- As at press time, ADA was up by 2.21% but all is not good.

- ADA’s struggles root from balance by holding and price action.

Cardano [ADA] ecosystem continues to face challenges while other cryptos are recovering, despite the exciting release of its Ouroboros Leios upgrade recently.

Cardano’s price rose by 2.21% in the past 24 hours, trading at $0.3558 at press time.

This price action comes after the announcement of the Ouroboros Leios upgrade, which aims to enhance Cardano’s speed to over 1500 transactions per second (TPS).

Additionally, Cardano completed the first hard fork of the Voltaire era, introducing community-based governance and on-chain voting. As the Cardano Governance Workshop prepares for the V2.1 update, the network continues to grow, achieving 96 million total transactions.

Despite these positive developments, many key metrics for ADA remain unfavorable.

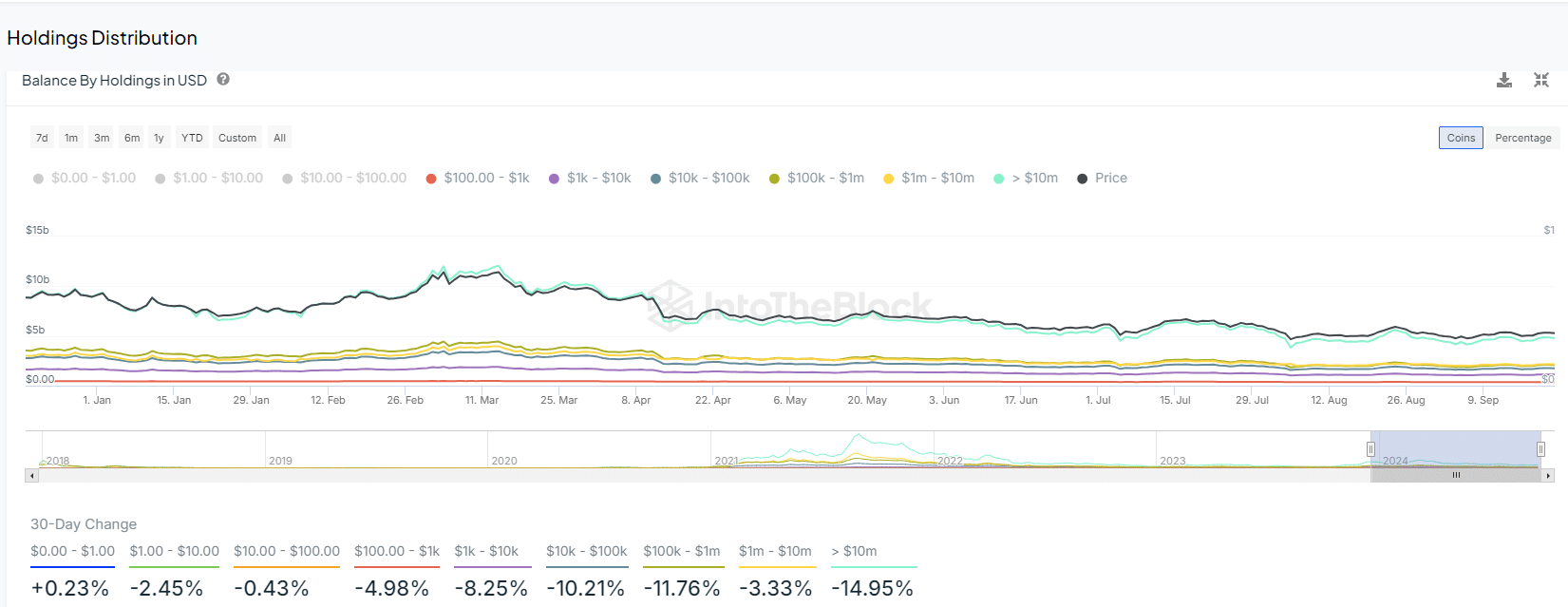

Declining balance by holding

One of the concerning metrics is the declining balance by holding in USD. The percentage change in balances held has consistently moved into red territory, with this month being no exception.

Small traders with less than $1 worth of Cardano saw a minor 0.23% increase, but the decline in holdings across other categories is substantial.

Large investors holding over $1 million worth of ADA saw a combined decreases of up to 18%. This indicates that whales, who play a significant role in any cryptocurrency market, are exiting ADA, which could signal further trouble ahead.

