- The expected rally in TIA faces potential delays as profit-taking activity intensifies.

- While market sentiment remains solidly bullish, with key metrics hinting at positive movement.

Celestia [TIA] has managed to rebound, offsetting a 19.23% monthly loss with a 6.10% gain over the past 24 hours. Market activity and technical charts continue to support a bullish outlook.

However, as traders move TIA holdings onto exchanges in preparation for sell-offs, this rally may pause or see temporary setbacks.

Traders favor profit-taking over long-term gains for TIA

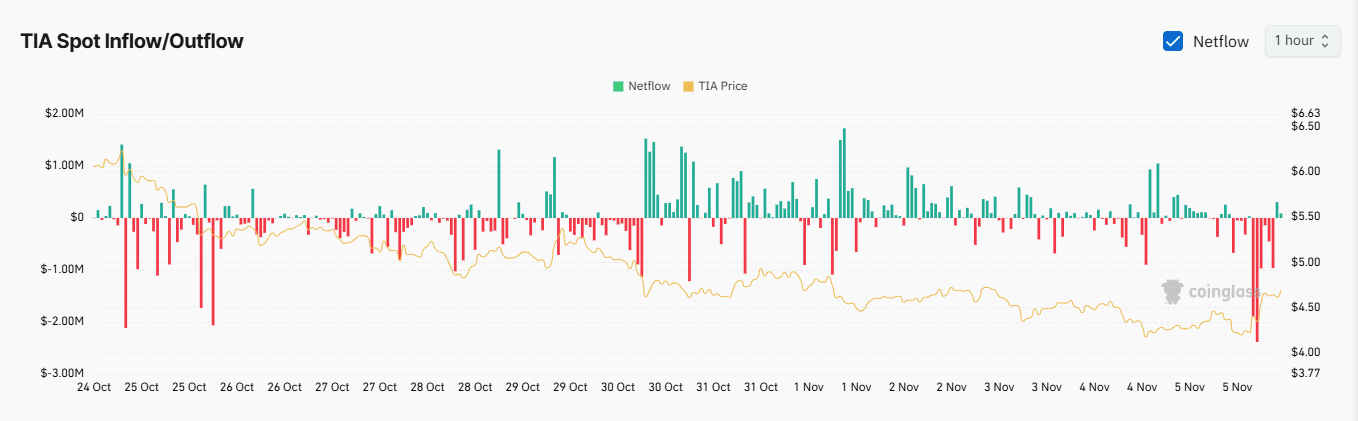

Data from Coinglass revealed that TIA began to experience profit-taking activity, as Exchange Netflow has turned positive.

A positive Exchange Netflow indicates that traders are moving TIA from private wallets to exchanges, positioning the asset for sale to capitalize on recent market gains.

At press time, over $277,000 worth of TIA has been transferred to exchanges for potential profit-taking in the last hour. If sold, this influx could limit TIA’s rally.

