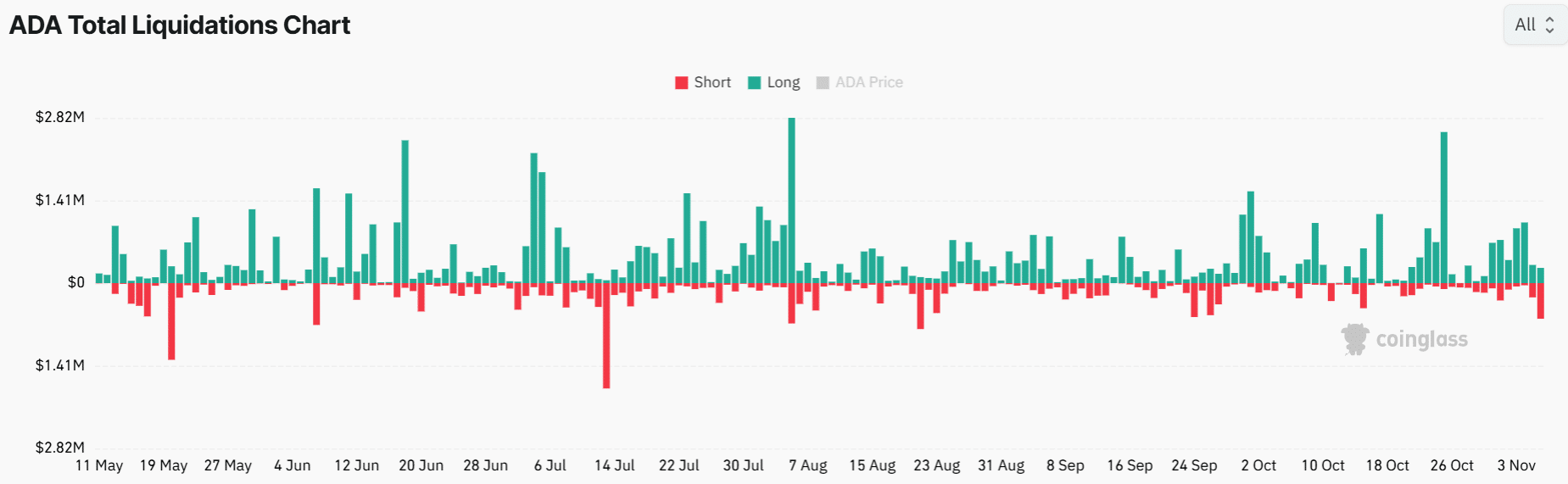

- Cardano short liquidations surged to the highest level in two months after a 10% rally.

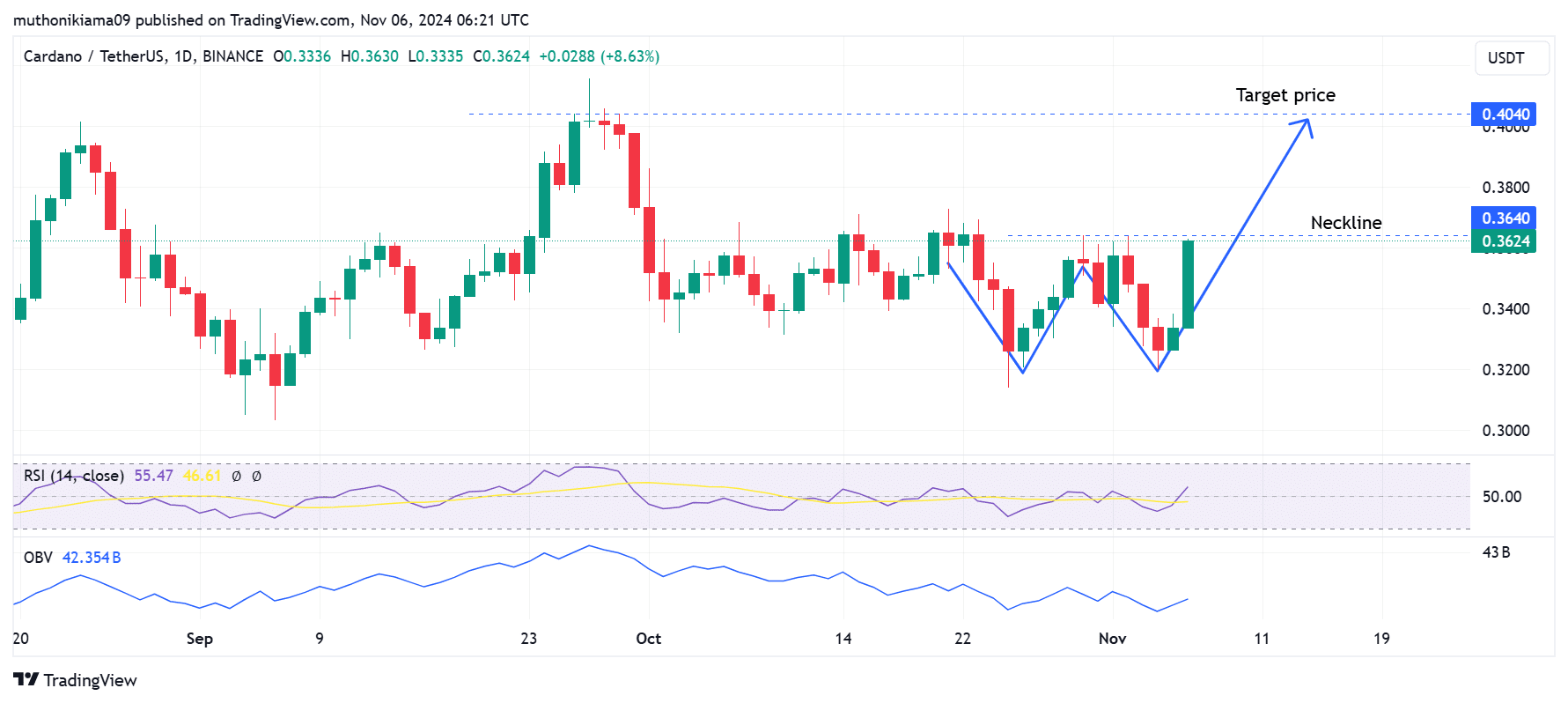

- ADA has also formed a double-bottom pattern on its one-day chart, signaling an upcoming bullish reversal.

