Chainlink has plunged 38% this week, breaking through major support levels. There could be further declines, potentially targeting the $5 support level, but a recovery is possible if it holds at that point.

Chainlink (LINK) has suffered along with the broader cryptocurrency market, seeing significant downturns. In the past week, LINK’s value dropped 38%, with a sharp 25% decline just in the last day. This decline follows LINK’s recent surge above $21 in March and is influenced by technical patterns seen on its price chart.

Chainlink Faces Potential Further Decline After Breaking Key Support

Analysis of the 3-day chart reveals that LINK has broken through a critical support level, indicating potential for further downside.

In trading, a “support level” refers to a price point at which an asset typically does not fall below, as buying interest is strong enough to counteract selling pressure.

Since LINK broke through the support in the $13 to $11.40 range, the asset has faced further decline, suggesting a weakening in buyer enthusiasm.

Source: TradingView

Looking at the chart, there is a likelihood of LINK falling further until it reaches another major support at the $5 region. If LINK reaches this support and breaks through again, we could see more significant selling pressure. Conversely, if the price stabilizes or bounces back at this point, it could indicate a potential recovery and restoration of investor confidence in LINK.

Market Reactions to Chainlink’s Decline: Mixed Signals and Whale Activity

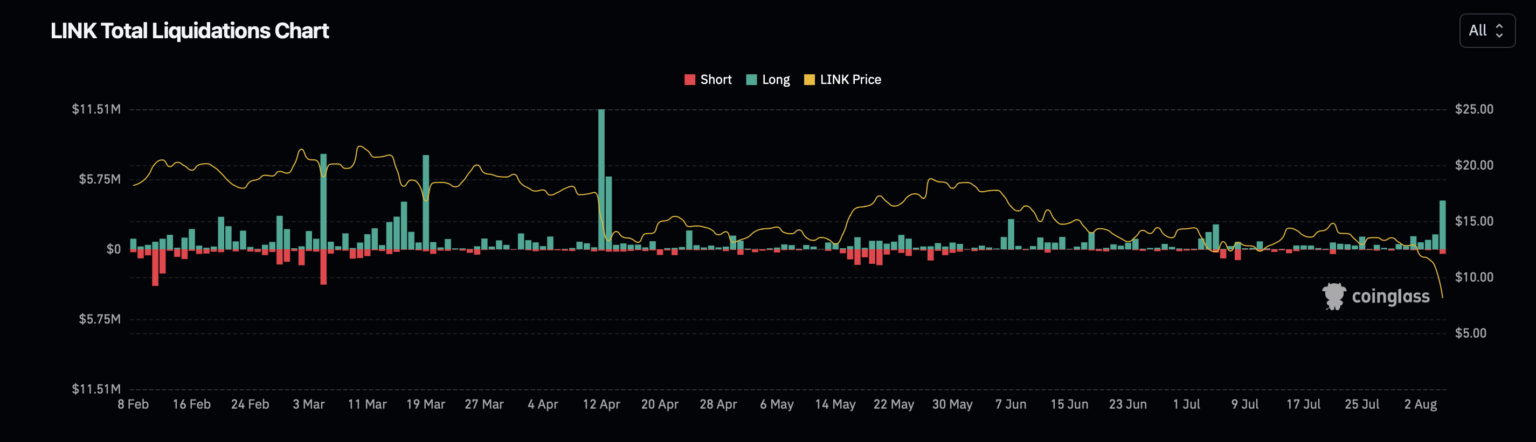

The market’s reaction to Chainlink’s recent movements has been mixed. According to data from Coinglass, over the past 24 hours, the broader crypto market saw more than 290,799 traders liquidated, with total liquidations reaching $1.11 billion.

Source: Coinglass

Within these figures, LINK-specific liquidations amounted to over $6 million. This was primarily due to long position liquidations of $5.11 million, compared to $384,430 from short positions.

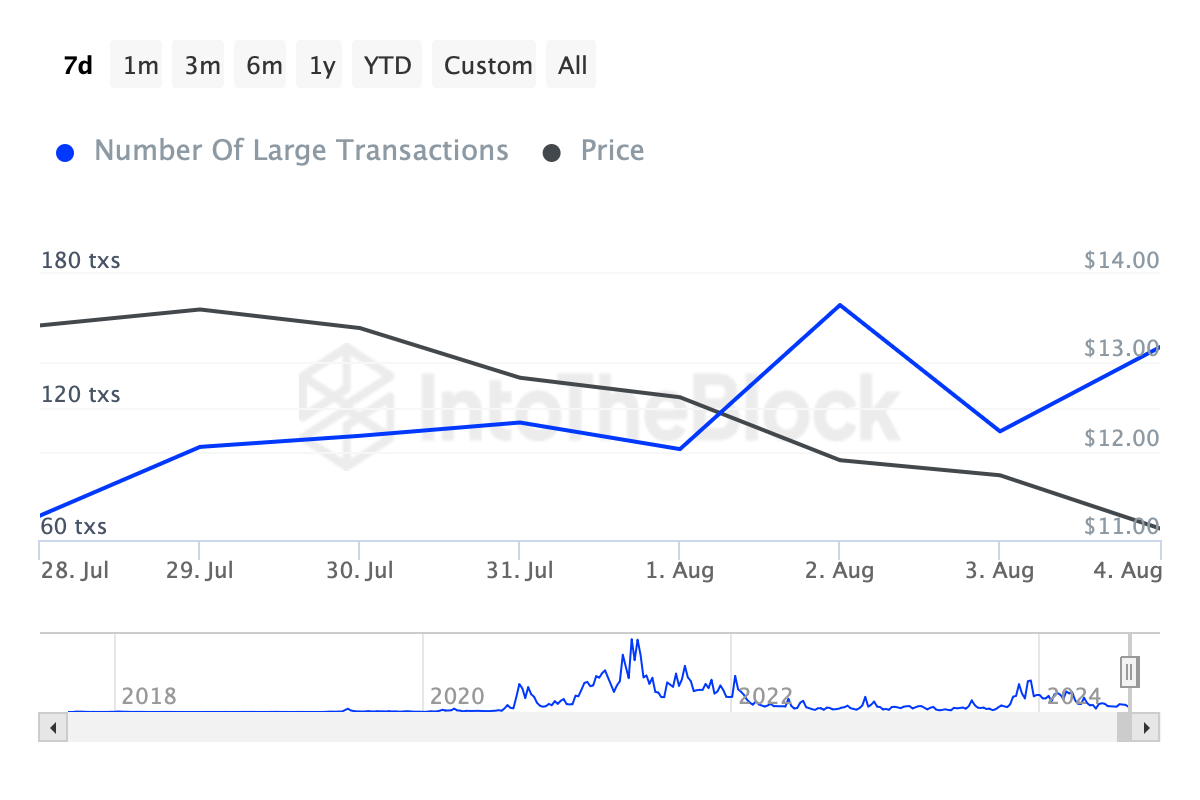

Interestingly, despite the downturn, some large-scale investors, or ‘whales,’ appear to view the lower prices as buying opportunities. Data from IntoTheBlock shows a significant increase in large transactions (over $100,000), rising from 71 transactions last week to 147 today.

Source: IntoTheBlock

This uptick suggests that while the short-term outlook may seem bearish, certain investors are positioning themselves for a potentially favorable long-term trajectory.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News