Chainlink (LINK) has surged after breaking a 500-day horizontal resistance. While this is bullish, it indicates a potential short-term correction before a continued increase. The $12.50 support is crucial; failure to bounce may result in a deeper retracement as part of wave four.

After reaching its yearly high of $16.60 on November 11, the Chainlink (LINK) price saw a slight decline. However, on November 14, LINK showed signs of recovery, initiating a bounce. The question now is whether it can sustain this momentum and move towards $20.

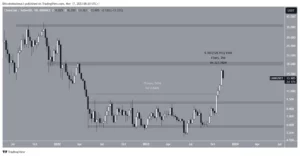

Chainlink Breaks Free from Extended Trading Range

In October, Chainlink’s (LINK) price experienced a rapid increase on the weekly timeframe. The acceleration became more pronounced after the price broke through the $9 horizontal resistance area, resulting in the formation of four bullish weekly candlesticks.

Before this breakout, the $9 area had acted as resistance for an extended period of 525 days. The surge reached its peak at $16.60 within just 28 days, marking an impressive 130% increase.

Cryptocurrency trader CryptoBusy highlighted the significance of such breakouts from long-term ranges, suggesting that prolonged consolidation often precedes significant price movements.

Crypto Cobrex expressed optimism about LINK’s long-term performance, likening it to a decentralized AWS (Amazon Web Services) platform. He emphasized LINK’s diverse functionalities, including data features like Data Streams and Data Feeds, computing capabilities such as Functions and Automation, and cross-chain connectivity innovations like CCIP (Cross-Chain Interoperability Protocol).

LINK/USDT Weekly Chart. Source: TradingView

Chainlink’s Growing Ecosystem and Developments

The Chainlink team reported the inclusion of 70 projects in their build program, offering enhanced access to Chainlink services and technical support. Additionally, eight ecosystems are part of the Chainlink Scale program, aimed at accelerating chain innovation. Excitingly, Chainlink Staking v0.2 is set to launch on November 28, indicating ongoing advancements in the Chainlink ecosystem.

Elliott Wave Analysis and LINK Price Projection

Technical analysts utilize the Elliott Wave theory to discern recurring long-term price patterns and investor psychology, aiding in trend direction determination.

According to the daily timeframe count, the current LINK price movement is identified as wave four within a five-wave upward sequence. Wave four is considered corrective, rectifying the extended wave three, which was over 2.61 times the length of wave one.

If the count proves accurate, the completion of wave four is anticipated near the 0.382 Fibonacci retracement support level at $12.50. Interestingly, this potential bottom aligns with the launch of Chainlink staking.

While the precise target for the peak will become clearer post the completion of wave four, an initial target is set at the long-term resistance of $19.50. This target represents a 40% increase from the current LINK price and a 55% rise from the $12.50 support level.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News