Dogwifhat’s (WIF) 50-day Simple Moving Average (SMA) crossed above its 200-day SMA on November 1, forming a golden crossover — a bullish indicator signaling potential upward momentum. Following this technical event, WIF’s price surged by 37%, reaching a five-month high of $3.

With this bullish indicator in effect, the key question is whether WIF can sustain its rally and maintain support above the $3 level.

Dogwifhat Forms Golden Cross

On November 1, WIF’s 50-day SMA (blue line) crossed above its 200-day SMA (yellow line).

The 50-day Simple Moving Average (SMA) tracks an asset’s average price over the last 50 days, highlighting short- to mid-term trends. Conversely, the 200-day SMA reflects the average price over 200 days, serving as a barometer for long-term trends. Typically, when an asset’s price surpasses its 200-day SMA, it suggests a sustained uptrend.

A “Golden Cross” occurs when the 50-day SMA crosses above the 200-day SMA, indicating that recent momentum is outpacing the long-term trend. This crossover signals a shift from a downtrend to an uptrend, often prompting traders to consider long positions in anticipation of further price gains.

This is true of WIF, whose price has climbed by almost 40% since the formation of the Golden Cross pattern.

WIF Sees Spike in Demand

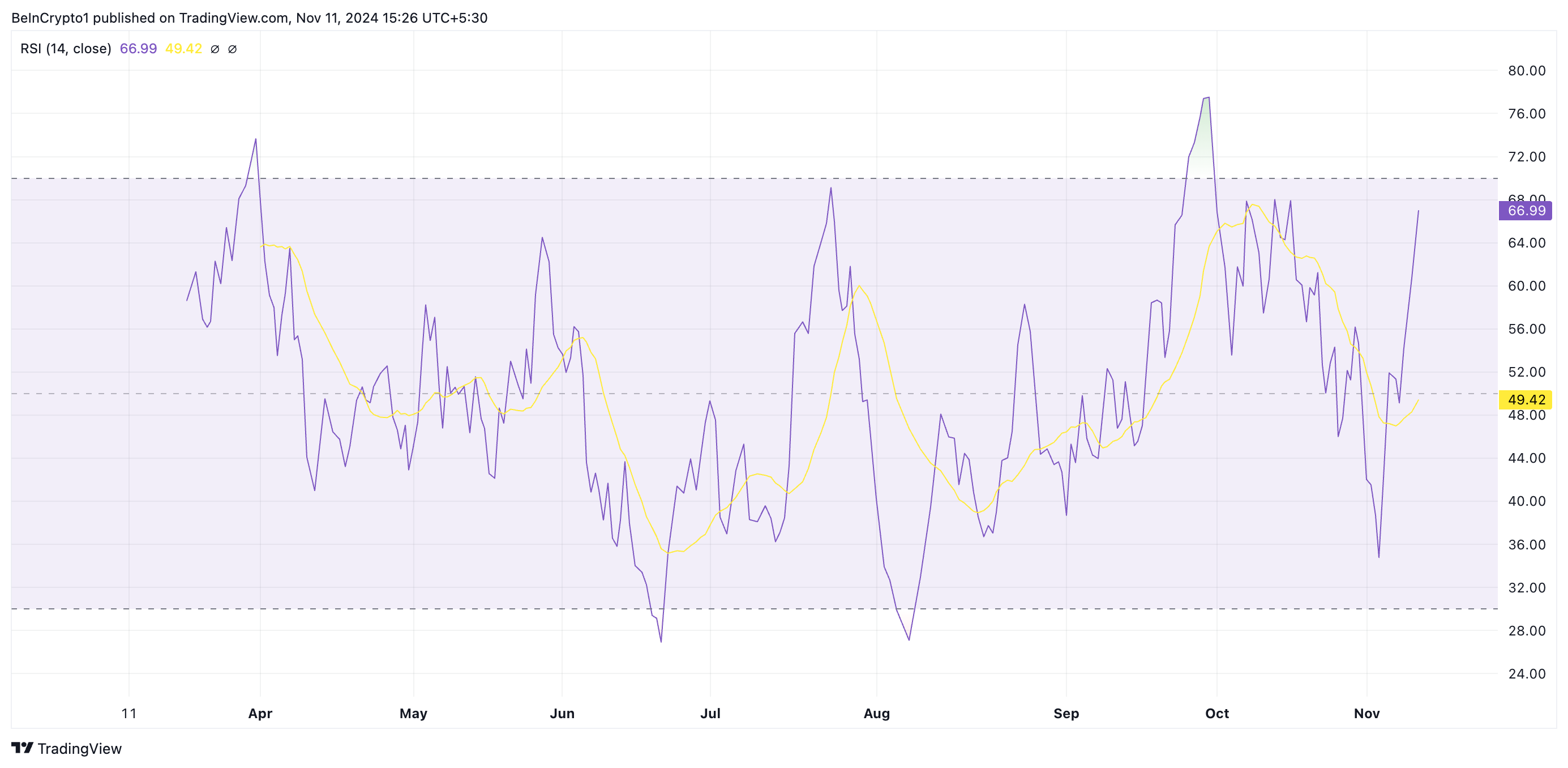

Over the past seven days, the value of the dog-themed meme coin has surged by 48%, and BeInCrypto’s assessment of its technical setup confirms that it may extend these gains. For example, its rising Relative Strength Index (RSI) indicates the growing demand for the meme coin. As of this writing, the indicator’s value is 66.99.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. In contrast, values under 30 indicate that the asset is oversold and may witness a decline.

