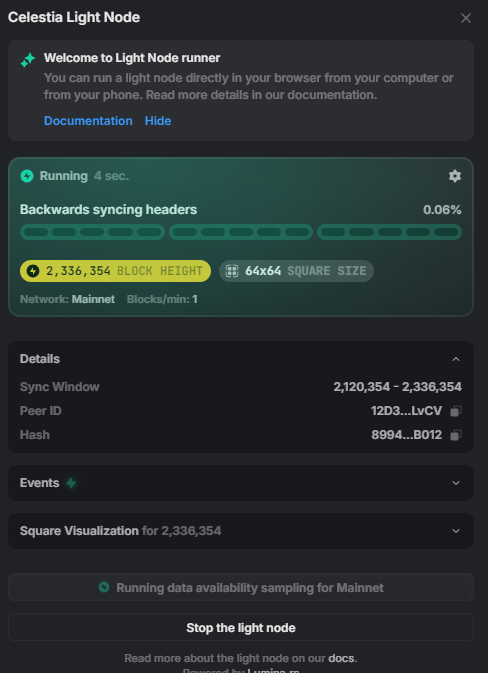

Celestia (TIA) aims to popularize its node structure by running a node in anyone’s browser. Using the TIA block explorer temporarily turns every user into a node operator.

Celestia, the Data Availability network with modular scaling, is trying out a novel way of spreading awareness. Anyone opening the Celestia block explorer starts running a light node, serving to secure and decentralize the network. Celestia is approaching its first anniversary after launching its main net on October 31, 2023. The Celestia chain offered a Data Availability layer even before EigenDA, with the goal of becoming an intermediary between L2 and Ethereum for suitable projects.

The Celenium block explorer has a feature that allows any user to start running a light node, connecting to other peers. The node does not require high-level resources, or overload a computer similar to browser mining. Celestia’s light node can be switched off at any time. Previously, light nodes required manual or command line launching.

The light node receives Celestia on-chain data, without the need for centralized calls. The lack of RPC also means one less attack vector for network participants. Running a node is strictly for personal usage, as well as for builders that want to deploy to Celestia. The node does not pay out any TIA rewards and does not require staking or other upfront investments.

The Celestia Data Availability layer is another way for L2 to interact with Ethereum. Celestia already supports projects like Manta. Others, like Arbitrum or Optimism, do not need a Data Availability layer; instead, they rely on direct L1 records by using blobs. In theory, however, Celestia can offer scaling services to existing chains, allowing them to break out of the limitations of their own block size.

Celestia still relies on its list of validator nodes for verification. It aims to build a scalable Data Availability layer by offering and propagating up to 1GB in block space. For now, this seems redundant, as even the busiest L2 hardly fills up Ethereum blobs.

Celestia plans to introduce the light node while running every wallet. For now, the light node requires few resources, as Celestia has not onboarded many chains of its own. However, light nodes will not store the whole blockchain and will prune old data. Celestia will turn into one of the most ambitious competitors to EigenDA, with a roadmap to constantly increasing block size.

Celestia expects large-scale token unlock in November

One of the factors weighing down on Celestia is the upcoming token unlock. TIA is a low-float token with around 200M in circulation and 1.07B in total supply. There is no known max supply for TIA tokens.

TIA unlocks 998.58K each day, requiring the market to absorb $4.3M in new tokens. From November 1, the supply of TIA will expand by 175.56M, expanding the circulating tokens by 83.3%. This is one of the biggest token unlocks for the year, sparking doubts about whether the market can absorb the dilution.

TIA tokens peaked at $20.53 in February, through a mix of bull market hype and active marketing. As of September 13, TIA traded at $4.20 on volumes of $43M in 24 hours.

Early backers control close to 20% of the TIA supply. The November unlock will make the tokens transferable for early backers, seed round investors, and early ecosystem contributors. More than 50% of TIA tokens are set aside for insiders, with only 26% unlocked.

Some of the early buyers acquired TIA at $0.01 per token, as the project raised $56.6M in a series of VC rounds and public airdrops. TIA is one of the most successful token sales, with a 4X growth in BTC terms, 14X in dollar terms, and 7.8 times against Ethereum (ETH). Even at a lower price, some of the initial buyers may achieve significant gains from realizing profits.

Even locked TIA tokens can be staked for additional rewards. The rewards will also be added to the total supply. Some of the VC backers may continue to stake, while only selling their reward tokens. TIA tokens will also find additional demand from chains that use the Celestia Data Availability layer, as a payment for data services.

Cryptopolitan reporting by Hristina Vasileva.