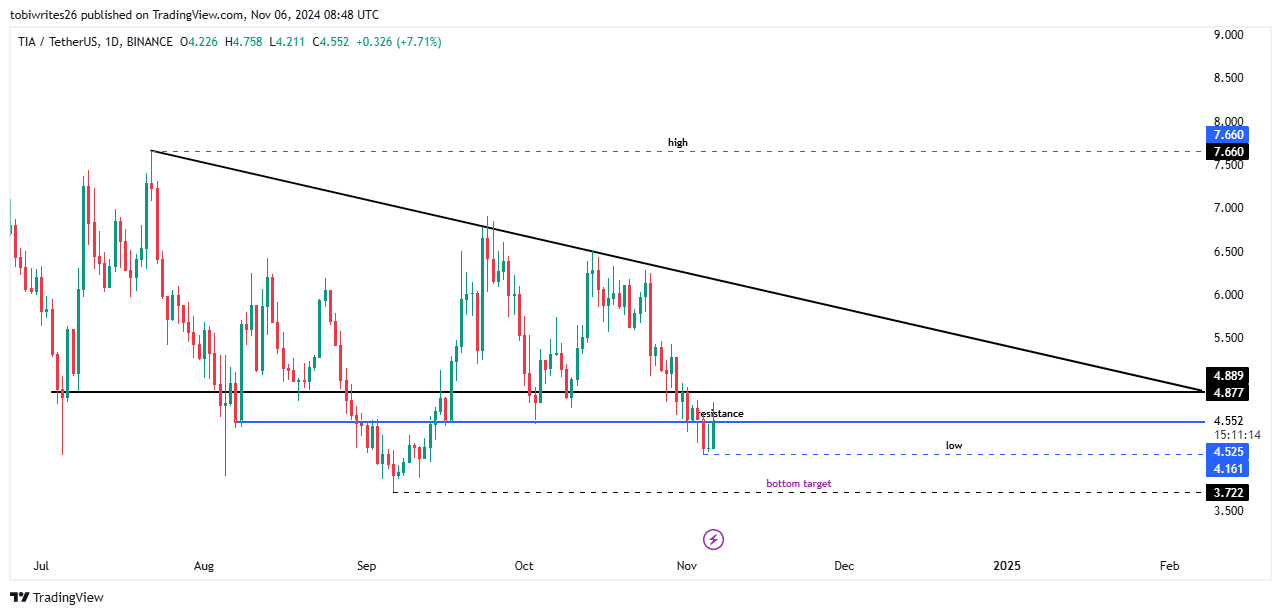

This trend aligns with a resistance level at 4.525 on the chart, where significant selling pressure could drive the asset’s price down to a target of 4.161. Continued pressure could see TIA fall further to 3.722.

Bullish structure holds as TIA profit-taking begins

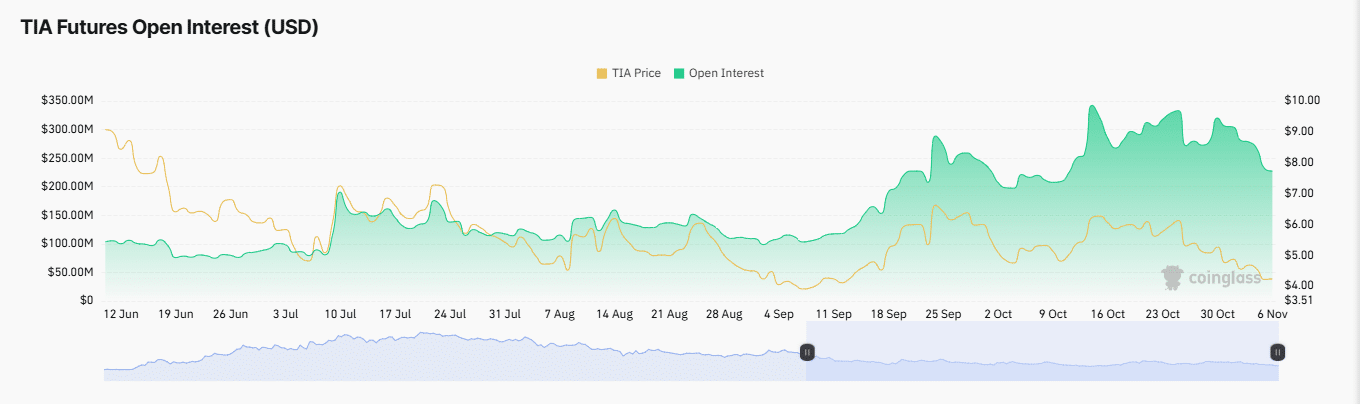

Despite recent profit-taking on TIA spot positions, Open Interest remained high, with traders opening more long contracts.

A high Open Interest rate— at 14.69% at press time and valued at $266.49 million—suggested a substantial number of unsettled futures contracts, indicating strong market engagement.

This uptick in Open Interest is likely to support further upward momentum for TIA.

Additionally, the Funding Rate has stayed positive, with long traders paying shorts to balance the price disparity.

This steady funding reflected growing confidence in the rally and increased bullish positioning among market participants.

If these metrics hold, any downturn in TIA’s price is expected to be temporary, with recovery anticipated soon.

Read Celestia’s [TIA] Price Prediction 2024–2025

Long liquidations weigh on TIA rally

At press time, liquidation data suggests the market is still under bearish pressure, with long liquidations totaling $1.11 million. This significant sell-off has further suppressed TIA’s price, keeping it from rallying higher.

If long liquidations persist, the downtrend may continue until the market can gather enough momentum to challenge and break through resistance levels.