An RSI reading of 66.99 indicates that the asset is approaching overbought territory but has not yet crossed the overbought threshold of 70. This suggests that buying momentum remains relatively strong and may continue in the short term.

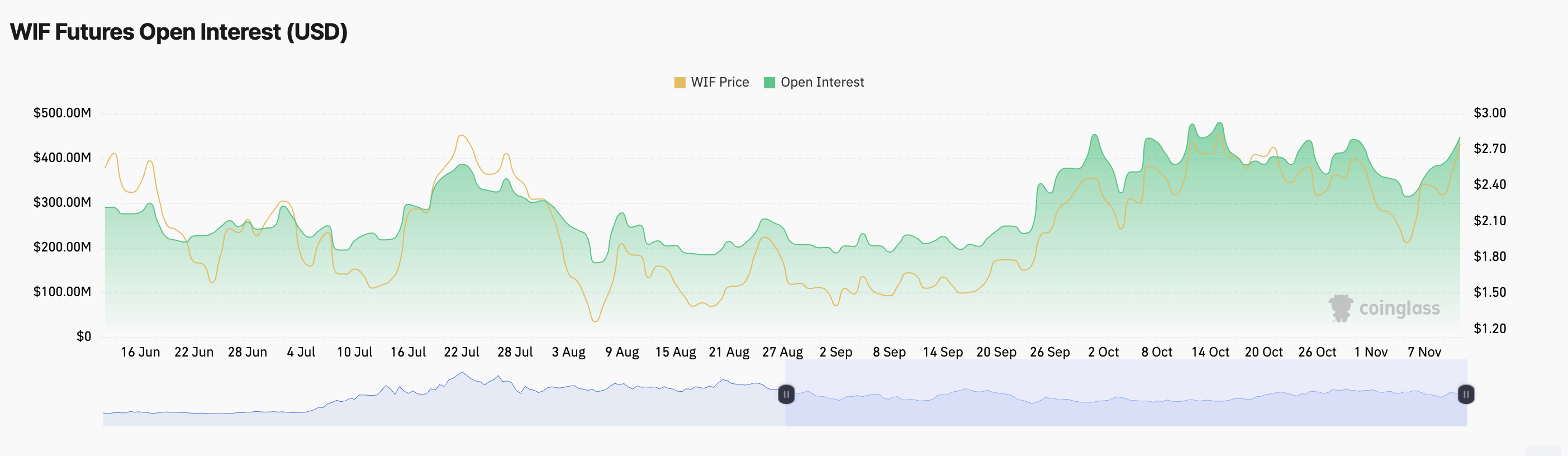

Moreover, WIF’s price rally is accompanied by a corresponding rise in its open interest. This is at a monthly high of $448 million at press time.

Open interest refers to the total number of outstanding contracts (futures or options) that have not been settled or closed. As with WIF, when open interest climbs along with price, it typically indicates that new money is entering the market, and the current price movement is supported by an increase in trading activity. This is a bullish signal that hints at a continued rally.

WIF Price Prediction: The $3 Price Level Is Key

Currently, Dogwifhat (WIF) is trading at $3.00, hovering just above its long-term resistance at $2.99. If buying pressure persists, this level could turn into a support floor, potentially driving WIF toward $3.41. Breaking past this mark could open the door for a rally to $3.96, which stands as the final hurdle before WIF targets its year-to-date high of $4.86.

However, this optimistic scenario could unravel if market sentiment turns bearish. A decline in demand could push WIF’s price down to $2.51.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.