The support for CBDCs is growing year by year. Citi, a big bank, found this from looking at different places where they’re trying out CBDCs.

Many securities firms want to use CBDCs to make local financial settlements faster in the next five years.

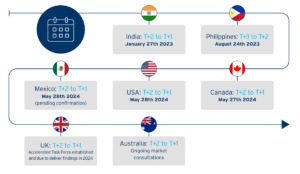

Citi’s new white paper talks about India’s recent move to finish all trade settlements within 24 hours of a transaction. Other countries like the United States and Canada also want to make settlements faster, and the Citi survey looks at how things like digital ledger technology (DLT), CBDCs, and stablecoins can help with that.

Global economies transitioning to faster settlement times. Source: Citibank

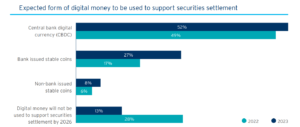

Out of the 483 people who answered the survey and 12 places that handle money (called financial markets infrastructures or FMIs), 87% think that CBDCs could make settlements happen faster by 2026.

Compared to last year, more securities firms now support CBDCs. The number went up by almost 21%.

Expected form of digital money to be used to support securities settlements. Source: Citibank

The increasing support for digital cash from year to year is backed by tests happening within countries and between different countries. A report from Citibank said:

“Recent experiments where banks from different countries worked together are showing us how central bank funding can be used digitally, both inside a bank and across whole markets.”

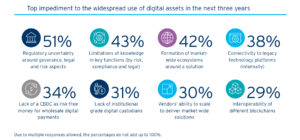

However, in the coming years, there are things that could make it hard for digital money to become very common. These include not being sure about the rules, not knowing much about it, making it work with old-style money systems, and making different blockchains work together.

Top impediment to the widespread use of digital assets in the next three years. Source: Citibank

Among different financial groups, institutional investors, banks, and people who manage money (asset managers) are best at growing and making solutions that work everywhere. This is really important to make CBDCs, stablecoins, and other money systems that are controlled by big groups work for everyone.

In the next five years, by 2028, the way people think about money will change. Citibank’s report says that things like digital ledger technology (DLTs) will become normal, people will get money faster, there will be new ways to get money, and old-style money systems will go away.

Just a month after India talked about using its CBDC to pay other countries, the Reserve Bank of Australia finished testing its own CBDC inside the bank.

We’ve released a report with the Digital Finance CRC @DigiFinanceCRC today on the findings from an Australian central bank digital currency pilot.https://t.co/bTT84yBp02#RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/WXfe7lchHj

— Reserve Bank of Australia (@RBAInfo) August 23, 2023

The bank in Australia thinks that having a CBDC could help make new and better things in finance, like making it easier to trade things like debt, help new digital money systems grow, and make sure everyone is included in the digital economy.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News