Cardano’s MVRV ratio has improved, signaling growing investor confidence and potential for positive price movements. Whale investors holding between 100 million and 1 billion ADA have increased their holdings by 11%.

Additionally, ADA’s price has broken above a bullish flag pattern on its 8-hour chart, suggesting further upward potential.

Cardano Shows Positive Signs with Improved MVRV Ratio

Cardano (ADA) is showing promising signs as its MVRV ratio, a key bullish indicator, has improved. This metric suggests increasing investor confidence and potential for positive price movements in the near future.

Additionally, Cardano has recently witnessed a notable surge in whale activity. Investors holding between 100 million and 1 billion ADA have increased their holdings by 11% over the past month. These large investors now control 6.71% of the total ADA supply. Historically, such significant accumulation by whales often precedes substantial price rallies, as their large-scale purchases can drive market momentum.

Cardano (ADA) Shows Strong Retail Interest and Bullish Technical Signals

Retail investors are showing a strong interest in ADA, with a bullish bid-ask volume imbalance and an uptick in the ‘InTheMoney’ metric indicating that most retail investors are currently profiting from their ADA investments. This widespread optimism is further supported by an increase in Total Value Locked (TVL) on the Cardano network, alongside rising trading volumes.

Currently trading at $0.4791, ADA boasts a market capitalization exceeding $17.09 billion. It has recently breached a bullish flag formation on its 8-hour chart, suggesting a potential profit of nearly 10% and the possibility of a significant surge of up to 100%, potentially reaching $1 within the next few weeks.

Further analysis suggests a notable liquidation point near the $0.492 mark, which could trigger price corrections. However, if ADA breaks past this level, it could target $0.5 or even $0.528 in the short term.

Cardano Innovations: Hydra and Ouroboros Leios

Cardano Hydra, under development for several years, functions by bundling transactions together and processing them offline before synchronizing them with the online network. This approach aims to alleviate network congestion and enable high volumes of transactions to be processed simultaneously on the chain.

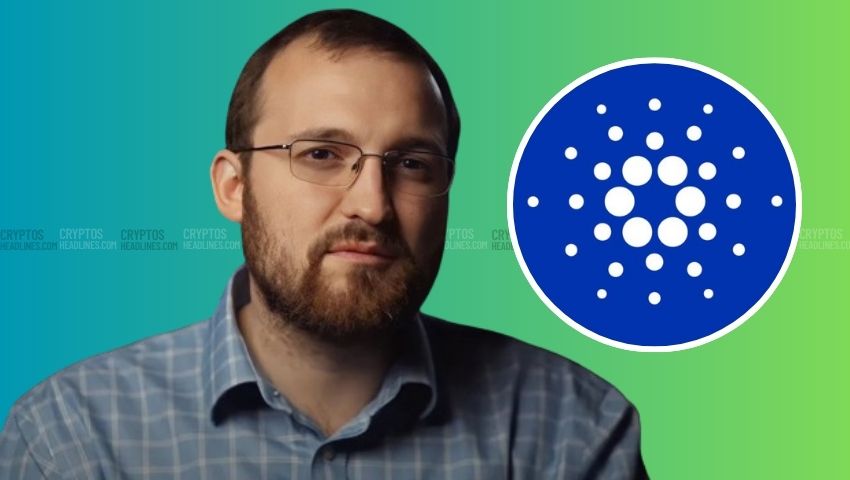

On the other hand, Cardano Ouroboros Leios focuses on enhancing network efficiency. By combining the strengths of Hydra and Leios, Hoskinson envisions Cardano supporting the creation of a global-scale financial operating system.

Cardano’s Development and Potential in the Web3 Space

Cardano is widely acknowledged as one of the most actively developed protocols in the Web3 space, boasting more GitHub commits than Ethereum and other competitors. However, it faces challenges in speed compared to protocols like Solana.

Despite these challenges, innovators like Hoskinson are leading the blockchain community’s efforts to rival traditional financial networks such as Visa and Mastercard in terms of funds transfer capabilities.

https://x.com/IOHK_Charles/status/1791538835018420658?ref_src=twsrc%5Etfw

Although Cardano currently lags in transactions per second (TPS) compared to legacy systems, ongoing optimism and continuous development within the Cardano ecosystem indicate that blockchain technology may soon offer a compelling alternative to established financial networks.

This development has the potential to significantly reshape global financial transactions, enhancing efficiency and reducing costs across the board.

Final Thoughts

Cardano (ADA) Overview: Promising Signs and Development Goals

Cardano (ADA) shows promising signs with an improved MVRV ratio, indicating increasing investor confidence and potential for positive price movements. Recently, there has been a notable surge in whale activity, with large investors increasing their ADA holdings by 11%, now controlling 6.71% of the total supply. Retail interest in ADA is also strong, reflected in bullish market metrics and rising Total Value Locked (TVL) on the Cardano network.

Trading at $0.4791 with a market capitalization exceeding $17.09 billion, ADA recently breached a bullish flag formation on its 8-hour chart, suggesting potential gains up to $1 in the near term. However, a liquidation point near $0.492 could trigger corrections, while surpassing this level might target $0.5 or even $0.528.

Cardano’s development includes initiatives like Hydra, designed to enhance transaction processing efficiency by bundling and synchronizing transactions offline. Meanwhile, Ouroboros Leios aims to further improve network efficiency, positioning Cardano as a contender in global financial systems despite current speed challenges compared to competitors like Solana.

Led by innovators like Hoskinson, Cardano aims to rival traditional financial networks in funds transfer capabilities, leveraging its active development and community optimism to potentially reshape global financial transactions for greater efficiency and reduced costs.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News