Cardano [ADA] has reversed from bearish trends amid a recovery across the broader cryptocurrency market. In just 24 hours, ADA has gained by nearly 10% to trade at $0.362 at press time.

The price rebound has led to ADA short liquidations increasing to the highest level in two months.

Data from Coinglass shows that around $868,000 in open positions on ADA were liquidated. Short sellers suffered the biggest blow as short liquidations came in at $608,000.

At the same time, funding rates surged significantly, jumping from 0.0008% to 0.0093% at press time.

This surge suggests that derivative traders were increasingly opening new long positions on Cardano. When long positions increase, it shows that traders have become optimistic about ADA’s future performance.

The positive sentiment in the derivatives market coincides with bullish signals on Cardano’s one-day chart.

Analyzing Cardano’s double-bottom

Cardano has formed a double-bottom pattern, which often precedes a bullish reversal. This pattern indicates ADA has found a strong support level, with an upward momentum likely to follow.

ADA has tested support at the neckline of this double bottom pattern at $0.364. If this bullish reversal holds, ADA is set for an 11% rally toward the next resistance level at $0.404.

A breakout towards this resistance level will be possible if there is also an uptick in trading volumes. The on-balance volume (OBV) indicator has risen on the one-day chart. This shows that buying pressure is increasing alongside the price increase.

The Relative Strength Index (RSI) also supports the likelihood of a rally towards the target price. This indicator has surged to 55 and crossed above the signal line confirming that bullish momentum is in play.

As these bullish signals align, a pathway toward $0.404 remains likely for Cardano.

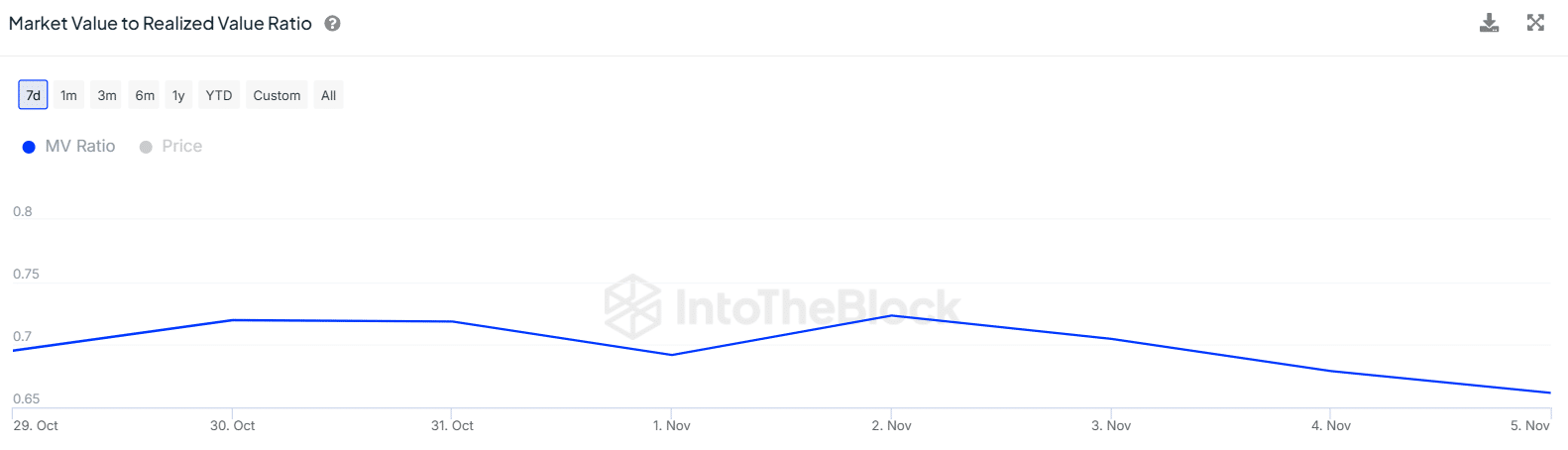

Cardano MVRV ratio stumbles

The Cardano Market Value to Realized Value (MVRV) ratio has dropped significantly in the last four days from 0.723 to 0.661 at press time.

A declining MVRV ratio shows that ADA’s market value is below the realized value. It indicates that the current ADA buyer is buying at an undervalued price.

However, it is important to note that even a decline in the MVRV ratio could also show that investors are losing confidence in the ADA rally. As such, more buyer support is needed to confirm the uptrend.

Will Cardano sustain its gains?

After the recent rally, ADA’s market capitalization surged to $12.70 billion per CoinMarketCap, flipping Toncoin [TON]. In just 24 hours, Cardano added over $1 billion to its market capitalization.

Realistic or not, here’s ADA’s market cap in BTC terms

A return to the top-ten largest cryptos could renew positive sentiment from investors, supporting the likelihood of more gains.

However, ADA’s recent rally looks dependent on the broader market sentiment. Therefore, investors should watch out for any changes in sentiment across the broader market to confirm the continuation of the uptrend.