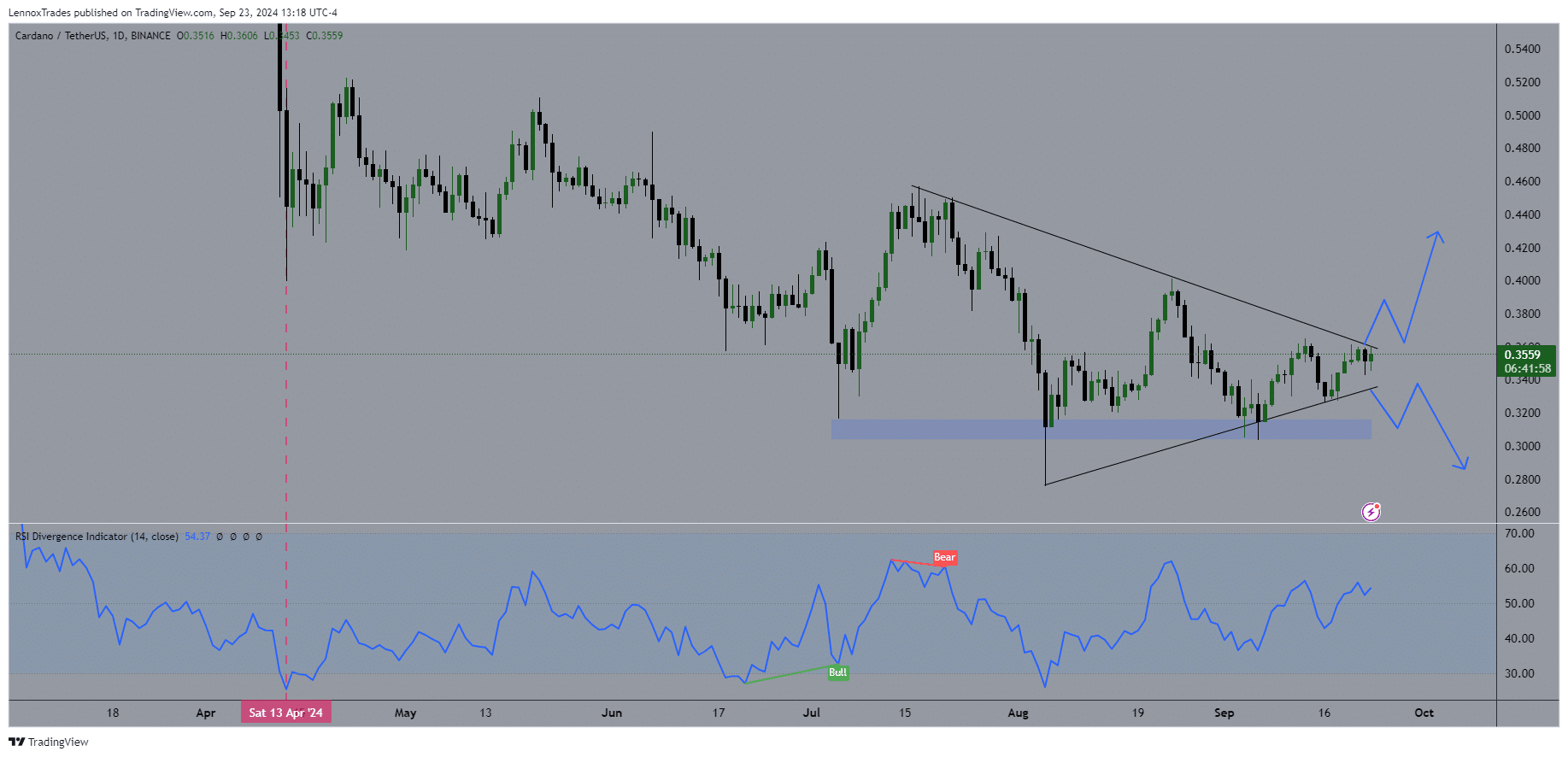

Can ADA break out of its symmetrical triangle?

Although the situation appears bleak for Cardano, there are some signs of optimism. ADA’s price action within the symmetrical triangle pattern suggests that a potential breakout could be on the horizon.

Since August 5th, ADA/USDT pair has been stuck in a consolidation phase, with both the upper and lower trendlines rejecting a breakout three times.

However, as at press time, today’s rejection by the upper trendline might eventually break, given the rising momentum across the broader crypto market.

Source: TradingView

If ADA manages to break to the upside and confirm the breakout with a retest, it could follow the positive trends of other cryptocurrencies.

On the other hand, if ADA breaks and instead forms lower highs and lower lows, it could continue its decline as the RSI Divergent indicator is still bearish for ADA.

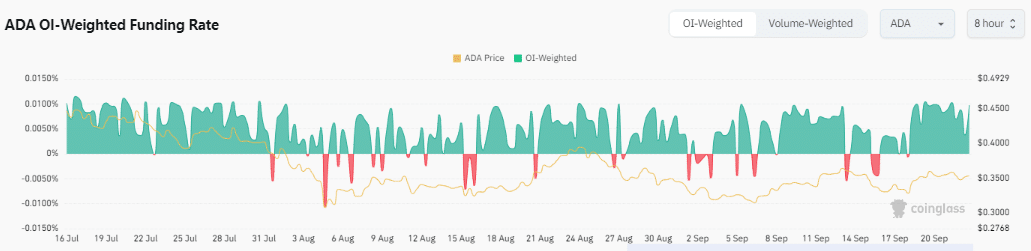

Positive funding rates provide hope

Another hopeful aspect for ADA is the OI-weighted funding rate, which is currently positive at 0.0097%. This suggests that traders are paying to maintain long positions, indicating confidence in ADA’s potential for price increases in future for long-term holders.

However, for ADA to achieve a full price reversal, additional factors must align, such as continued increase in ADA’s trading volume and broader crypto market support.

If these conditions are met, Cardano could experience a positive price trend, driven by the favorable funding rates and overall market recovery.

Read Cardano’s [ADA] Price Prediction 2024–2025

While Cardano faces significant challenges recently, including a decline in whale holdings and difficulties breaking out of key price patterns, there are still factors that could drive ADA higher.

Positive funding rates, potential breakouts, and market recovery could help ADA regain momentum and see a more bullish price outlook.