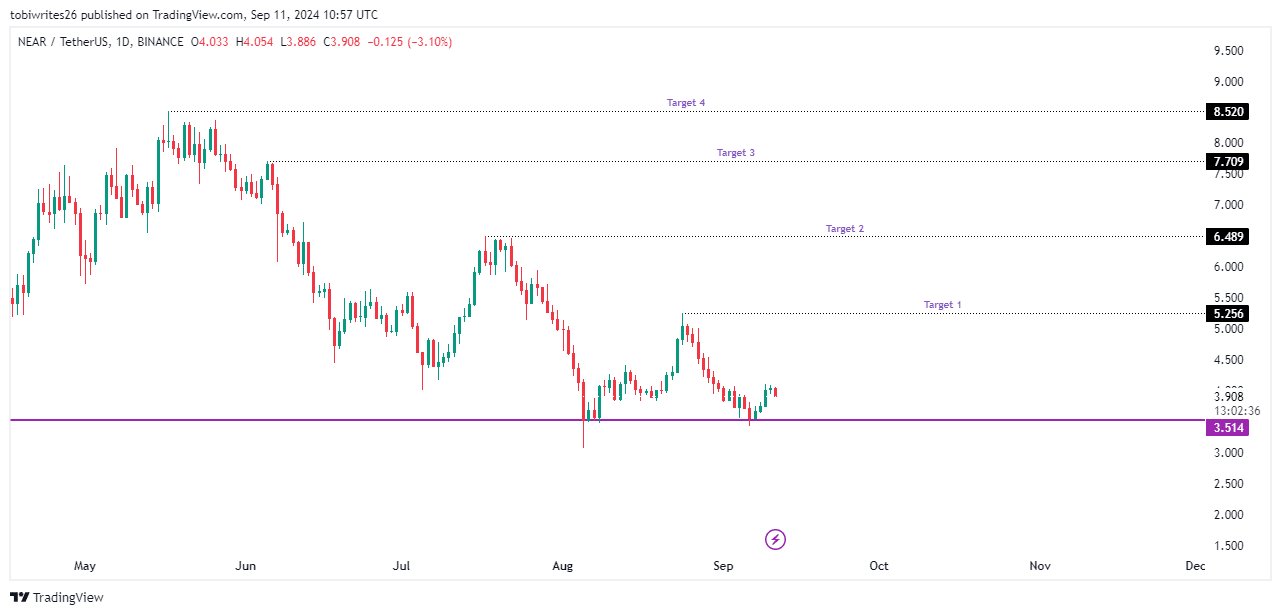

If this upward trend persists, NEAR could target short-term prices of $5.256 or $6.489, where significant liquidity exists. Further momentum could potentially push prices to $7.709 and then to $8.520.

In addition to these dynamics, broader investor activities were also influencing NEAR’s price trajectory.

NEAR investors at play

According to DeFiLlama, the Total Value Locked (TVL) in NEAR has been climbing, reflecting increased investor activity.

TVL, which measures the cumulative value of assets deposited within a cryptocurrency protocol, has reached $198.72 million, rebounding from a recent dip on the 6th of September.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

A rising TVL is a bullish indicator, signaling growing deposits and demonstrating rising investor confidence and engagement with the protocol.

If this trend continues, NEAR’s price is likely to follow suit, benefiting from the positive momentum.